Uncertainty is Certain

Last week was a busy news week due to President Biden’s continued travails, but if you’re an energy investor, some important news came out that may have been escaped your notice. It wasn’t earth-shattering, but it reveals the interplay between investing, regulation, and uncertainty that should never be overlooked. As usual, when we talk about uncertainty, implied volatility and options pricing inevitably come into play.

Background: last January, the Department of Energy’s announced a pause on issuing permits for new liquified natural gas (LNG) facilities until a new assessment of their economic and environmental impact could be completed. They didn’t indicate how long the assessment process would take, so the “pause” amounted to a de facto ban. Since LNG has become a critical component of the world’s energy supply balance, especially in times of shortage, energy producing states and LNG producers soon went to court to try to overturn the decision. Last Monday, a federal judge in Louisiana ruled in their favor, calling the department’s approval pause “completely without reason or logic.”

LNG investors aren’t cheering just yet. The judge’s ruling won’t be the final say on the matter. There will be endless follow up litigation and, practically speaking, the Department of Energy still retains authority over all LNG facility permitting. In other words, they can drag the permitting process out or just say no. In addition, regulatory approval for LNG expansion also depends on the results of the upcoming elections this November (as well as US energy policy in general). Increased geopolitical risk emanating from the war in Ukraine may also have an effect, as occurred in the fall and winter of 2022 when European natural gas supplies were extremely limited.

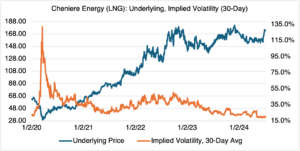

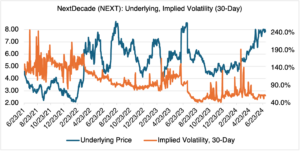

Given all these conflicting factors, it’s no surprise that the judge’s ruling, although very clearly in favor of the industry, only led to a very modest rally among LNG producers and virtually no change in implied volatility. Below are charts of two of the most popular examples, Cheniere Energy (LNG) and NextDecade (NEXT):

Source: OptionMetrics

Source: OptionMetrics

Although a certain amount of regulatory and political uncertainty hangs over the expansion of domestic LNG production, it’s important to keep two things in mind: 1) the uncertainty won’t be resolved until November, and even then will go on for some time as new litigation inevitably arises or a new administration settles in, and 2) existing LNG facilities, especially Cheniere’s, are still operational, approved to export, and have long term contracts in effect. For LNG producers, “Business as usual” will probably be the operative phrase over the next few months. Consequently, at least in the short term, both LNG and NEXT will most likely be more sensitive to natural gas prices (chart below) and earnings announcements than regulatory concerns. Implied volatility, which has been generally declining year-to-date, will be stuck in a band and probably won’t be much of a factor one way or the other (charts below).

Source: OptionMetrics

One additional note about NEXT. Last month, they announced a 20-year LNG supply agreement with Saudi Aramco. Since then, the stock has repeatedly tested the $8.00 level, but has not yet succeeded in breaking through. If it does eventually, relatively short term calls, such as the August $8.00 calls, roughly $0.57 ($7.82, 63.2 % volatility) at the time of this writing, will benefit from both rising price and implied volatility. Below is the valuation table from OptionStrat:

Source: OptionStrat

Written On the Stars

A few weeks ago, I noticed this headline from Business Insider: “Can the stars predict the stock market? Gen Z thinks so.” During my career, I can think of a few times when astrology has suddenly become a “thing” on Wall St. The immediate causes are easy to guess: a seemingly accurate prediction from one of its more well-known practitioners, skepticism of traditional methodologies and institutions, or the quest for certainty in an uncertain world.

I have a simple question for all those that purport to beat the market consistently using astrology, “technical” analysis, Ouija Boards, plain old fundamental analysis, or whatever they can dream up: if your technique works so infallibly, why are sharing it? Raise money, start a fund, and get fabulously rich! If you know which way the market is going, it’s not that hard.

But (and very unfortunately), it is.