Tales from the Crypt

This week, I thought I would check in on some stocks that I have reported on previously, as well as one newcomer. I warn you now, it’s a depressing bunch, but if you like buying stocks when they are well-priced (i.e., no one is lining up to buy them), have something going for them, and for their long-term growth potential, they may be just the ticket for you.

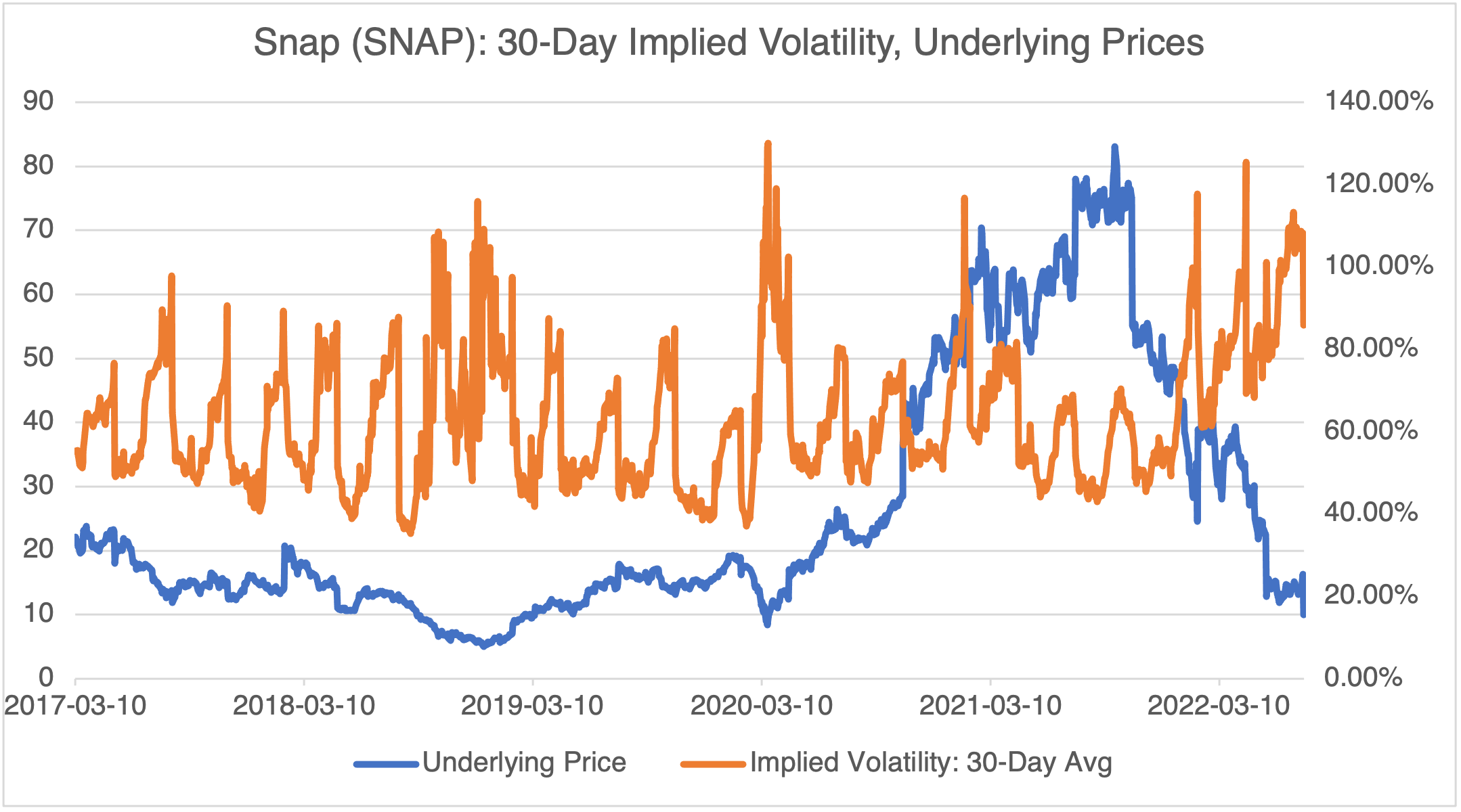

First up is Snap (SNAP). Snap is having a dismal year so far, posting a 39% decline (that’s impressive even by crazy commodity standards) last Friday alone and is now off 79% YTD. The earnings call last Thursday was a nightmare, a masterclass on how to tank a stock in 60 minutes or less. Nothing says “buy me” like “[W]e believe it will likely take some time before we see significant improvements,” or “uncertainties related to the operating environment…” prevents management from providing third-quarter revenue or EBITDA guidance (isn’t that a big part of their job?). In a nutshell, the problems that Snap is currently facing are affecting its competitors (Google, Meta) as well, namely, lower ad revenue and earnings due to a deterioration in the global economy. Of course, analysts are now lining up to downgrade Snap — they’re a little late, to say the least.

With all the bad news, what does Snap still have going for it? A loyal customer base (Snap dominates in the 13-24 year old demographic), increasing daily active users, and robust revenue growth. No, it’s not perfect by any means, but that’s why it’s trading below $10 and at pre-pandemic levels! If you’re looking for long-term bargains, Snap may fit the bill.

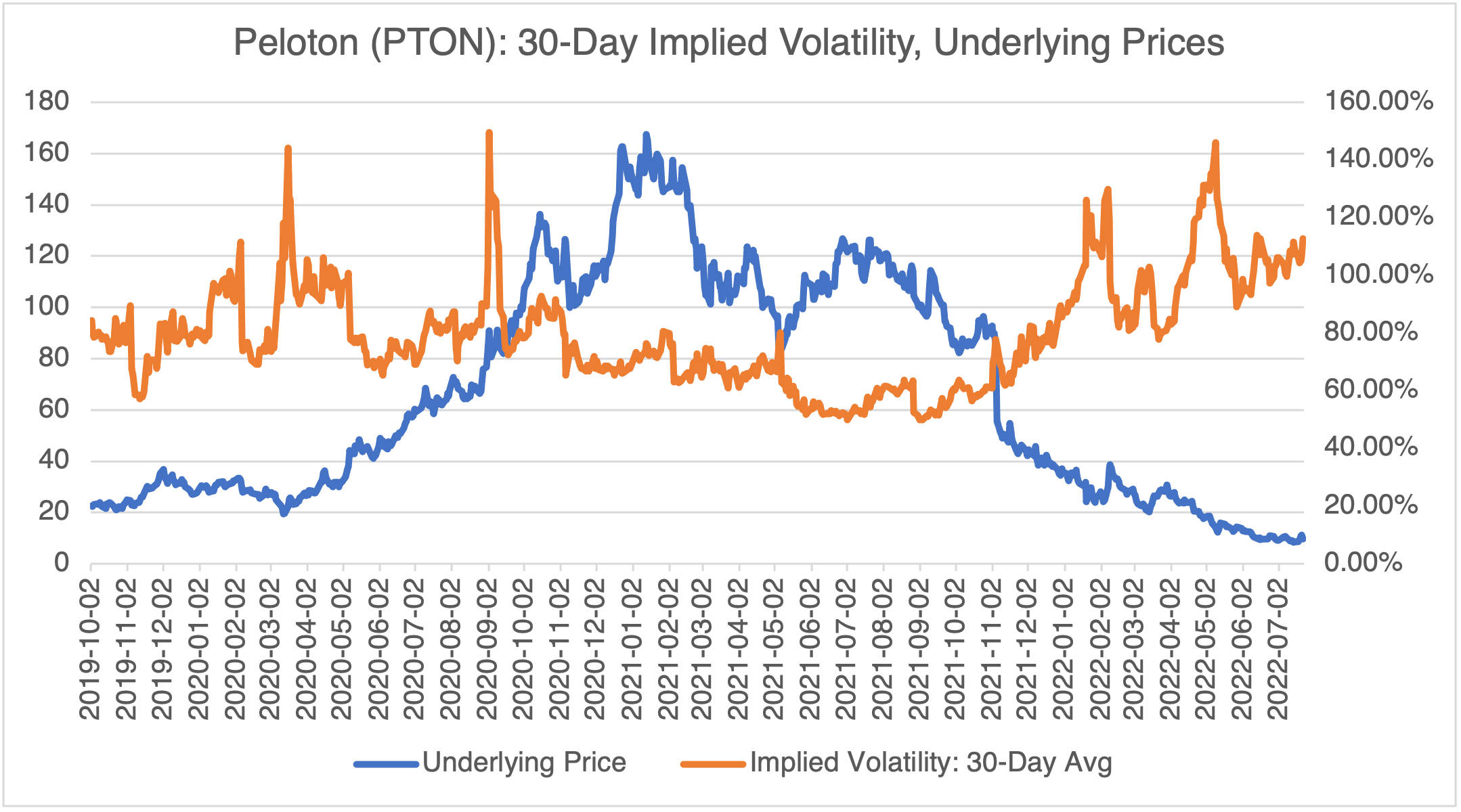

I’ve written about Peloton (PTON) stock a few times before. Long story short — the stock is still flatlining. No, not everyone in the world is going to have a Peloton in their bedroom and adjusting course to reflect that obvious fact has proven difficult for them. New management has instituted a number of changes — outsourcing production, altering the pricing structure, layoffs — but the stock has not responded. One thing Peloton does have is an incredibly loyal customer base, with only 0.75% churn (quit) rate. In short, they offer a great product but need to deliver it in a more cost-effective fashion. If current management can rationalize its cost structure and stay focused, then it could be a great long-term buy.

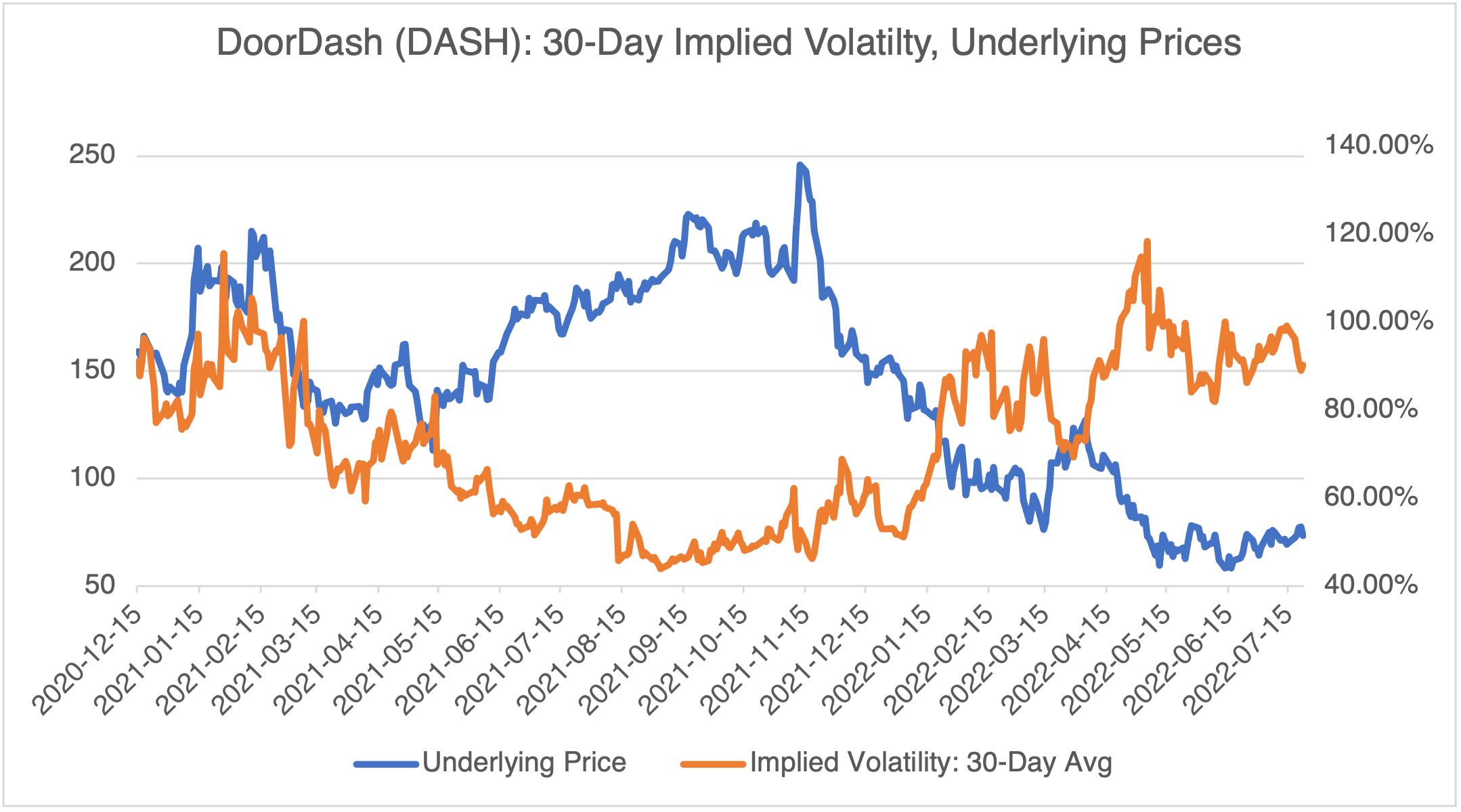

DoorDash (DASH), another pandemic favorite, is off over 50% YTD but seems to have stabilized since early May in the $55 to $78 trading range. What’s the problem? DoorDash has a lot of competition, delivery services are all basically the same, and they are all competing on price. It’s a commodity, and the only way to make money in the commodity business is through volume, volume, and more volume. Personally, I get several email offers a day from DoorDash or any one of its competitors.

Does DASH have some bright spots that could make it a good long-term buy? Two words: market share. As of the end of last May, DoorDash had a 59% meal delivery market share, over double its nearest competitor, Uber Eats, at 24%. Its sales per customer also dominates the sector. With the stock trading near or at its all-time lows, DASH might be a compelling long-term buy.

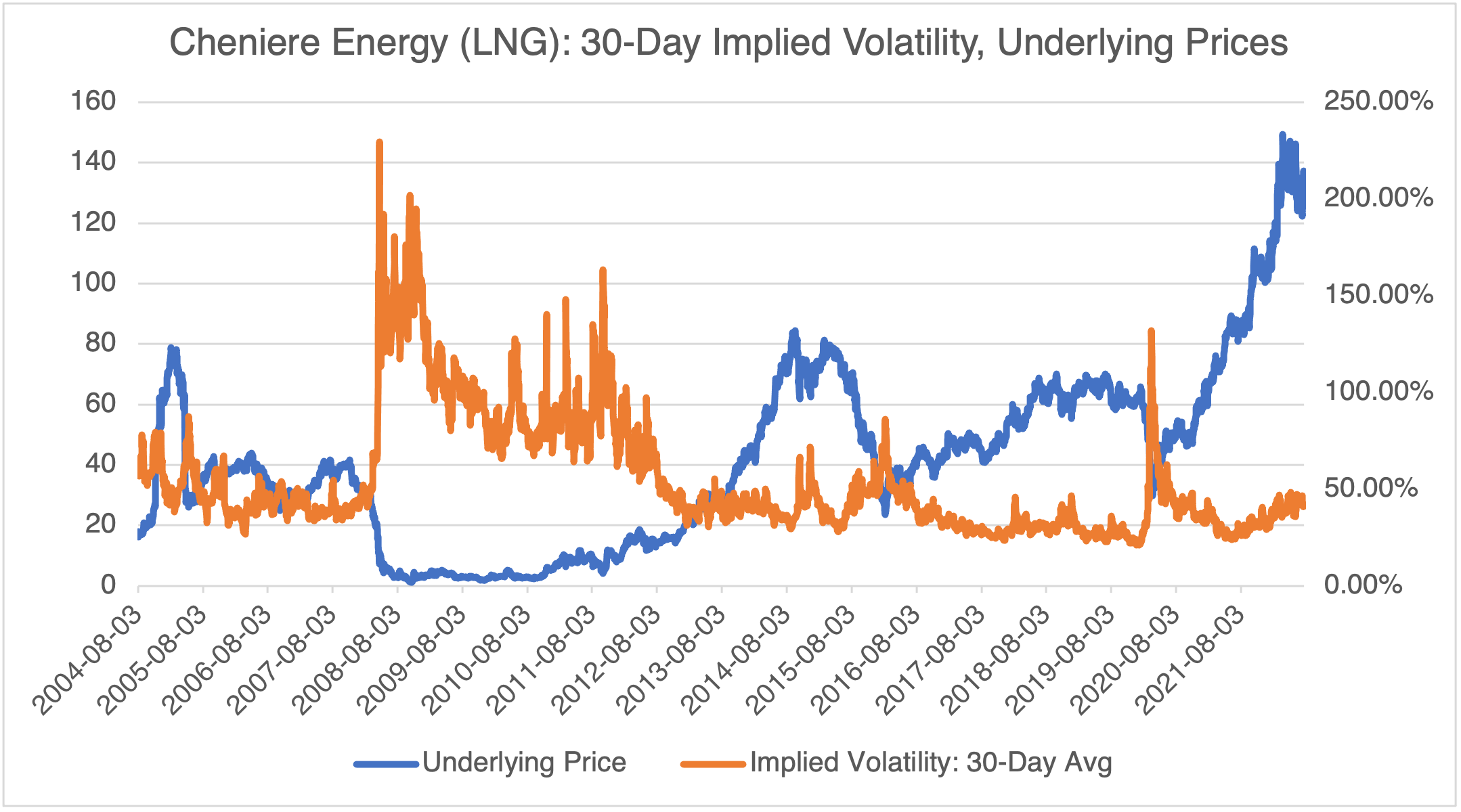

One non-depressing stock is Cheniere (LNG) Energy, the country’s largest producer of liquified natural gas. The Ukrainian War has produced a European energy crisis, particularly in natural gas. Putin’s implicit threat to cut off natural gas supplies to Europe has made the prospect of mandatory rationing this coming winter very real. Liquified natural gas, which is correlated closely to crude oil and may be shipped internationally, has benefited from this, along with Cheniere.

There is a twist, however. Unlike Snap, Peloton, and DoorDash, Cheniere is in the midst of its glory days. For an LNG producer, you couldn’t do much better than a full-fledged energy crisis to raise your stock price. However, that already happened, and the effect is built into LNG’s stock price. In other words, Cheniere might not have much upside left without fresh news to propel it to new highs. On the other hand, if you want to play LNG one way or the other, options are relatively cheap with their implied volatilities at the bottom of their historical range.

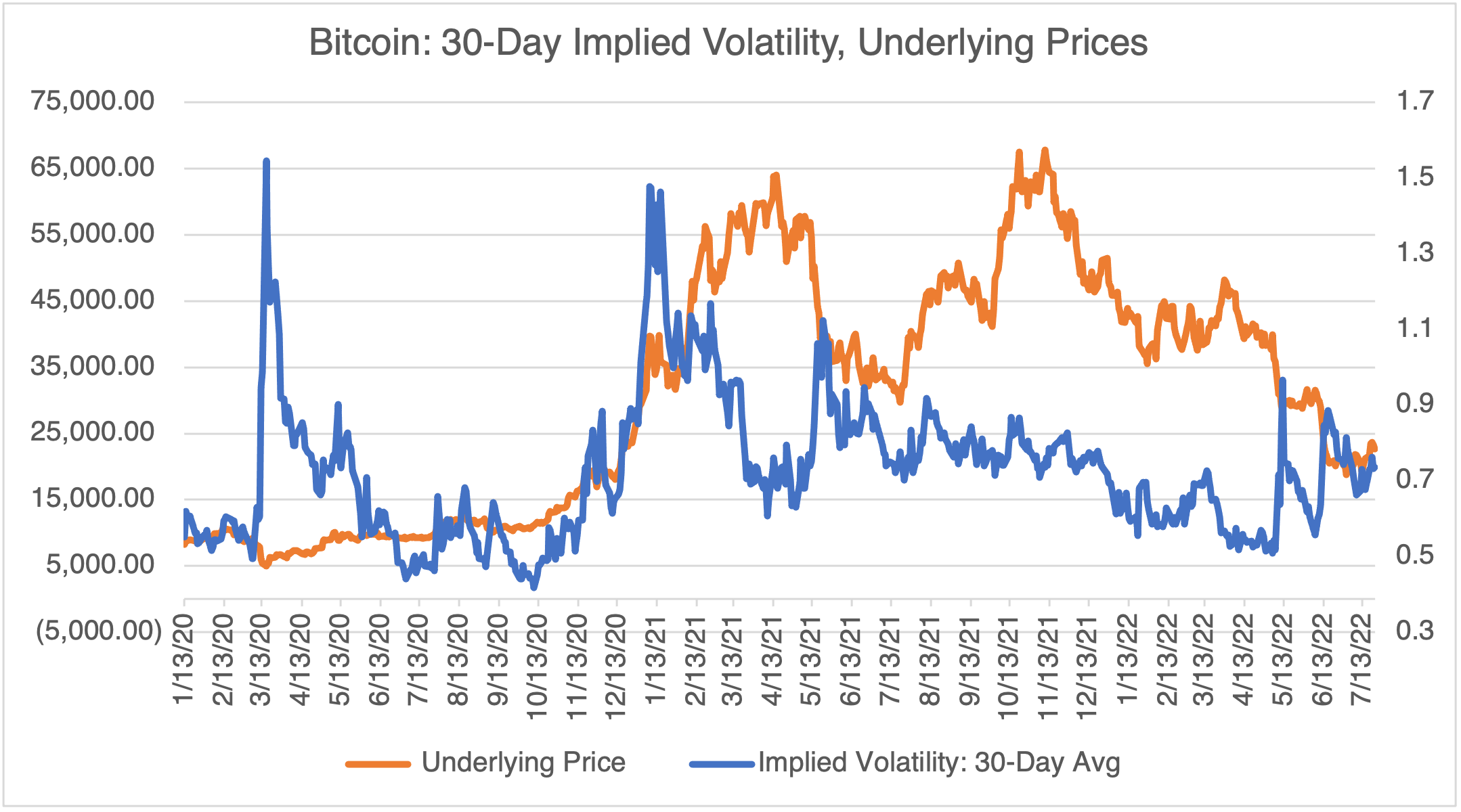

News of crypto’s demise has largely faded from the news. Now that all the weak hands have been flushed from the market, Bitcoin has been showing some life lately. It’s not out of the ICU just yet but is showing a little upside progress. As I noted in previous blogs, crypto is well correlated with traditional asset classes, e.g., equity, so this is not surprising.

One interesting note on Bitcoin. Last week, Tesla reported that it sold $936 million of bitcoin in Q2, about 62% of its original $1.5 billion position amassed since the beginning of the year. The company also took a $170 million impairment charge against the carrying value of its bitcoin holdings during the first six months of the year. Accounting intricacies aside, as a shareholder, I would question why the company had $1.5 billion of bitcoin and other cryptocurrencies to begin with. For a short time, buyers could buy a Tesla using bitcoin, but that policy was suspended in March 2021. Frankly, I thought Tesla made money by selling cars, not by speculating in cryptocurrencies. Unconventional, surprising, and inappropriate, but I guess that’s what you sign up for when you invest in a company run by Elon Musk.

Seriously?

I’m pretty sure if you’re reading this that you know who Adam Neumann is, founder and cult leader of WeWork. The antics of he and his wife are well documented and they were even the subject of a movie starring Jared Leto and Anne Hathaway, “WeCrashed.” There has also been documentary and who knows how many articles written on the topic. Needless to say, they don’t make movies about boring people and you come away wondering how anyone in their right mind trusted these two to run anything other than a charity 5K.

Well, Adam and his wife have reappeared, this time touting his latest venture, Flowcarbon. Brilliantly, it combines three trending themes, climate change, blockchain, and NFTs. As far as I can tell (the website is incomprehensible and filled with crypto speak), the company facilitates carbon credit transactions through the issuance of GNT “smart contracts,” which are a bundle of tokens. GNT stands for Goddess of Nature Token (no kidding).

According to Bloomberg, “Adam Neumann and his wife came up with the branding for the company. One of his favorite words is “flow,” which reminds him of the flow state found in surfing, a hobby.” If you think that this is some real-life version of “This is Spinal Tap,” you would be right.

Despite the Neumanns’ history, and the hard-to-believe business plan, he managed to raise $32 million from the likes of Silicon Valley financiers Marc Andreessen and Ben Horowitz through their a16z crypto venture capital firm. Other investors included General Catalyst and Samsung Next. Reportedly, another $38mm was raised through the sale of the GNT tokens. You can’t make this up.

Sure enough, CarbonLoop announced in July that it was suspending the issuance of new tokens indefinitely and waiting for the crypto markets to stabilize. That could be a new record on how fast investors’ money was obliterated.

Evidently, once you reach a certain level on Wall St., it’s really hard to get permanently, inexorably, and irreversibly fired. You don’t have to be Nostradamus to predict that it’s just a matter of time before the Neumann’s will be back, pitching yet another grift with some other suckers’ money in tow.