Pros are Different

I often write about individual stocks that I think are interesting, mispriced, or in the news. Sometimes, they just have cool names that merit investigation (e.g., Rocket Lab). In all cases, I include a chart of historical prices and implied volatility (IV). I’m often asked why I include volatility and whether it would be more productive to include other metrics. Well, maybe, but obsessing about implied volatility is what separates pro option traders from everyone else.

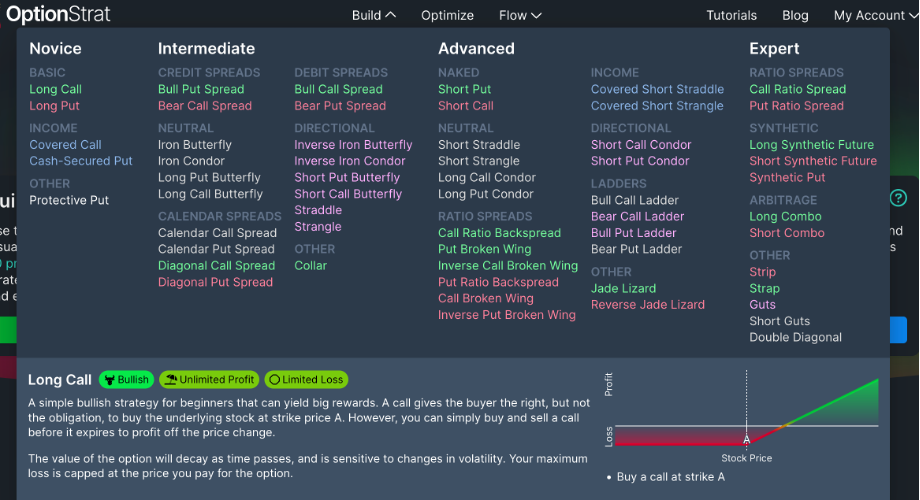

Why is this? Because true option pros aren’t betting on price direction. Predicting the future price direction of a stock is not where they have a competitive advantage. Rather, the center of the world for them are the two factors that make options unique instruments, implied volatility, and time decay. In pro-speak, they are running a “non-directional” book. And unlike most traders’ portfolios, their book is not composed of individual and independent strategies, such as those seen below from OptionStrat:

Rather, a professional’s book is a combination of options that are either mispriced for some reason or the other side of a client transaction. In this case, “mispriced” means that its implied volatility is too high or low relative to other strikes or expirations on the same stock, or even similar ones. Since they usually specialize in the same stocks and trade them every day, pros come to have a feel for where all the individual options should be trading at any moment in time. On a longer-term basis, they might be playing historical volatility vs. implied volatility, either for indexes or individual stocks. In any case, price direction doesn’t really enter into their strategies. In future blogs, I will detail exactly what they’re doing and how they make money (and lots of it!).