An Oil Shock, Again

Although I am usually opposed to buying deep out-of-the-money calls (“lottery tickets”), the war between Iran and Israel might be presenting just such an opportunity.

Despite hints that it was imminent, the war was a shock to the crude oil market. The front-month contract (July) jumped 7.3% and its implied volatility by 7.1 percentage points. As of this writing, the war is still in its early stages, but Israel is overwhelmingly dominant, having destroyed Iranian air defenses and now free to roam at will. The Iranians are reportedly seeking negotiation, but without US pressure, that’s not going to happen until Israel is satisfied that the nuclear threat has been eliminated.

Despite increased hostilities in the region since late 2023, oil supply from the Mideast (including Iran) has not been affected to any significant degree. This might be providing the crude market with a false sense of security. For example, if the Iranians, as a last chance gamble, try to close the Straits of Hormuz (about 20% of world oil consumption flows through the Straits every day) or strike out at the Saudi oil fields (they have threatened to do so in the past), a violent increase in crude prices may result.

Most likely, any attempt to do either will prompt a military reaction by the US and select Allies. Although the Iranians will not be anywhere near successful in the medium to long-term, the act of trying, and the involvement of the US in a real shooting war with Iran (who will be supported by China and Russia), will be enough to seriously spook the markets, and not just energy. In such a scenario, crude shooting to over $100 or more is possible.

As many commentators have pointed out, it is not in Iran’s best interest to curtail supply in any manner. First, Iran needs the hard currency that only their oil exports can provide; second, they don’t want to anger their biggest customer and supporter, China; and third, they won’t risk the consequent destruction of their energy infrastructure.

However, all those factors are long-term. In the short-term, if the Iranian regime feels that their continued existence is threatened, it could become increasingly desperate. Israel is now challenging Iran directly, and the conflict is no longer a proxy war but a real war on Iranian soil. If Iran’s hard liners sense an existential threat, trying to close the Straits, or attack the Saudi oil fields, or some other cataclysmic measure, might prove irresistible to them.

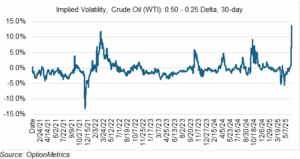

Hence, the rush into deep out-of-the-money crude oil calls, a classic “who knows what could happen” strategy. As you can see below, out-of-the-money skews (in this case, 0.25 delta – 0.50 delta) blew out during the first day of the war. This makes OTM crude calls expensive on a volatility basis, but still relatively cheap in absolute dollar terms. However, if the war metastasizes into something larger, or even more intense, the difference will be inconsequential and a technical nicety. Sometimes, brute force positions are merited.

Keep in mind that supply doesn’t necessarily have to be affected for crude to rally significantly. Rather, it’s the perception that it could that could do the trick. If the US gets directly involved, either through naval action in the Straits or helping to destroy the Fordow nuclear facility, the war will no longer be perceived to be a regional matter. Both are, as we say in risk management, are a “non-zero” probability. A significant payoff is therefore not out of the question.

Great Market Acronyms, 2.0

First, there was TACO (“Trump Always Chickens Out”). Now, there’s BDCO: Bibi Doesn’t Chicken Out. It’s a riff on the first one, but it’s still pretty good.