Is Crypto Dead?

Perhaps the biggest financial story of 2022 has been the implosion of the crypto market. FTX and Sam Brinkman-Fried have dominated the news over the last few weeks, and rightly so — it’s a great story! Arrogance, greed, negligence, fraud, and conceit; they’re all there. And as was the case with Theranos, financial establishment icons such as Sequoia, Blackrock, and various pensions, were all eager investors (does anyone do due diligence anymore?). Evidently, no one is immune to a great pitch that preys on their deepest FOMO fears. In the cold light of day, one wonders how anyone in their right mind could have not seen this coming.

Luckily, so far it’s been an implosion, and not an explosion, because it hasn’t infected other asset classes. It has affected other crypto exchanges, such as BlockFi, but has remained largely contained. The usual round-up of market hysterics have been warning of more widespread contagion, but so far nothing has spilled over. Why?

Looking past all the hype and promises, crypto has never had all that many connections to traditional finance to begin with. The list of banks as creditors to defunct crypto exchanges, such as FTX, is largely non-existent. Apparently, crypto was in its own bubble, trading, lending, borrowing, and defrauding each other, but rarely outside of its inbred ecosystem. As proof, consider the following: crypto as an asset class was worth about $3 trillion and lost about 70% of its value, or $2.1 trillion, with no discernable effect on the financial system. That’s amazing, but not surprising. Traditional financial instruments such as stocks, bonds, mortgages, commodities, and most derivatives, serve an actual function in the real world and economy. Crypto, on the other hand, did not really serve as a means of payment outside of some narrow, and often illegal, venues. Most people I know don’t have a problem using dollars to pay for things. It’s getting the dollars that is the hard part!

Since it never had many real-world commercial applications, crypto devolved into a low volume speculative vehicle. It’s touted role as a hedge against inflation, war, and deflating currencies was proven wrong time and time again (after all, we got all those during the Ukraine war and crypto went down, not up). It basically moves in lockstep with the broader markets. In other words, it’s similar to other products that are a lot easier to trade and have a lot less baggage.

As a Wall St. vet, I’ve seen all this before (coincidentally, Elizabeth Holmes was sentenced to 11 years at the peak of the crypto implosion). The Street just has too much money sloshing around and too many people worried about being left behind not to attract fraud. What’s new here is that it happened in a brand new asset class, crypto, and threatens the survivability of the class itself. When stock fraud occurs, no one questions the continued viability of the equity market. Not so here.

And so, the obvious question after all this: is crypto dead?

Probably not, but I think it’s safe to predict that it and its brethren will probably be in suspended animation for some time. As one investor put it, “I cannot imagine a single large institution that will invest in the space right now, possibly ever again.” That’s a big statement. Institutional memory tends to fade over time, and Wall St. is just too much of a herd not to get back in. Commodity trading is a great example. Banks tend to get in, and out, on about a five-year schedule. All it takes is news of some firm, large or small, that made a boatload trading and, whoosh!, everybody rushes back in. Gap analysis, as it’s called in consultant speak, in action.

It’s tempting to say that the scandal represents the usual growing pains of a brand new market. As they say, give us a few years to get the kinks out and then it will be a real, grown-up market. Crypto supporters point to the frequent booms and busts during the 19th and early 20th century when the US banking system was growing up. It took regulation, deposit insurance, outlawing private currencies, and the creation of the Fed to stabilize it. There is a crucial difference, however: dollars served a real and central role in the economy; crypto does not. And until that changes, crypto will never be anything more than a speculative curiosity with a lot of potential that never occurs.

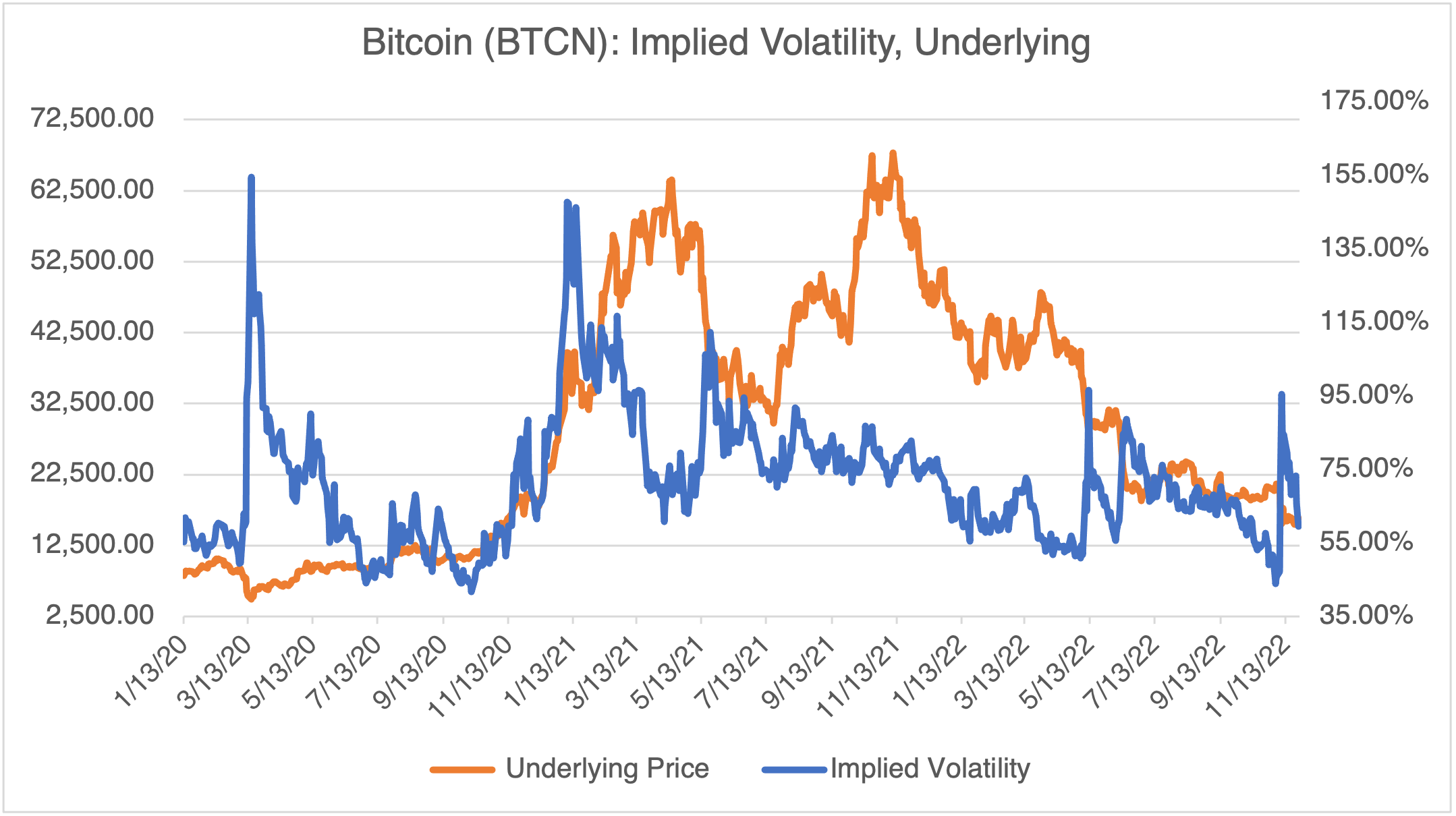

With all that as background, Bitcoin continues to trade. I’ve written before that markets abhor 100% unanimous opinions and have a nasty habit of proving everyone wrong, at least in the short term. I must admit, given the one-sidedness of the commentary, it’s a tempting buy. The implied volatility of BTCN tends to move in the same direction as price. On that basis, the options are relatively well priced, with vol trading on the low end of its historical range. Of course, if you are going to trade BTCN, ONLY trade it on a mainstream and regulated exchange run by adults, such as the CME.