Quantum Leap

There was a show on in the late 80’s called Quantum Leap in which a scientist gets caught in an experiment that causes him to be “trapped in time.” The result is that he can inhabit someone else’s body, and you see a different version of him in each episode. Needless to say, it could get super confusing.

I thought of this recently when a trader friend of mine called me to talk about Wall Street’s latest tech obsession, quantum computing. Computer geeks and the like are touting it as the Next Big Thing. Similar to blockchain, there are very few people (if anyone!) who really know what it is (exactly), or can explain it so that it makes sense to normal people. Helpfully, Google delivers the following definition:

“Quantum computing is a type of computation that uses the principles of quantum mechanics, a branch of physics that deals with the behavior of particles at extremely small scales (like atoms and photons). It represents a fundamental shift from classical computing, which is based on bits that can be either 0 or 1.”

So far, so good, but then the explanation gets a lot more challenging, and starts talking about “qubits,” “superposition,” “quantum tunneling,” “entanglement,” etc., etc.

To most investors, the details won’t matter that much. Suffice it to say that quantum computers will be much, much faster than classical computers, especially when it comes to cryptography, simulation, optimization, and machine learning. Combine AI and quantum computing, and you have the potential for a world that we will not recognize.

Why the sudden interest in quantum computing? After all, it’s been around for over a decade. Last December, Google revealed its latest quantum computing chip, Willow. It’s speed is incredible, allowing it to perform a certain calculation in under 5 minutes that would take one of today’s fastest computers 10 septillion years (which is older than the universe) to solve.

The announcement led many to believe that widespread quantum computing will be commercially available much faster than previously believed. Its development has been on a low boil for some time, similar to fusion and other technologies that hold great promise, but always seem to be just out of reach. Despite disclaimers that major challenges remain and that widespread commercial applications are decades away, investors have not been deterred. They may not be wrong.

I’m willing to bet that the vast majority of investors couldn’t explain the first thing about quantum computing, other than it’s a lot faster (somehow), and could be the markets’ next AI. That didn’t stop them from going on a QC buying spree after the Google announcement, taking in Quantum Corp. (QMCO), Quantum Computing (QUBT), and D-Wave Quantum (QBTS). IonQ (IONQ), and Rigetti Computing (RGTI).

Timing is everything in investing, and although quantum computing has incredible potential, it doesn’t necessarily follow that it’s a great idea to buy the sector right now. After all, estimates put commercial applications at least 10 to 15 years in the future. In the quest to find the latest tech, investors may be very premature.

But, I’m not sure that is the case here. As noted above, the combination of AI and quantum computing could be one of the most important technological advances since the internet and the advent of personal computers. Given its potential, and the amount of capital available, technological advancement could proceed faster than anticipated. Each new advancement will bring quantum computing closer to reality, and will cause QC stocks to ratchet up.

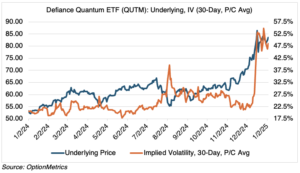

That’s not to say that the current crop of companies involved in QC will be the ones to ultimately benefit. In 1908, there were 253 auto manufacturers in the US alone; by 1929, there were 44, and by the 1950s, only five remained. Although the barriers to entry for quantum computing startups are vastly higher in terms of required capital and intellectual requirements, the sector’s vast potential will attract innumerable participants over time. Given that the sector is in its early stages, it’s too early to tell who will emerge as the market leader, the Nvidia of quantum computing. The Defiance Quantum ETF (QTUM), which invests in “machine learning, quantum computing, cloud computing, and other transformative computing technologies,” takes a broad-based approach and increases intra-sector diversification.

As you can see, both QUTM’s price and implied volatility have shot up since Google’s announcement last December. Obviously, quantum computing’s potential is not a closely guarded secret! Although QUTM’s implied volatility is about 2.3X greater than it was before the announcement, it is still a bargain when compared against the IV of the individual quantum computing stocks mentioned above, which range from 118% to 172%. The options are expensive, reflecting the massive uncertainty that these companies can produce breakthroughs, much less even survive. Given that, and considering the long timeframe involved, investments in the underlying issues are probably more suitable for long term investors.