Euro Defense Stocks – Fading Glory?

European defense stocks are all the rage. After it became apparent that the President would pursue a more independent and unilateral foreign policy, Europeans reacted by committing to spend €800 million as part of a new defense spending plan (“ReArm Europe”). The market’s reaction was not hard to predict. The Select STOXX Europe Aerospace & Defense ETF (EUAD) has increased 75.6% year-to-date; Rheinmetall (RHM), a German defense stock, has surged 202.0%. Most recently, in late June NATO members pledged to spend 5% of their GDPs on defense spending. European rearmament, which has been promised for decades, may be real this time.

I write “may” because a degree of skepticism is merited. Post-WWII Europe has relied on the US to provide for its security concerns, which has allowed them to build up an extensive social welfare state instead. “Guns or butter” still applies, and Europe has been decidedly on the “butter” side for the last 80 years. Culturally, economically, institutionally, and politically, it will be extremely difficult to suddenly change course and build up a substantial and credible defense establishment. That doesn’t happen overnight, or even over several years; it’s a multi-decade undertaking that requires innovation, deep supply chains, and consistent economic growth to pay for it all. In peacetime, and without the immediate pressure of war or invasion, the chances of long-term success are slim.

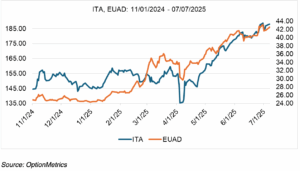

That’s not to say that short-term defense spending doesn’t matter. As I mentioned previously, the newfound interest in defense has led to a sharp rally in European defense stocks year-to-date. However, on a medium to long-term basis, the outcome is much less clear. Price action since mid-April may be indicating that the Euro defense investment theme might be running out of momentum. Using the Select STOXX Europe Aerospace & Defense ETF (EUAD) as a surrogate for European defense stocks, and iShares US Aerospace & Defense ETF (ITA) for the equivalent in the US, we can see that European defense stocks have easily outperformed the US sector year-to-date (75.6% vs. 28.9%). However, since April 7 (the bottom of the tariff sell-off), the results are much closer, 43.6% vs. 38.5% (see chart below). Apparently, the market’s infatuation with European defense stocks has spread to the US. That’s not to say that the European defense rally is over, just that it might moderate relative to the US.

Scary Stuff!

Risk managers worry most about unexpected events, the ones that come out of nowhere, sometimes in the middle of the night, and cause the markets to go crazy for a few days. Tariffs were a great example, and after a brief hiatus due to various wars, they’re back in the news. But for whatever reason, the markets seem to have gotten used to tariff uncertainty and don’t seem to get too worked up by it anymore. Of course, that may change as the President negotiates, pronounces, and threatens as the latest deadline approaches (see Copper’s 13% rise on Tuesday).

If tariffs aren’t scaring people anymore, then news that Chinese President Xi may be in trouble of losing his job just might. Needless to say, these rumors have been around off-and-on for a few years now, and outlandish predictions and conspiracy theories are the lifeblood of social media. Normally, they are best ignored, but these are not normal times. If the last several months have taught us anything, it’s that unlikely events sometimes do occur, and with higher frequency than we predict.

The thinking is that President Xi has presided over a weakening economy since 2020, with chronic structural issues and slowing growth, but hasn’t been able to reverse the situation. In addition, President Trump’s new found willingness to use force (Iran), has highlighted the danger of Xi’s belligerence toward Taiwan and the West in general. In short, Xi has been less than successful both domestically and internationally, and his critics are lining up. Most likely, this will lead to nothing and Xi will just purge his rivals, as usual, and that will be that. But in the unlikely event that Xi’s is deposed, it will have a significant impact on the markets. Since uncertainty will spike, the initial effect will most likely be negative until it becomes clear who is taking over.

Again, I wouldn’t bet on it, but the geopolitical situation over the last several months seems to be in transition (to put it lightly!), and not in favor of China and its fellow BRIC members.

Next Week

Jane St. vs. India. Options are at the center of it, but right now it’s hard to figure out whether it was manipulation or just clever trading (haven’t we been down this road before?). I’ll write about it next week.