Peloton: Last Gasp?

In a few articles going back as early as February 2022, I discussed the ongoing travails of Peloton (PTON). Why of the tens of thousands of securities available did I choose to write about Peloton, a producer of high-end exercise bikes? Mostly, because Peloton was a true Covid Darling, a company that could do no wrong during the height of the pandemic. Although it seems kind of crazy to think so now, a lot of investors were absolutely convinced that no one would ever go outside again, that the world was permanently changed and there was no going back.

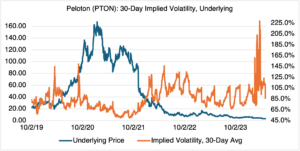

Like most predictions of the future, they were mostly wrong. Most people are naturally social, and they don’t want to work out in their house forever, no matter how trendy or convenient the torture device. Peloton was not immune to this, but apparently thought they were. Massive overproduction swelled inventories and rapid retail expansion increased costs. In market parlance, Peloton bought the high. PTON peaked out at $167.42 in early 2021 but it’s been mostly downhill since then. Barry McCarthy, the CEO they hired in early 2022 to replace the founder and turn the company into a subscription company that sells hardware and not the other way around, called it quits on May 2nd and abruptly resigned. At the same time, 15% of the staff was laid off, the fifth such mass layoff in the last four years and part of restructuring plan to cut $200 million in expenses. It’s not surprising that the stock is trading around $3.60, very near its all-time low of $3.37. Bleak.

So, what now for Peloton? If you’re getting that Sears/Bed Bath and Beyond/Circling-the-Drain vibe, you’re not alone. The company is now being run on an interim basis by two board members while they look for a new CEO (a difficult ask for the best of recruiters, to say the least). The good news for whomever they hire is that a) there isn’t a lot of downside left, and b) they will be able to demand a fat paycheck for a suicide mission. The bad news for them is that whatever strategy they dream up, it’s hard to reignite growth if the company’s main product is suffering from lack of demand and is yesterday’s news. Peloton is simply too big for the product it sells and needs to be “right-sized” (or whatever they call it now). Downsizing a company to reflect reality is never a good time.

Right on cue, potential buyers are beginning to circle. Just this morning, rumors of a possible buyout surfaced, sending PTON back over $4.00. The buyers will follow the typical PE playbook: cut costs to the bone, refinance the debt, generate free cash flow, and maybe — just maybe — generate gains after 13 straight quarters of losses. Everyone loves a bargain, and PTON may fit the bill.

On an options basis, you will not be surprised to find out that PTON’s implied volatility is extremely high and lately has gone deep into triple digits. This reflects the massive uncertainty regarding the company’s future and makes even deep out-of-the money options expensive. That being said, PTON is susceptible to vol crush (which I covered in my last two blogs), so you might be ablet to pick up some vol bargains after announcements that are publicized in advance.

Source: OptionMetrics

Source: OptionMetrics