Too Low?

A recent market development that should be getting more attention is the seemingly endless slide of the VIX. For those of you who aren’t familiar with it, the VIX is an index that measures the market’s expectations of volatility over the next 30 days, based on the price of S&P 500 options. In other words, SPX 30-day implied volatility. Since one of its components is uncertainty, which is related to market sentiment, some refer to the VIX as the “fear index.”

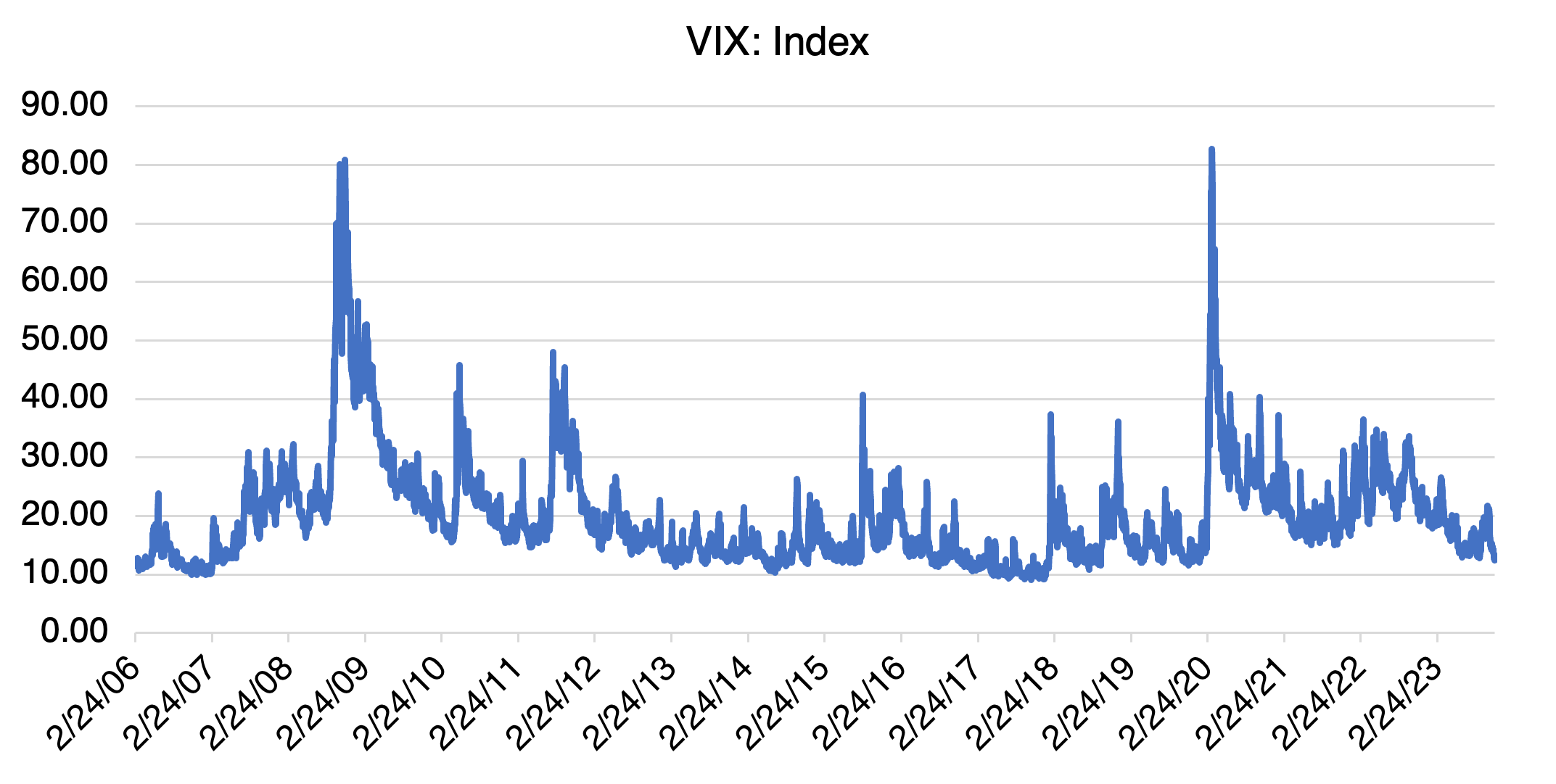

As you can see from the long term chart below, the VIX tends to revert to the sub-20 level if little uncertainty is deemed to be present, i.e., the S&P 500 is increasing and geopolitical events (e.g., military conflict) that could derail the market are considered contained.

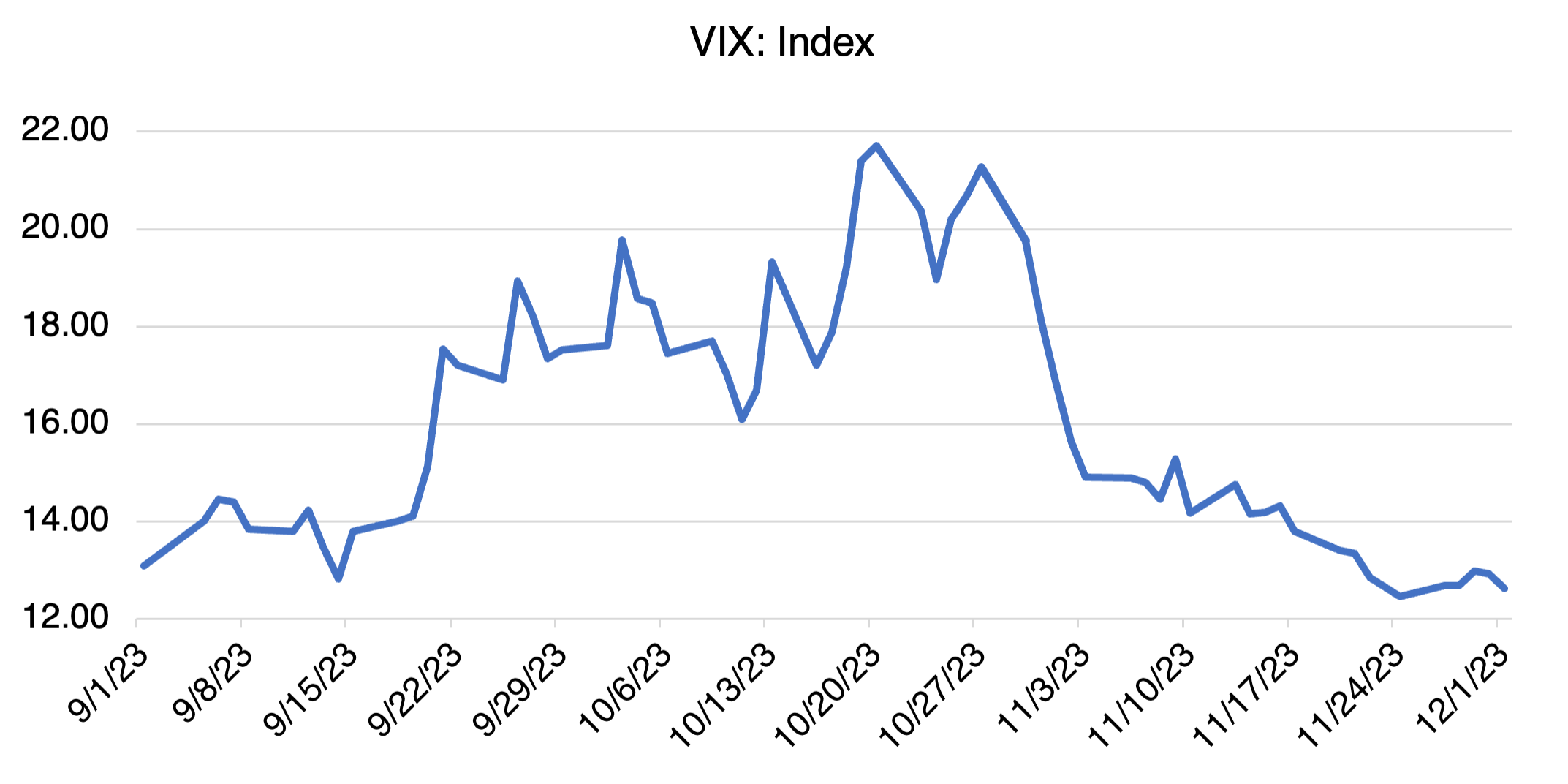

Evidently, the market believes that both of these conditions have been satisfied. The VIX has been plunging since October 27, just 14 trading days after the start of the war in the Mideast. The close on November 24th at 12.46 was the lowest it’s been since January 2020, right before Covid. Of course, that doesn’t mean that it can’t go lower, just that the upside/downside ratio of the trade is questionable. The clichéd movie line “It’s quiet…too quiet,” comes to mind.

It Seemed Like a Good Idea…At the Time!

I recently read about the sorry saga of Enviva (EVA), America’s largest exporter of wood pellets for power generation and home heating and cooking.

For the 99.9999% of readers who don’t follow the ins and outs of wood pellets, they are usually considered Biomass, and as such, a carbon neutral alternative to fossil fuels (although it’s controversial just how neutral they really are). The wood pellet market has grown significantly over the last few years, especially in Europe as an alternative to Russian natural gas. Enviva has been capitalizing on this trend since 2010 with plants and export facilities across the Southeast. Unfortunately for them, operational difficulties cut into their profits and led to a dividend cut last May. Since they had previously assured investors that the dividend was indeed safe, EVA investors freaked out and a 67% one day decline followed.

This set the stage for something even worse. Is seems that in Q4 2023, it had purchased pellets from a European customer with the intent to resell them at a profit. The bet was that European energy supplies would remain tight and that the conditions present in 2022 would repeat, causing the existing rally in wood pellet prices to continue.

No such luck. A warm winter in Europe and new fuel supply arrangements (spurred on by the prospect of freezing to death) caused pellet prices to plummet to about half of what they had been when the trade was executed. Losses from the trade are reported by some sources at an estimated $280 million and extend through 2025. That’s a lot of money, much less for a company that doesn’t (and shouldn’t) trade for a living. As a matter of fact, that’s a lot of money even for companies that do trade for a living!

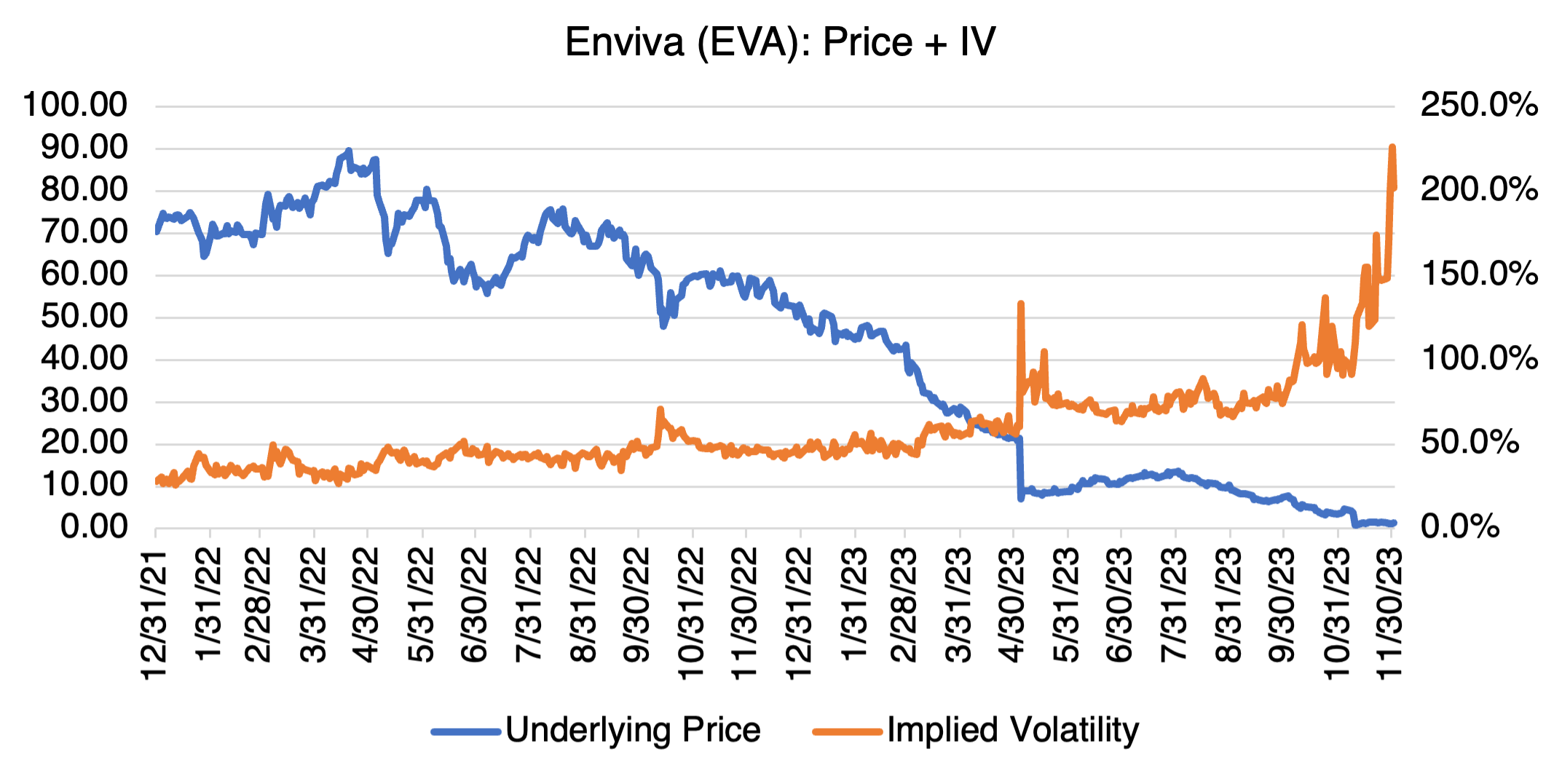

As usually happens in such circumstances, Enviva replaced (read: fired) the CEO, issued a statement that the company “may be in breach of certain of its covenants…[which] raise substantial doubt regarding the company’s ability to continue as a going concern,” and hired a bunch of advisors to try to figure out how to wiggle out from the mess. They have their work cut out for them: year to date, Enviva is down an impressive 97% ytd and closed at $1.24 on December 4. If you want to try to catch a falling knife (which rarely works), here’s the price chart and implied volatility (which is +/- 200%!):

I bring all this up to not to pile on Enviva — their 97% YTD stock price decline is punishment enough for 10 companies — but to point out that many trading debacles have occurred in organizations that never should have been trading in the first place. After the losses come to light, it’s usually revealed that the company had been trading profitably for some time (in a one-way market — “it’s easy!”) and had become addicted to the returns. Larger and more complex transactions inevitably followed, as well as the eventual blow-up when the market didn’t do what it was “supposed” to do.

My advice to investors: read the fine print carefully in the annual report and 10-K, especially the footnotes (sometimes the juiciest stuff is in the footnotes, albeit couched in almost indecipherable syntax). If you get the sense that the company in question is trading or aggressively “hedging,” especially in illiquid, niche commodities, and they can’t convincingly justify it, nor have the size, capital, history, or experienced staff (i.e., dedicated traders and risk management) to pull it all off, run!