Supply and Demand: Inescapable

This week, an update on two completely unrelated blogs I wrote previously, More Teslas?, 11/21/2022, and Orange You Smart, 03/08/2023. Both tales feature one of the most immutable forces in economics, supply and demand, and in addition might turn out to be harbingers of new investment trends.

EVs: Irrational Exuberance?

The market for EVs is maturing and facing some hard realities. On the demand side, early adopters that originally drove double digit sales gains have already bought an EV, and despite the hopes and dreams of regulators and the industry, are not being supplemented by other car buyers. Although EV sales growth in the first half of 2023 is still running 50%, its pace is down from the 71% reported for the same period in 2022 and the 65% reported for the year. It’s also important to point out that the overall share of EV sales in the US for the first half of the year was 7.2%, growing but still a relatively small number. The EV sales bonanza may be running out of steam.

The industry has attempted to raise demand with a series of price cuts and promotions. Despite this, the average selling price of an EV during the first half of this year was a little under $51,000, above the budget of most car buyers. Add to that serious practicality concerns, i.e. range and recharging options, and many buyers are sticking with traditionally powered vehicles. Higher interest rates, which effect all car sales, are not helping, especially for what many consider to be a second or third car.

Given all this, it should not be surprising that the Ford and GM are revising their sales and production targets. Ford has cut back production of the F-150 Lightening pickup, the much touted electric version of the most popular selling vehicle in the US., and scaled back overall EV production plans from 600,000 in 2023 to the same number in 2024. Similarly, GM abandoned its production target of 400,000 electric vehicles by mid-2024 and delayed the opening of its EV truck factory by a year. EV inventory is piling up — Ford has a 3 1/2 month supply of its Mustang Mach-E, double the industry average.

Is this a blip in the long term trend towards vehicle electrification, or just (as my first trading boss used to put it) “normal variation within trend?” If you believe that EVs will eventually get more range due to improved battery technology, that recharging infrastructure will expand, and that prices will decrease due to manufacturing efficiencies, then the current market is just undergoing growing pains and may be in for a few up and down cycles, or interim solutions, before widespread adoption. Hybrid vehicles, which relieve range anxiety issues, may ease the transition, and enjoyed a 48% sales jump in the first three quarters of the year from (6%) in 2022. In short, vehicle electrification might be a process, disappointing those investors who are accustomed to sudden, short term disruption.

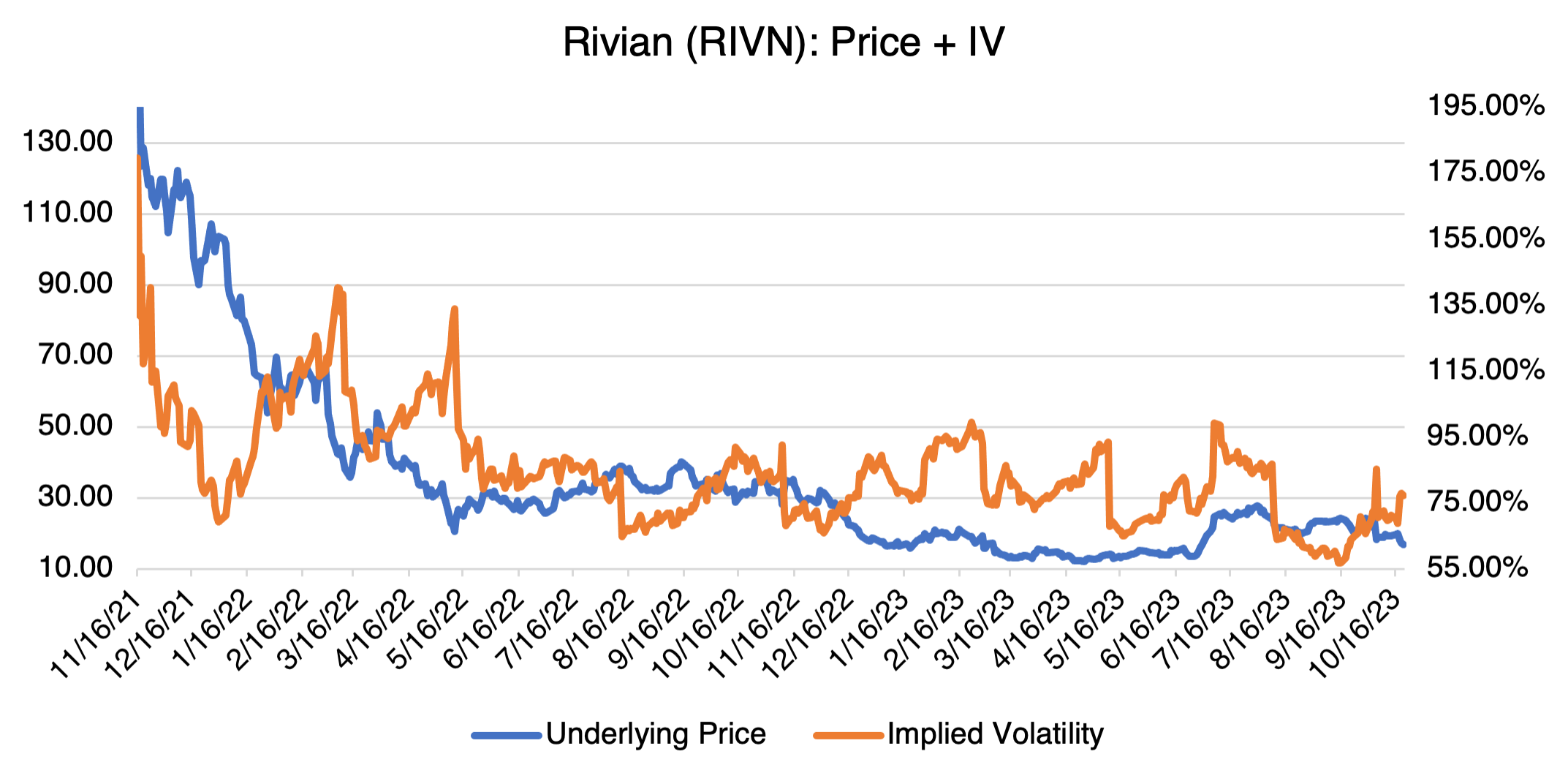

EV startups such as Rivian (RIVN) may be in for a rough (or rougher) patch. I’ve written several times about the extreme financial and engineering challenges that confront startups in any capital intensive sector. Rivian is no exception and has a cash burn of a whopping $1 billion every quarter. In the second quarter, they lost $33,000 on every car they sold. Their original plan to build a sports-car like pickup with advanced engineering and materials has been expensive and operationally difficult to produce. That would be true even for an established auto maker with decades of manufacturing experience, much less a startup like Rivian. Although sales are increasing and costs are coming down, RIVN will most likely have to raise prices to meet its targets. With Tesla and other EV manufacturers slashing prices, that will be difficult, especially since Rivians sell for an average of $80,000. On the other hand, sales were up 60% in Q2, and revenue grew 69%. Anecdotally, I am seeing a lot more Rivian pickups and SUVs on the street. Regardless, RIVN’s broad challenge is to prove that it can manufacture its product at scale before running out of cash.

Apparently, investors are skeptical. RIVN has yet to recover from its dismal showing since its IPO (RIVN IPO’ed at $78 in late 2021; it’s now trading around $17.50).

Notice that RIVN’s implied volatility is no bargain in the 75% region. Uncertainty pervades this stock, and that’s not going to disappear anytime soon. As much as you may like the cars and think they’re cool, proceed with caution.

Orange Juice: The Tech Stock of Commodities

Orange Juice Futures, or more accurately frozen orange juice concentrate, is one of those commodities that people who aren’t familiar with commodities talk about when they want to sound like they’re savvy investors. Pork Belly futures are another example, and despite having been delisted in 2011, are still mentioned when people want to prove that commodities are crazy volatile.

Regardless, people who know nothing about commodities could not be blamed this year for following orange juice. OJ prices are almost double previous all-time highs, and most of the increase has taken place in 2023. YTD, OJ is up approximately 92% (in comparison, FAANG stocks are up 74%). Impressive, even for a commodity known to have regular bouts of extreme supply driven volatility.

Why? In short, hurricanes and crop disease in Florida have decimated the crop to the point that supply is at its lowest level in 80 years.

Source: Trading Economics

Source: Trading Economics

Although OJ is a niche commodity, other soft commodities (cocoa and sugar), as well as live cattle, have also been moving up. In particular, cocoa and sugar are up 45% and 37% YTD, respectively. Breakfast is getting a lot more expensive!

Why is any of this important to anyone other than a specialized commodity trader? Because the price of OJ and sugar, similar to gasoline, has an outsized effect on consumers’ inflationary expectations and sense of where the economy is headed. $5.00 for a half gallon of orange juice and $8.00 for cereal makes people uneasy. Also, given the size of the movement, price increases in OJ, cocoa, and sugar will have an impact on any price index that includes food, e.g., the CPI. Fear of accelerating inflation is currently one of the main worried confronting investors in the broader markets and OJ, sugar, and cocoa sure aren’t helping.