GameStop. Again? Really?

I couldn’t resist writing about the latest action in GameStop, AMC, et al.

You may remember that a lot of seemingly normal people took up stock trading (it looks easy!) during the pandemic to pass the time between scary grocery runs and walking around the neighborhood for the first time in years. The most ardent of them were super-glued to their laptops, trawling for any podcast, video, or super-secret formula to pass the time and help them achieve their dreams of vast wealth in 24 hours or less. For many, this turned out to be one Keith Gill, known more popularly by his nom de plume (or should it be nom de guerre?), Roaring Kitty. It seems that he’s been MIA from the net since 2021, but reappeared unexpectedly over the weekend with a cryptic image (at least to the initiated) on X.

That was good enough for all his meme stock super fans who have been in suspended animation at their keyboards for the last three years. GameStop roared up 75% on Monday. In sympathy, AMC, the other meme stock superstar, rallied 78%, as well as other fundamental superstars Beyond Meat (BYND) and Blackberry (BB). The surge continued overnight as the story surged in popularity.

Note that the underlying fundamentals for all the stocks involved (in other words, the numbers that indicate how much money they’re spending and whether they are actually making money or not) haven’t changed one iota since before the resurrection of Roaring Kitty. More on that below.

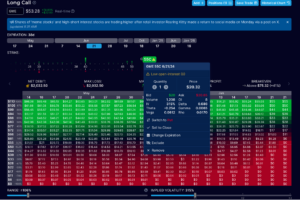

Needless to say, implied volatility for GME and AMC (screenshots from OptionStrat below) have increased to 300% +. I must say that I have been trading and commenting on commodity, equity, and foreign exchange options since the beginning of my career, way too long ago. I have experienced at least 5 wars, squeezes, irrational exuberance, crashes, manipulation, and all manner of crazy stuff. In all that time, 300% + implied volatility is something I’ve seen in all but the rarest of cases, and that was usually in some very illiquid, obscure commodity suffering from severe supply constraints, such as power.

Source: OptionStrat

Source: OptionStrat

So, what gives? To the dismay of most economists and finance professors, there’s nothing in the US Constitution that says that markets must be rational. As a matter of fact, it’s been my experience that most of the time they are irrational, and move on outdated information, rumor, or group think. The market can be a mob, and as we often see, mob-think can be very irrational. And besides, the rationale behind the rally — whether it’s sticking to evil hedge funds, genuine belief that the stocks are undervalued, or just a high speed momentum play — doesn’t really matter, and misses the point. The latest action in GameStop, et al, mirrors trends on Wall Street that have been developing for some time, namely the compression of the investment time scale to seconds, minutes, and hours, instead of days, weeks, or months, and the widespread expectation for outsized returns. In this regard, what’s been going on in GameStop, et all over the last few days is not all that much different from what’s been going on with high frequency trading, super short-dated options, and highly leveraged ETFs over the last few years. No one, least of all regulators, should be shocked.