Nix the VIX? I Don’t Think So!

A colleague of mine sent me an article from 1999 entitled “Ken Fisher on Nixing the VIX.” At the time, the VIX index was only 5 years old, and it would be another 5 years until the VIX futures contract was introduced. In the article, Fisher and his team debunk the notion that the VIX can be used to forecast underlying prices. As he says, “Volatility is volatility,” and he’s largely right, at least on a long term basis.

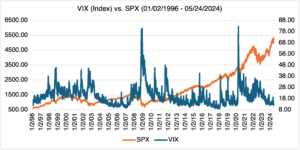

25 years later, many investors and traders continue to try to predict the market using the VIX. There’s a saying, notable more for its snappy rhymes than truth, “When the VIX is high, it’s time to buy. When the VIX is low, it’s time to go.” Sounds great, but don’t try trading on it on anything but a short term basis! See below for a long term comparison of the S&P 500 vs. the VIX:

Source: OptionMetrics

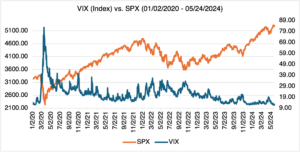

There doesn’t seem to be much of a long term correlation. That’s why trying to predict whether the SPX is bullish or bearish based on your medium to long term view of the VIX is problematic, at best. For shorter time periods (see below), it’s somewhat different: the relationship between the VIX and SPX is inverse (i.e., the VIX decreases when the SPX increases), with a correlation of daily returns that hovers in the low negative 70s. That’s considered significant, and on most days the VIX and SPX move accordingly. So, Ken Fisher was at least half right!

Source: OptionMetrics

And speaking of predicting the future…

Probable Predictions

Unfortunately, it doesn’t require any special expertise to make outrageous predictions. As a matter of fact, after watching YouTube for an hour and reading certain blogs, it seems like a prerequisite! I thought of this after reading an article in the Wall St. Journal about David Elias, the author of the 1999 book, “Dow 40,000: Strategies for Profiting from the Greatest Bull Market in History.” In his book, Mr. Elias, now 79 years old, predicted that the Dow would pass 40,000 by 2016 (as you can guess from the title).

Obviously, his prediction was correct, just 8 years late — “better late than never,” as Mr. Elias reportedly said. But that’s not really true.

Let’s give credit where credit is due: he got it half right, and with the Dow averaging about 10,500 in 1999, 40,000 was a pretty bold prediction at the time. But — and this is a very big but — his timing was way off. Most reasonable predictions eventually come true — it’s not a matter of if, but when. Recall all the frightening events that have occurred since 1999: 09/11, the crash of 2008 and fears of the second Great Depression, several wars large and small, and last but certainly not least, the pandemic. Everyone likes to think that they would stick with their convictions through thick and thin, that they can see through the smoke and fog of war, but very few can. In retrospect, it’s always obvious what to do. It’s a lot less clear when you are living through it and facing steep losses. And that’s why timing is key. I can make predictions about almost anything and they will probably come true at some point in the future — the question is when.

And finally, thousands of people make predictions, and just like the lottery, a few of them will turn out to be right. That doesn’t necessarily mean that the person with the winning ticket is super skillful, just that they happened to be lucky enough to win. After all, someone has to win. Since chance factors so heavily into the result, most who make correct predictions usually can’t do it more than once.

Mr. Elias’ next prediction is that the Dow will rise to 67,000 in the next 10 years. I hope he’s right.