Crypto Shenanigans

As you know, lately I have been writing about cryptocurrencies and how they have not been acting as advertised (to say the least). Each week has brought new revelations, culminating last week in crypto’s first official industrial strength meltdown. As is usually the case, a toxic brew of overconfidence, arrogance, social media hype, and greed all contributed to the situation. Crypto is by no means dead, but it has been dealt a serious shot below the water line.

I’m not going to comment (much) on what has taken place recently or those most publicly involved. I’ve pointed out several times that crypto is not a hedge against inflation, devaluation, war, or who knows what nightmare. It’s also not a lifestyle, philosophy, or cult (and if it is a cult, then it’s the most boring cult in the world). And it’s not a new and “idiosyncratic” asset class. Rather, it’s just the latest in a long line of niche spec vehicles that temporarily grab the world’s attention but wind up being overhyped and overdone. It’s annoying, but sometimes the humorless naysayers are right.

Whatever crypto really is or represents, several genuinely frightening issues did pop up last week that are worth noting.

The first issue is the specter of contagion sprouting from a collapsing crypto market. A few years back, when crypto was confined to enthusiasts, true believers, basement dwellers, and meme stock traders, the market was too small to realistically have an effect on broader markets. Since then, crypto has expanded its reach and has become the new plaything for institutional traders. Last week, with equity markets coming off hard and in unison, the “C” word, i.e., contagion, started appearing. The theory was that the crypto collapse was negatively affecting retail sentiment and thereby abetting the rush to the exits in other markets. In other words, after being destroyed in crypto, investors would sell anything that wasn’t bolted down to remain afloat.

Frankly, I think those pushing crypto contagion fears have it exactly the wrong way around — crypto’s decline is a symptom of the bear market in equity and fixed income markets, not the cause. Investors tend to shed the superfluous when times get rough (and question why they ever got involved with it in the first place), and whether you like it or not, crypto falls into that category. Market contagion gets clicks and makes for great disaster porn (Roland Emmerich, take note), but it’s a stretch.

The second issue is technical, but something to look into if you’re still trading on one of the newer crypto exchanges. I’m a veteran of a lot of trading injustices and blatant attempts to steal my money, but this one is pretty bad.

At the height of the crypto sell off, Coinbase (COIN) released its normally innocuous 10-Q. Contained therein was a certain disclosure that led to a serious Twitter storm:

“Because custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors (emphasis mine).”

Whoa, that’s a pretty big statement! Does that mean that if Coinbase goes bankrupt, they can seize whatever assets investors have in their accounts to pay off their creditors? Here’s what Coinbase’s CEO, Brian Armstrong, tweeted to calm everyone down:

“There is some noise about a disclosure we made in our 10Q today about how we hold crypto assets…Your funds are safe at Coinbase, just as they’ve always been.

We have no risk of bankruptcy, however, we included a new risk factor based on an SEC requirement called SAB 121, which is a newly required disclosure for public companies that hold crypto assets for third parties.”

“This disclosure makes sense in that these legal protections have not been tested in court for crypto assets specifically, and it is possible, however unlikely, that a court would decide to consider customer assets as part of the company in bankruptcy proceeding even if it harmed consumers (emphasis mine)”

He went on to say that the meltdown was a Black Swan event (it wasn’t). The real Black Swan event (if you must use the overworked term) was him mentioning bankruptcy in the first place. If a CEO mentions bankruptcy publicly, it’s serious. In any case, no risk of bankruptcy? None? Coinbase, currently trading about $68, is down over 70% YTD and reported a loss of $430 mm in Q1 (analysts had expected about $47mm). Bankruptcy might be a low probability event, but it is not out of the question given what’s going on and if another down leg materializes.

For the sake of argument, imagine that Coinbase or any crypto exchange that provides custodial services for its customers does go bankrupt. Adam Levitin, a Georgetown law professor, has provided a clear analysis of what could happen here.

Summarizing, he believes that “it ends very badly for the customers…” and that “…if you are a customer of a cryptocurrency exchange, you risk being a general unsecured creditor of the exchange if it should file for bankruptcy.” That’s a big deal, since most likely account holders will be general unsecured creditors and will have to wait at the back of the line behind the million lawyers, consultants, and workout people brought in to settle the bankruptcy. Good luck getting paid. But it gets worse. Crypto exchange deposits are not FDIC insured and bankruptcy-related losses are not covered by SIPC insurance, as is the case in a traditional brokerage firm. I know this is all boring stuff that gets lost in the excitement of opening an account, but it becomes very important when things turn ugly.

I’m not an attorney (thankfully!), but I can say that if youre trading or holding assets on Coinbase, or any other crypto exchange for that matter, you should read Professor Levitin’s analysis, as well as all your account documentation, very carefully.

Lastly, noticeably absent during all the turmoil has been the horde of celebrities and athletes that have cravenly pushed crypto on social media and broadcast media. Remember Matt Damon’s “Fortune Favors the Brave” crypto.com ad? Was he paid in crypto for his services? I doubt it! Good old US dollars were probably good enough. Frankly, if you take investment advice from the likes of Kim Kardashian, Paris Hilton, Mike Tyson, or Gwyneth Paltrow, you get what you deserve, plain and simple. But it does make you wonder why people with no investment background or training whatsoever can be supplying investment advice in very public forums, hiding behind a 0.0005 font disclaimer at the bottom of the screen.

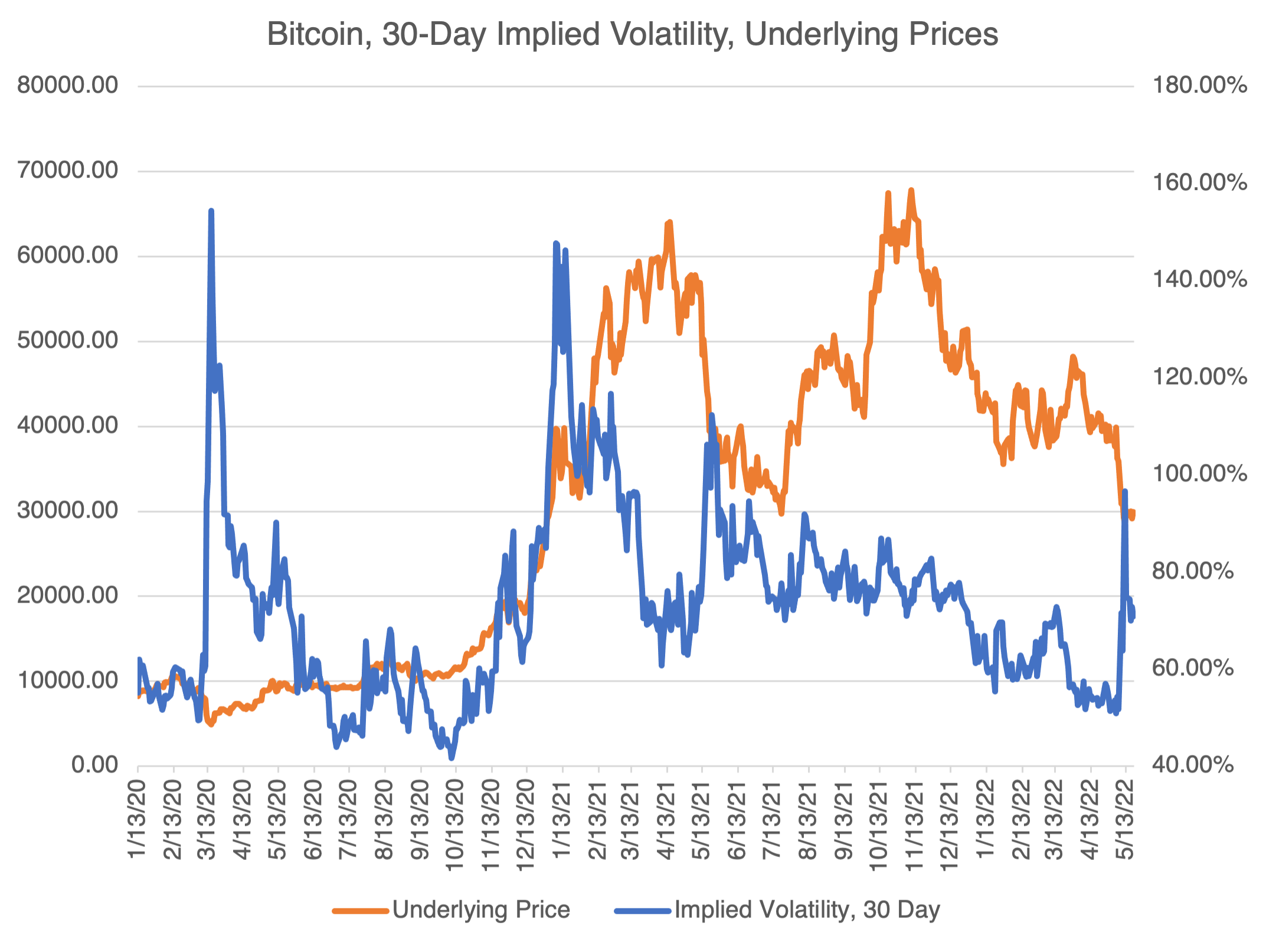

Now that I got all that out of my system, back to options. This chart should come as no surprise:

Naturally, the uncertainty surrounding Bitcoin increased markedly as did its implied volatility, increasing from a little over 50% pre-meltdown to a high of over 96%. As with all volatility jumps, once things calm down and crypto recedes from the headlines and volume decreases, it will recede back to the volatility levels from which it came. But currently, and if you’re thinking about buying Bitcoin using options because it’s “cheap,” I suspect you will be fighting against an implied volatility headwind.