Gold Isn’t That Volatile!

Now that everybody has put their guns away, we can finally go back to “regular” trading. It’s nice not to have to check the news every 10 minutes!

I’ve written about gold a few times, chronicling its unrelenting rise since 2022. Fueled by geopolitics, uncertainty, inflationary fears, central bank buying, and momentum, gold made new highs just two weeks ago on June 13th. It may go in and out of vogue, but gold has been very “in” for the last few years. It’s one of the few commodities that everyone can relate to and can wear.

The popular perception is that gold is extremely volatile, and like many other commodities, can be a disaster if you get caught the wrong way. Despite what you might read on social media, that’s objectively wrong.

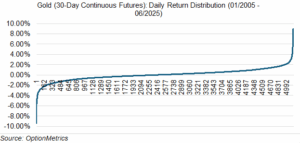

If you trade options, your opinion of gold volatility will be based on the factors that contribute to its implied volatility. Gold’s daily return is fairly low. Since 2005 – 5126 trading days-its daily returns have been greater than 3% only 48 times, and less than 3% 60 times. That’s 0.94% and 1.2%, respectively. As you can see below, gold is a pretty stable commodity from day to day:

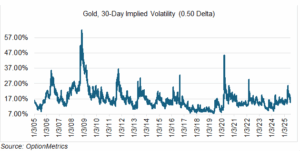

Given its low day-to-day changes and variance, Gold’s implied volatility trades at relatively low levels. It’s currently 15.4% (0.50 delta); it reached almost 26% when gold was making new all-time highs. Below is the long-term chart of gold’s implied volatility:

As you can see, it takes a serious crisis to get it to jump over the mid- to high-20s. Compare that to the many commodities, such as crude oil and natural gas, that regularly get into the triple digits, and you can see that gold isn’t an especially volatile commodity.

Despite the amount of breathless commentary aimed it’s way, gold may seem volatile, but it really isn’t.

Saylor vs. Chanos!

If you’re a fan of bitcoin, then undoubtedly you are familiar with Michael Saylor’s creation, MicroStrategy (MSTR), or just Strategy. Saylor is the Executive Chairman and co-founder, and he gets a lot of press. Unlike many other CEOs, he’s comfortable with social media and in front of the camera, and makes a very convincing and transparent case for his company. He’s a great salesman, and has never been bashful about describing MSTR’s strategy, in detail – there has never been any super-secret sauce that he won’t divulge. Evidently not: about 200 other companies are trying to replicate his strategy (as well as MSTR’s 197% 1-year return).

On that much he and Jim Chanos, the famous short seller, can agree. Chanos, whose most significant triumph was Enron, has been quite vocal on social media and elsewhere about MSTR’s potential overvaluation. He believes that MSTR’s so-called Multiple Net Asset Value (MNAV) , i.e., the value of the company in relation to the value of its bitcoin holding, which has varied between roughly 3.5 and 1.0 since 2022 but averages out to between 1.5 and 1.9, is too high and not merited. As such, his trade is long bitcoin and short MSTR. He has no idea what bitcoin should be worth, just its MNAV.

Of course, Saylor disagrees, and although he has posted some technical explanations, he usually resorts to his core belief that bitcoin will one day transform society. He can’t help himself. As he put it on X, “Tickets to escape the matrix are priced in Bitcoin.” Or this: “Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.” Huh? To Chanos, all this is a sign of over confidence manifesting in a questionable, yet alluring, strategy. To Saylor, it’s a sign of clever finance and a great transformation to come. To the rest of us, it makes for an interesting back and forth.

In the meantime, keep track of MSTR’s MNAV for extreme values – they could indicate good entry and exit points. And watch Saylor and Chanos duke it out on social media. It’s entertaining in a finance geek sort of way, and neither has resorted to name calling (yet).

An Amazon Wedding

No one really knows for sure how much Jeff Bezos’ wedding cost (and many would say that they don’t care – but I suspect they all watch the Real Housewives, secretly). A good estimate is about $25 million. That seems like a lot of money – to most people. Bezos’ net worth is estimated at $237 billion. If he earns just 5% simple interest on that amount, he would be making about $1.4 million per hour for every hour of the year, all 8,760 of them. When you look at it that way, his wedding was paid for in a little over 18 hours, no sweat. Given that, I’m surprised he didn’t spend even more (maybe he scrimped on the flowers?).

Have a great 4th! It’s the 249th anniversary of our nation’s founding!