Gambling… Sort Of

Lately, some trader friends of mine have been asking me about short-dated options and whether they should trade them or not. When I answer, “it depends,” they aren’t’ happy — they want a simple yes or no answer (but are really hoping for a “yes”). Unfortunately, that just isn’t possible. Despite the hyperbolic endorsements and tales of startling returns on social media, short-dated options are not necessarily for everyone, experienced options traders included.

Why? Because short-dated options, and by that, I mean options with expirations of one week or less, require some different considerations than conventional options. Since their expirations are so close, the effect of certain metrics, e.g., time decay, becomes amplified, and at the same time, implied volatility can vary so much that it is of limited use. Also, and especially for deep out-of-the-money strikes, the bid/offer spread can be exorbitant. Of course, this will turn out to be immaterial if the option goes in-the-money (the operative word being “if”) but will factor in if you decided to close out the position in the short time before expiration.

Regardless, valuing short-dated options is still a matter of probability, i.e., the object is to determine the probability of the option expiring in-the-money. Historical returns can provide a simple and intuitive method to calculate this. For example, how many times has the stock in question moved more than X% over X days? How many times has it moved X% before an impending earnings announcement? From the results, you can get a basic idea of the probability of the stock moving to whichever strike you choose. Of course, the past is not always an accurate guide as to what could happen, but this simple technique is certainly better than intuition or gut feel, both of which are inconsistent and easily affected by media-induced hype or subjective experience.

In some ways, short-dated options tread dangerously close to the “G” word — gambling. Whether trading stocks is gambling or investing is an age-old question that I’m not going to get into here. If you have an extra 6 hours or so, you can review all the opinions, commentary, and raving and ranting online. I bring it up because a) it’s important for you and your long-term financial health to recognize whether you’re gambling or investing, and b) it allows me to introduce my next, and related topic — sports betting stocks, specifically DraftKings (DKNG).

During the pandemic, and when people were locked in their houses, sports betting took off. It’s currently legal in 38 states. Total bets jumped to almost $120 billion in 2023, up 27.5% from 2022. Interestingly, the industry’s hold percentage (the percentage the house keeps after all bets are settled) was 9.1%. That’s great news for them, but not so much for bettors.

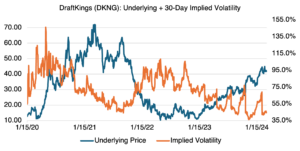

As for DraftKings, they are one of the few pure sports betting plays that are public. Like many stocks that initially benefited from the pandemic, they’ve had a wild ride since 2020. From a low of $11.30 in March 2020, to an all-time high of $71.98 just one year later, and then back down to an all-time low of $10.27 in May 2022, the stock ebbed and flowed with the pandemic. Since the beginning of 2023, DKNG has been rallying consistently. At the same time, its implied volatility, which regularly spikes before earnings announcements, has been trending lower; it is currently in the lowest range it’s been since DKNG went public in early 2020 (see chart below). As with most stocks, its implied volatility trades lower as the underlying increases. If you’re bullish on sports betting in the US, DKNG options are historically inexpensive from a volatility standpoint.

Source: OptionMetrics