Split Strikes

A few blogs ago, I recommended watching the new Madoff documentary on Netflix. By now, most of you know the story, but it does bring to light some details relevant to investing and options trading that are worth reviewing.

Madoff’s scheme, for those of you who have been on a desert island since 2008, was an audacious and shameless $65 billion con that went on for at least 17 years (although no one really knows for sure). In a nutshell, he took investors’ money and provided them with consistent, but not outlandishly high, returns, averaging 10 to 20 percent from 1990 – 2008. Uniquely, out of 215 months of operation, he reported an unheard of 198 positive months and only 17 negative ones, a 92% win/loss percentage. And if that weren’t enough, his worst month came in at only a-0.64% return . What was his secret?

The trick was that he never invested anything, not a dollar, and that the whole operation — returns, statements, positions, strategies, performance, compliance — indeed all the trappings of an actual fund, were fake. New money coming in from investors was used to pay off older investors, ad infinitum, while providing fees and toys to Madoff and friends and family. In other words, a giant Ponzi scheme, Wall Street style. The whole thing came apart during the 2008 financial crisis when many investors needed their money back and new money just couldn’t come in fast enough to offset the outflow. Game over.

How did Madoff fool so many allegedly sophisticated investors for so long? I won’t go into the details behind the psychological tricks he employed. Suffice it to say that he employed the classic tools of any investment con: trust, FOMO, exclusivity, fancy offices, respectability, and greed. In short, “I’m a Wall Street Big Shot and have been for a long time. Therefore, I must know what I’m doing and have the results to prove it. And look, this is an exclusive club and I’m doing you a favor by letting you join. If you don’t want to give me your money, others are waiting.” The allure of sitting at the cool kids table is real, and the basis of many classic cons. A somnambulant SEC also helped.

In one respect, you have to admire Madoff’s operational accomplishment. Producing fake statements, complete with a fake reconciliation of all the month’s trades and a fake pre-determined return, and for thousands of customers, takes real work and an expert, fully functioning back office. After all, it’s hard enough to do that correctly when the profits are real, much less completely fake! And that’s one of the reasons the scheme went on for as long as it did — to outsiders, everything, including Madoff himself, looked real and as expected. Unless, that is, you looked at his returns for longer than 10 minutes and considered them in relation to reality, his stated strategy, and common sense.

As part of his pitch, and when asked just how he delivered such consistent returns, he talked about his super-special, don’t-tell-anyone-or-I’ll-have-to kill-you Split Strike Strategy. Again, an exclusive strategy that only the most sophisticated investors employed. And now it’s available to you, too! Although most of how he described the strategy was authentic Wall St. gibberish, the split strike strategy is indeed a real thing, perhaps the only real thing in the whole upside-down Madoff universe. It’s worth reviewing.

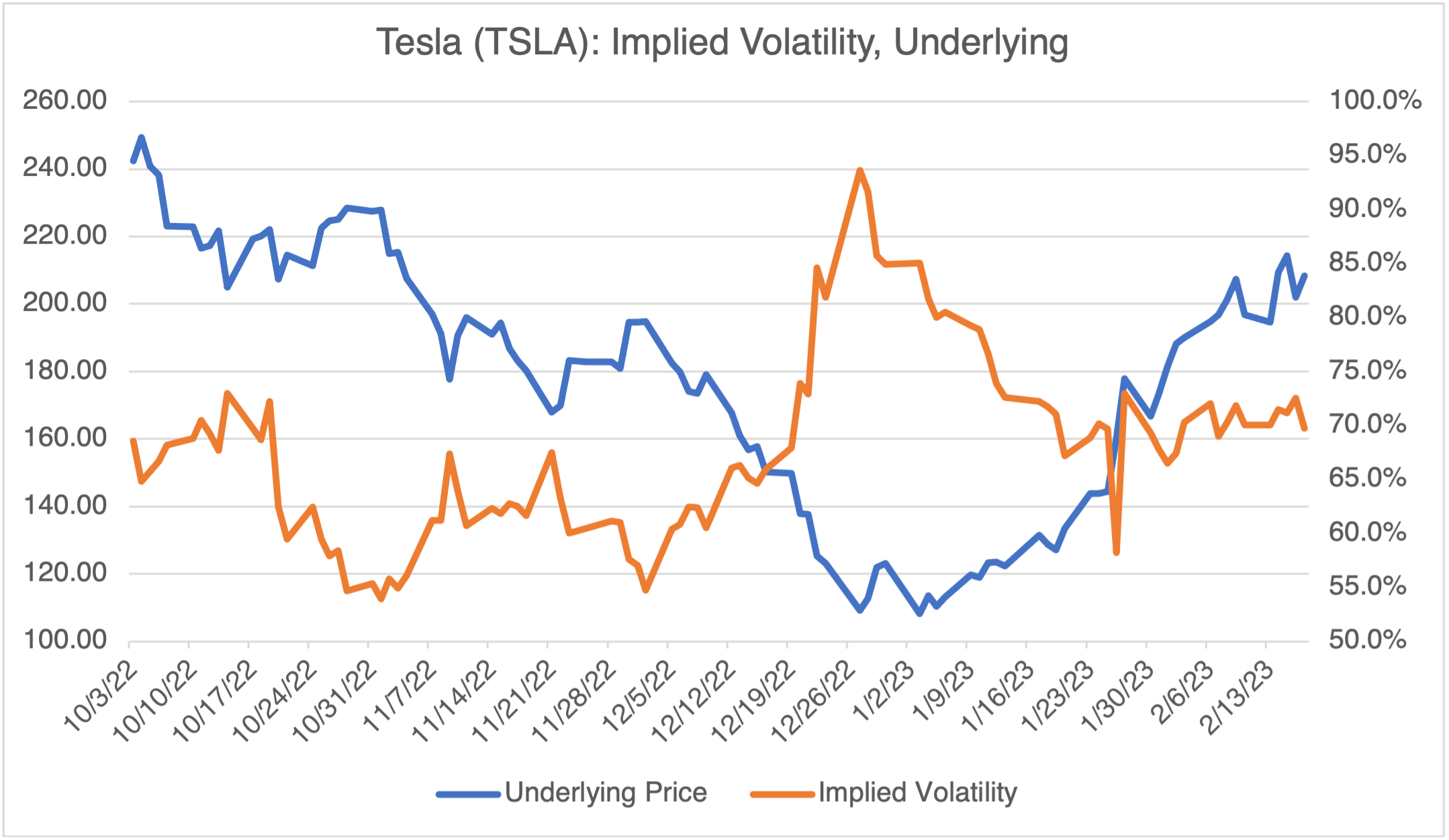

Let’s take Tesla as an example:

Now, assume you want to buy Tesla (like everybody else), but are afraid of its volatility and getting caught in a downdraft. A split strike options strategy is designed for this and will protect your downside while at the same time limiting your upside. The volatility of your returns over time will therefore be reduced.

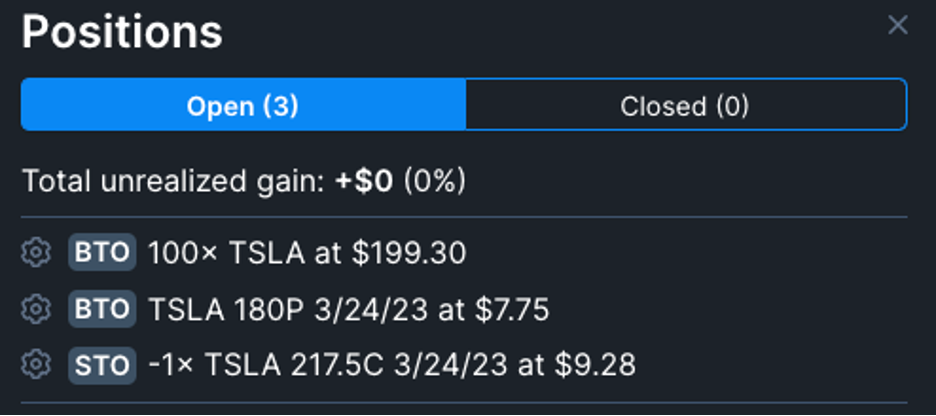

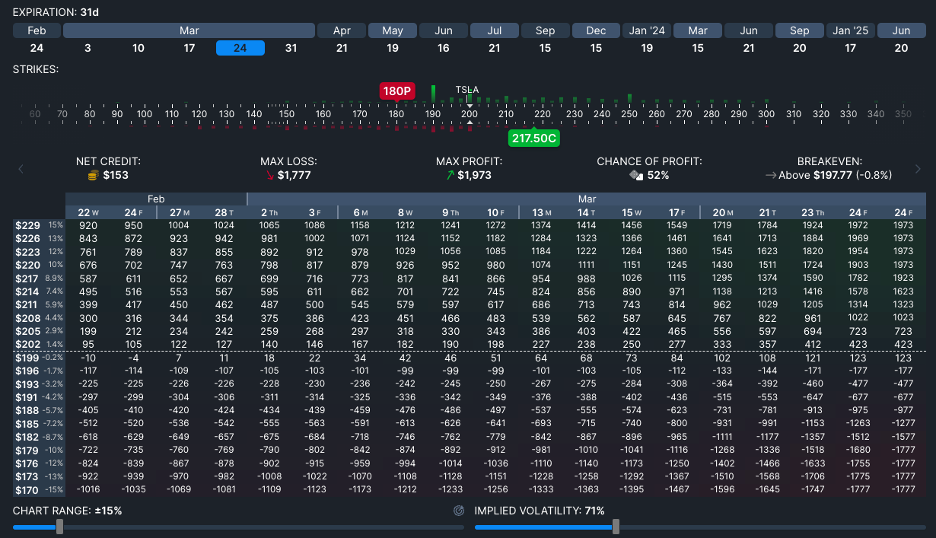

Consider the following trade from our options profit calculator: (You can use the build menu above to follow along)

Our profit calculator tool can show you the predicted profit and loss for this strategy. As you can see in the charts it generated, the result is that you limit your downside while at the same time capping your upside. The strategy is similar to the more popular buy/write strategy, in which calls are sold against a long position, generating income but limiting upside potential. The split strike strategy limits the downside as well. You can still lose, of course, but the losses will be limited to the difference between the stock purchase price – the put strike +/- the credit or debit of the put/call combination. In this case, it would be $199.30 – $180.00, or $19.30, plus the credit that you collected from the options, $1.53, to yield a max loss of $17.77. Obviously, you can adjust the strikes to change your upside/downside levels and the credit or debit from the options. In any case, and to use baseball analogies, this strategy is great if you want to hit a lot of singles, not homeruns.

And so, at least one thing that came out of Bernie Madoff’s mouth was true: the split strike strategy is indeed a legitimate technique to limit downside risk and to produce more consistent returns. It is not, however, a strategy that never loses, and certainly not only 8% of the time, as Madoff’s track record indicated. However, since he never actually executed it in the real world and made up all his results, we’ll never know for sure how it would have worked out for him.