Meta and Snap: The Undead

I’m not crazy about unanimous opinions, especially when it comes to stocks. Usually, the situation isn’t as bad (or as good) as the consensus indicates. Recently, Meta and Snapchat both took it below the waterline after announcing less than great results due to a variety of factors: lower ad revenue, changes to Apple’s ad-tracking policy, and in the case of Meta, continued disappointing results from its Metaverse initiative and competition from TikTok. The declines were immediate and steep: in one trading session, Meta lost almost 29% and SNAP 39%. Currently, this brings them to down 73% and 78% YTD, respectively. Impressive, and tempting if you’re looking for bargains. But before you do, consider the implied volatility analysis below.

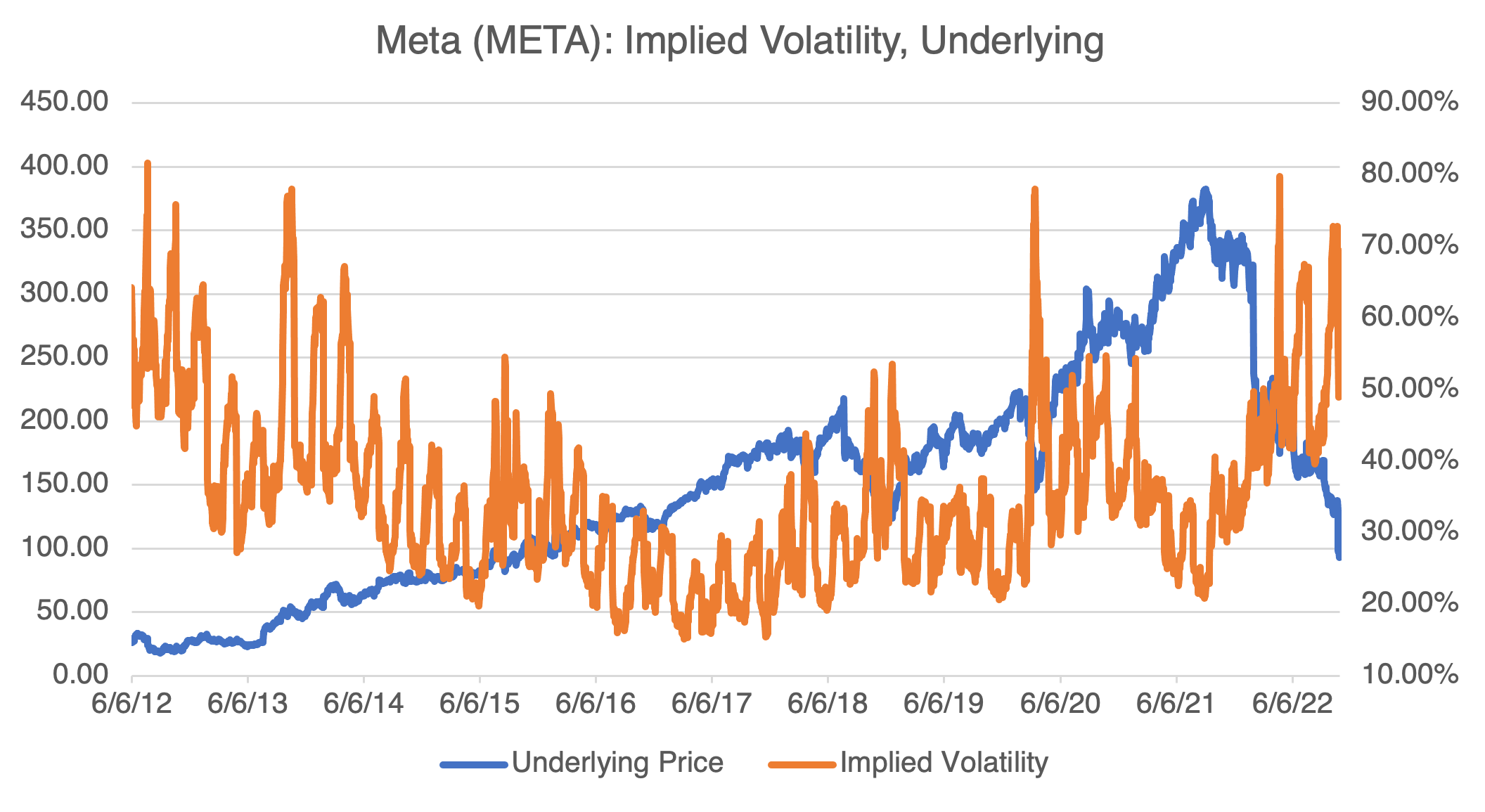

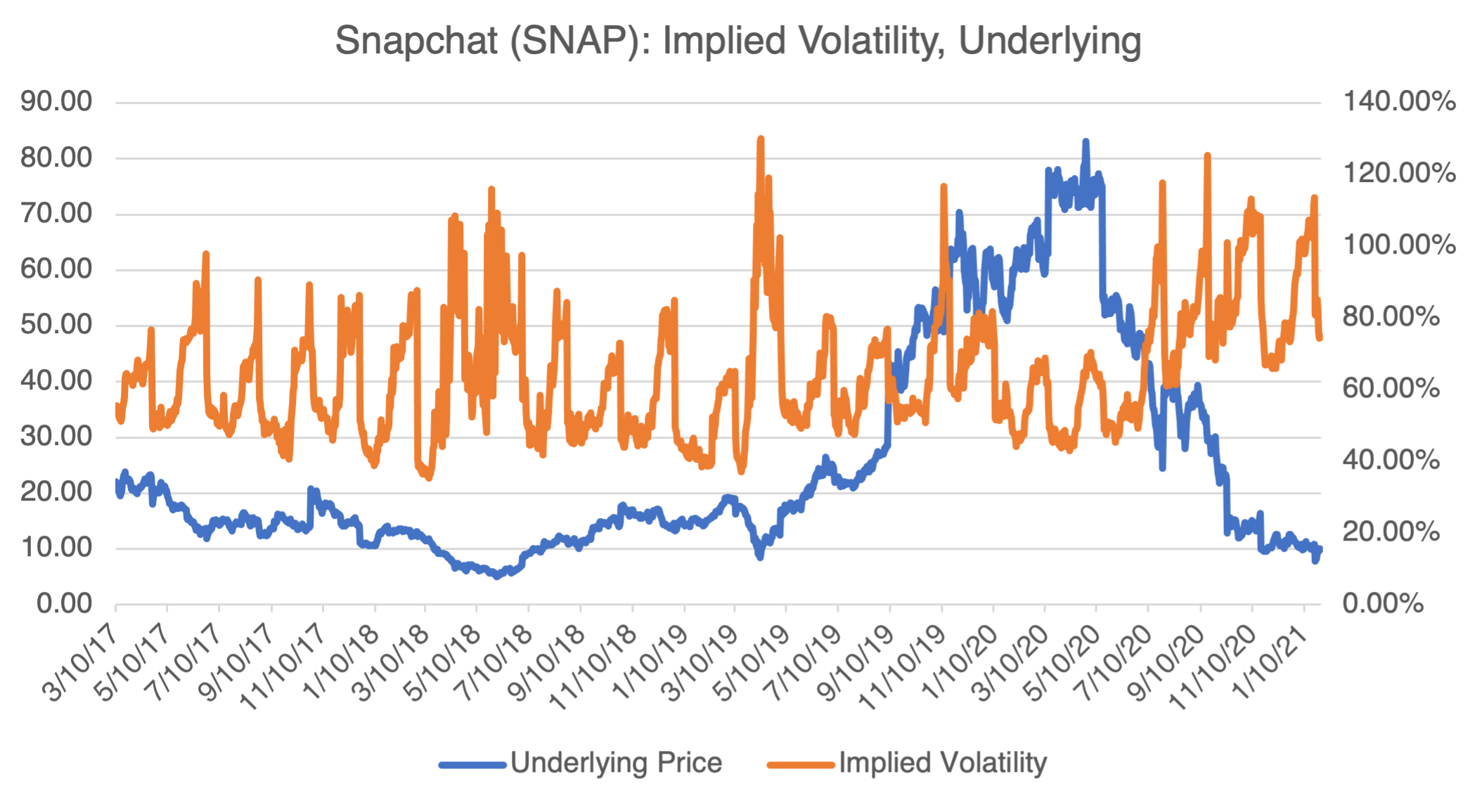

For both META and SNAP, they represent the rare stocks that have no clear implied volatility (IV) trend. Usually, IV tends to increase as price level decreases, and vice versa, or clearly increases if the stock’s future is uncertain. That does not seem to be the case here. Rather, both IVs tend to trade in a range and the most you can conclude is whether it’s relatively cheap or expensive. However, that’s not to say that implied volatility is unimportant, especially if it’s trading at high absolute levels and is susceptible to large swings (in other words, implied volatility is itself volatile!).

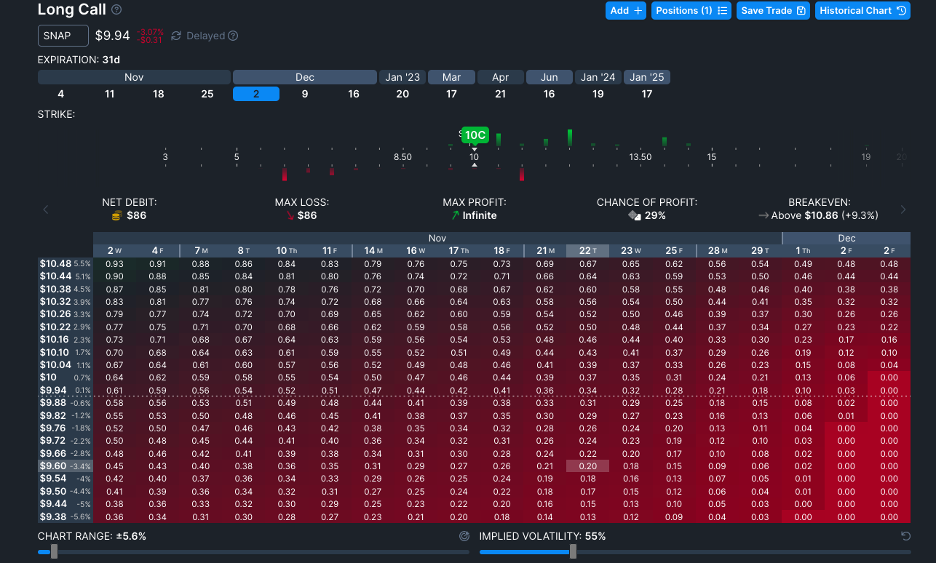

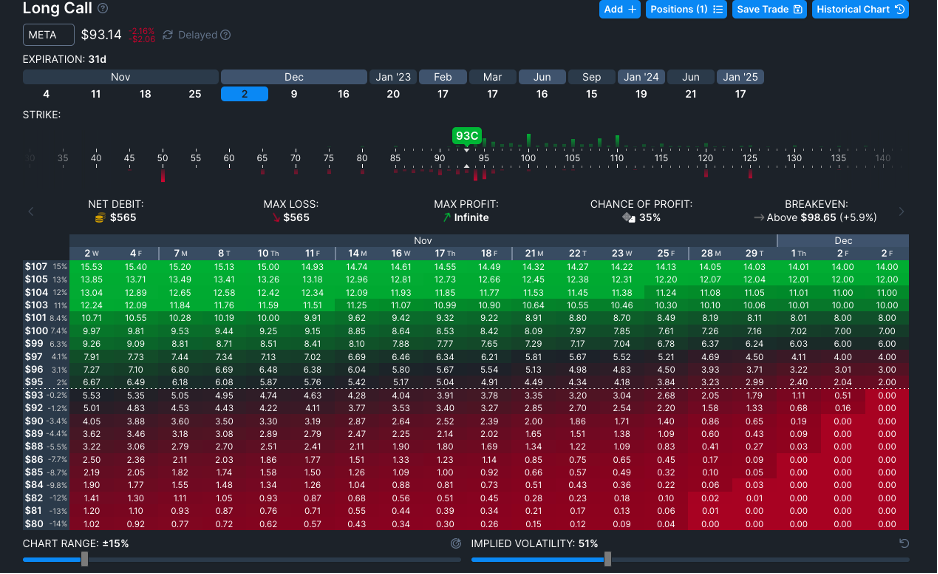

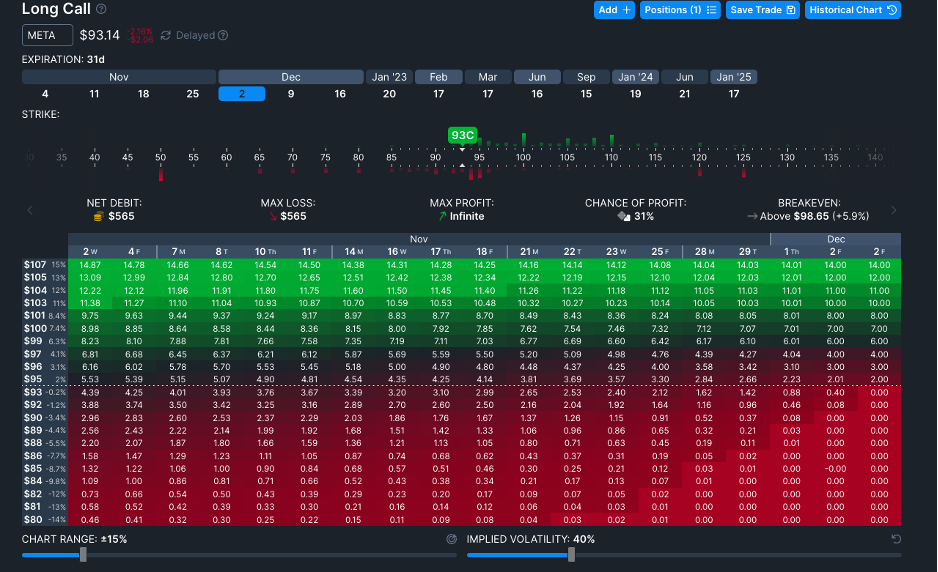

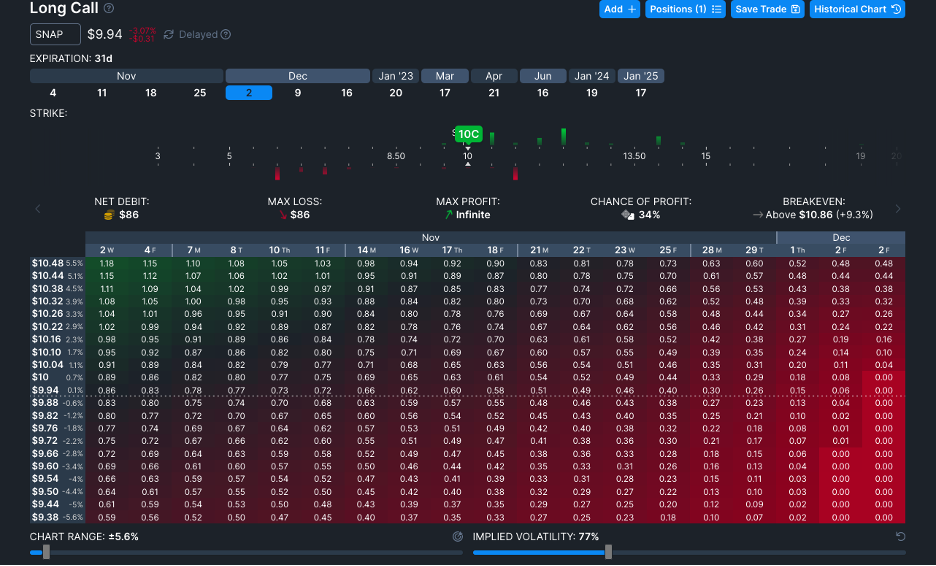

Consider the option contract value displays below for META and SNAP. Both show the effect on option value from changing implied volatility (using OptionStrat, you can vary the results by moving the implied volatility slider on the bottom). From the historical implied volatility charts above, the changes simulated are not abnormal and could be expected if both stocks leave the spotlight and prices stabilize.

Looking at just today, 11/02, with no time passing, the results from lower implied volatility could be devasting if you are considering buying calls outright to take advantage of META and SNAP’s relatively low prices:

META: $93 call, 12/02/22 exp., 51% IV, value = $5.53

$93 call, 12/02/22 exp., 40% IV, value = $4.39 — 21% lower!

SNAP: $10 call, 12/02/22 exp., 77% IV, value = $0.90

$10 call, 12/02/22 exp., 40% IV, value = $0.47 — 48% lower!

The effect will be similar as time passes and the contract moves closer to expiration. So yes, implied volatility matters!

META, 51% Volatility:

META, 40% Volatility

SNAP, 77% Volatility

SNAP: 55% Volatility