Rockets for the Future

This week, I’m keeping up my review of futuristic, disruptive stocks whose business models or products were a figment of someone’s imagination just a few years ago. One stock that certainly qualifies (and has a 50’s sounding cool name) is Rocket Lab (RKLB).

Rocket Lab is similar to SpaceX in that they both engineer, build, and launch rockets for commercial purposes, the only difference being that RKLB is a lot smaller than SpaceX and doesn’t have the pervasive Musk hype machine behind it. If your satellite needs a ride to space, RKLB can help. Admittedly, the privatization of space has attracted a lot of new entrants, each with their own alleged and sometimes unproven edge. What sets RKLB apart is that they have actually achieved orbit, a much more complex procedure than just firing a rocket into space (however defined). As important, Rocket Lab has shown repeatedly that they are capable of “responsive launch,” i.e., changing orbits or providing launch windows in a relatively short period of time. This capability has become more in demand since the war in Ukraine. Also, Rocket Lab is not pre-revenue, but a going concern with $41mm in revenue in Q1 and 149 satellite launches so far. It also manufactures satellite components, diversifying its income stream somewhat.

A related space stock (and it even has “Lab” in its name) is Planet Labs (PL). Whereas Rocket Lab provides space transport, Planet Labs owns a constellation of satellites that provide “earth observation” services. Unlike the satellites portrayed in movies, 90% of PL’s are small, weigh about 13 pounds each, and cost about $300K each. All together, they are capable of snapping 3 million photos per day and provide information to defense, intelligence, mapping, and agricultural services. With over 200 satellites in orbit, Planet Labs has the largest earth observation fleet in the World.

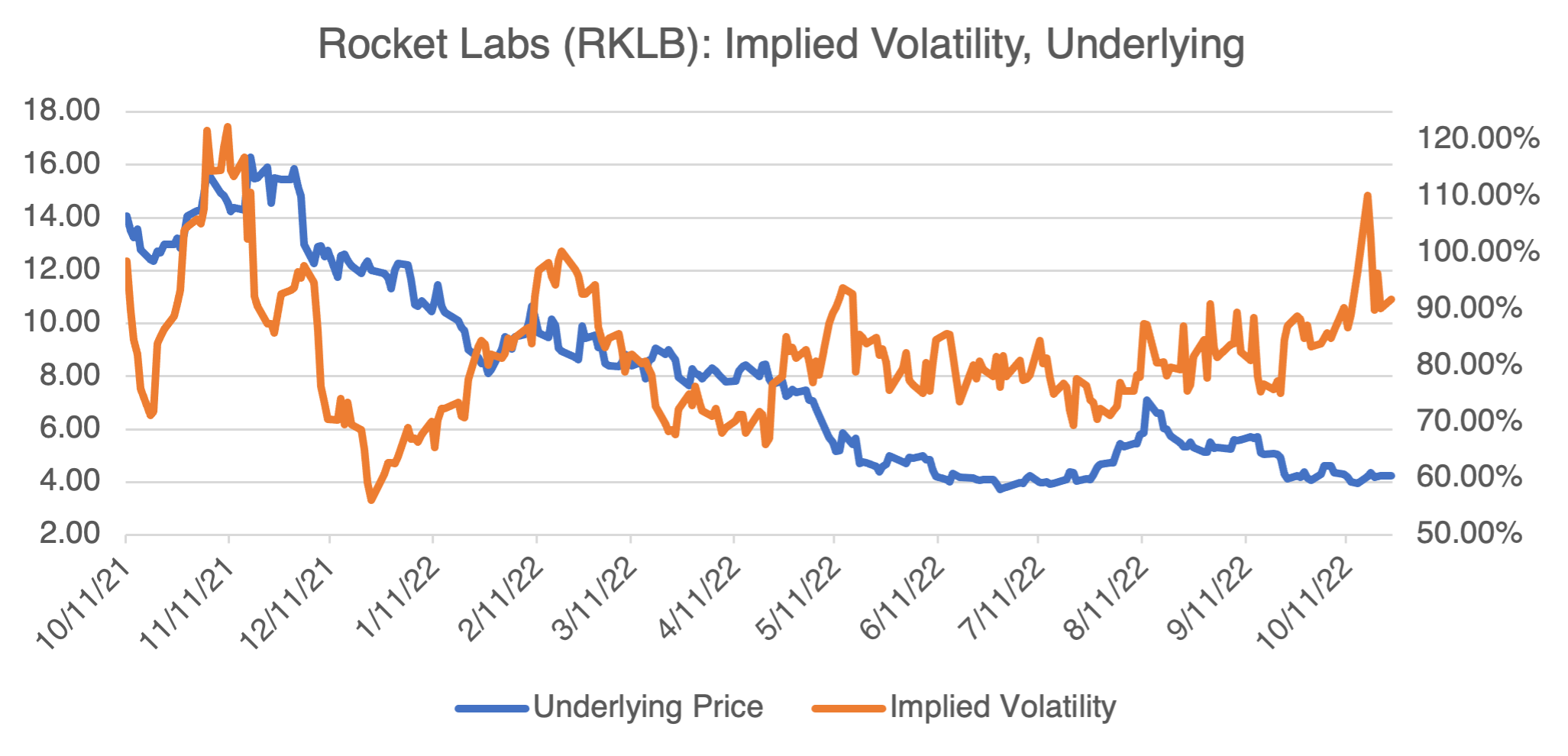

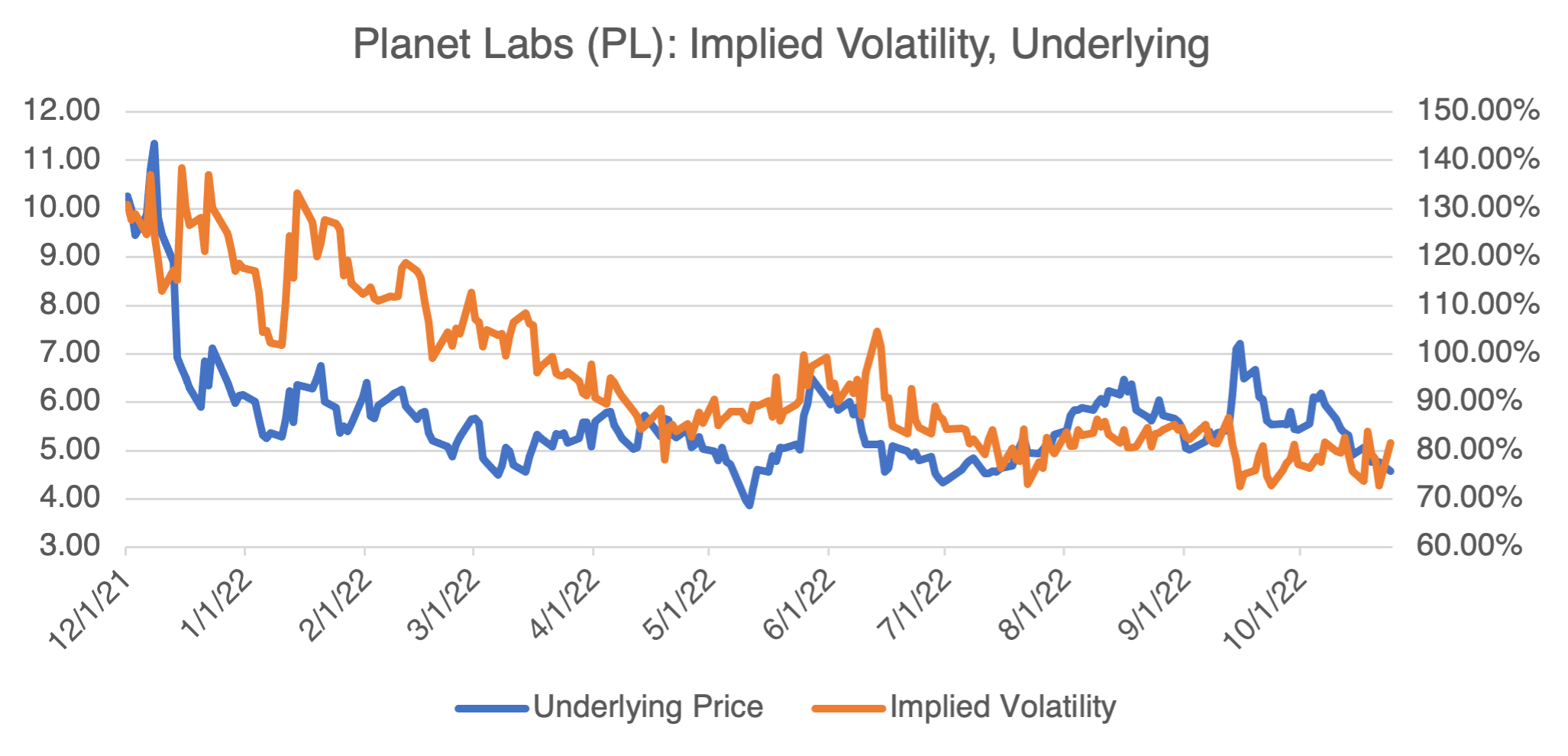

It should be noted that both stocks, as well as the one featured last week, Joby, are SPAC survivors. That is, they utilized a SPAC (Special Purpose Acquisition Company) to go public. They weren’t alone in this, as it was all the rage in tech and pre-revenue startups a few years back. It should come as no surprise that most of the SPACs are now dead, dying, or zombies. This has dragged down some SPAC companies that do indeed have good fundamentals and prospects. In addition, the space sector has not been immune to the general sell off in tech and higher interest rates. As you can see from the charts above, both RKLB and PL are trading at, or near, their lows. Net result: both stocks represent cheap entry into the space sector.

Rant Time! Insider Trading Is OK (i.e., for Certain People)

Apparently, one perk of working for the government is that it’s OK to engage in trading practices that would get the rest of us plebians thrown into jail, or at least dealing with the SEC for the rest of our lives. Over the last few weeks, the Wall St. Journal has been running a series of articles that detail just how much this has been going on. Even for the most jaded and cynical, it’s pretty shocking.

From the Journal:

“The Journal obtained and analyzed more than 31,000 financial-disclosure forms for about 12,000 senior career employees, political staff and presidential appointees. The review spans 2016 through 2021 and includes data on about 850,000 financial assets and more than 315,000 trades reported in stocks, bonds and funds by the officials, their spouses or dependent children.”

The most depressing highlights:

- More than 2,600 senior officials owned or traded stocks in companies that stood to rise or fall while those very same companies were lobbying their agencies for favorable treatment.

- More than 5 dozen officials reported trades shortly before their agency’s disclosed imminent enforcement action.

- More than 200 EPA officials, or 1 in 3, invested in companies that were lobbing the agency.

- At the Defense Department, some held stock in Chinese companies that were being considered for the blacklist.

- Almost every agency in the Executive branch was involved: the EPA, FTC, SEC, CFTC, Defense Dept, Justice Dept., the Commerce Dept., etc., etc., etc.

- Agency ethics officials in charge of monitoring officials’ transactions were either overwhelmed or did nothing.

The full article is available here if you’d like to read more.

Disturbingly, the series got little notice outside of the Journal itself. Even more disturbing is that I haven’t heard yet of anyone being disciplined, fined, or fired as a result of their actions. Maybe it’s business as usual, and maybe they feel it’s their due as underpaid government employees, but insider trading regulations should apply equally, no matter who you are or where you work or how much money you make. Frankly, I’m not even sure why this is even cause for debate. As investors that sweat each trade, I urge you to read the articles and draw your own conclusions.