Oil is Back – For Now

Crude oil is back. Having rallied almost 20% so far this year, Brent is hovering around $90 and is up over 16% year-to-date. Shooting above the psychologically important $100+ level may even be in the cards.

What’s really interesting here, and instructive, are the fundamentals being cited for crude’s most recent upsurge. Most commentators link higher prices on the threat of supply disruption or curtailment stemming from the twin wars in the Mideast and Ukraine. Crude oil has always responded to geopolitical tensions, and the current situation seems no different.

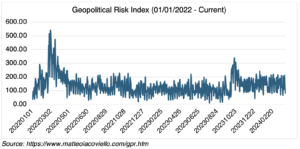

However, there is a problem with this analysis: geopolitical tensions have been a factor on and off and since Russia invaded Ukraine over two years ago and the war in the Mideast broke out last October 7. They are nothing new to the market and were present when crude was going sideways, and even lower, for several months before the latest rally. I have referenced the GPR index, a measure of geopolitical risks, in previous posts. As you can see below, the index has not moved up to any significant degree since oil started rallying in late February. Geopolitical tensions have remained relatively stable, albeit at elevated levels, since October 7.

Given this, it doesn’t seem like geopolitical tensions are behind oil’s ascendancy since late February. On the other hand, markets can be fickle and sometimes focus on fundamentals and narratives that make sense on the surface, and are convenient, but are inapplicable, outdated, or even false, for that matter. Regardless, fighting with the market is never a good idea. Concerns about geopolitical tensions seem to be ruling the day for the time being, no matter how valid they are. Although given a lot less attention, supply and demand fundamentals — extension of supply cuts by OPEC 10 members and stronger than anticipated global growth — are also supporting the crude market.

Approaching or pushing through the $100 level is not out of the question. Since the market is focused on geopolitical tensions, any new flare-up or offensive could cause the market to react. Needless to say, if crude pushes past the $100 level, oil producer and refining stocks will attract a lot of attention, perhaps more so than usual. 2024 is an election year, and the prospect of higher crude prices driving up gasoline prices will become a focus of the campaigns, and the press. Crude will be in the spotlight.

However, it’s a double-edge sword: an extended and comprehensive cease fire could knock the wind out of the crude rally. Given recent reports, it’s not out of the question, despite failed attempts in the recent past. Given that geopolitical tensions are already built into current price levels (rightly or wrongly), a cease fire would eliminate the market’s geopolitical prop, at least temporarily. In addition, a move over $100 could trigger changes to the current supply/demand balance, encouraging OPEC member to increase production while at the same time triggering lower demand as consumers react to higher prices. Lower crude prices, or at least sideways price action, could result as the bulls head for the exit.

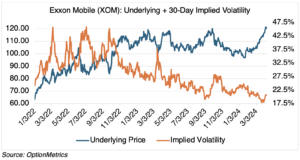

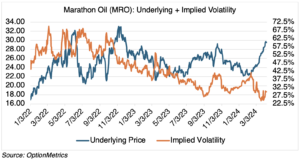

Oil producers and refiners have been benefiting from crude’s price runup. Year-to-date, the S&P 500 Energy Index (SPN) is up 17.1%. By comparison, the S&P 500 Information Technology Index, which includes some super-hot AI stocks, is up “only” 11.4% YTD. Unexpectedly, Exxon Mobil (XOM) (chart below), an old school producer of fossil fuels, is up nearly 18.5% this year, putting it way ahead of such tech stalwarts as Microsoft, Google, Apple, and Tesla. Similarly, Marathon Oil (MRO) chart below) is up over 21% YTD. Exxon and Marathon are obvious trading candidates if you think that crude still has upside potential due to tensions in the Mideast and supply/demand fundamentals, or conversely, that the rally is fragile and susceptible to a cease fire.

Notice that the implied volatility of both XOM and MRO have been decreasing since they started rallying in early February. This follows the usual inverse relationship between price and implied volatility common to many stocks and commodities. It also makes options in Exxon and Marathon relatively inexpensive, especially if you are considering straddles or some other long volatility strategy. For reference, below are at-the-money straddles, May 17 expiration, for XOM and MRO (OptionStrat, April 9). From the long side, they are essentially a bet that the movement in the market will be enough to counteract the effect of time decay. Keep in mind that like all options positions, you don’t necessarily have to hold the position all the way to expiration to get its benefits or limit losses. With straddles and strangles, this is an important point.