Dependable, and Very Profitable, Vol Crush

I’ve written about Nvidia vol crush a few times now. To recap, vol crush is implied volatility increasing before earnings announcements and then crashing soon afterwards. For stocks that are in the news and well-followed, such as NVDA, vol crush can be a very consistent and profitable trade.

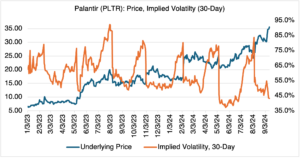

Due to its upcoming inclusion in the S&P 500, and its connection to AI, Palantir (PLTR) is up over 122% ytd. It’s also one of the most widely-held stocks among retail traders. Maybe that’s why is has historically provided the mother lode of all vol crush trades. As you can see below, the pattern has occurred for each earnings announcements over the last two years:

Source: OptionMetrics

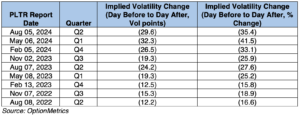

In table format, the vol crush pattern is even more evident. As PLTR has received more attention this year, the pattern has been intensifying:

Note that the changes above occurred from just one close to the next. For volatility traders used to fighting over just a few vol points one way or the other, the moves are extreme, to say the least, and one of the more consistent trades out there.

Bet on Anything!

Last week, I discussed 0DTE options and the increasingly fine line between investing and gambling. Coincidentally, and soon afterwards, Interactive Brokers announced that they intend to begin offering bets on its ForecastEx platform on the outcome of the presidential election. This comes after a US district judge held that the CFTC had overreached in blocking such markets as a threat to the integrity of US elections. Of course, the agency immediately appealed, again. Prediction markets have been available outside of the US for some time, but the ruling opens the door for other US-based prediction markets, such as Kalshi, to begin trading.

Personally, the threat from betting on presidential and other elections isn’t clear to me, but critics, and the CFTC, warn that such markets could incentivize the manipulation of elections for financial gain. Although that might be unlikely (and that’s probably one of the reasons why the CFTC keeps losing this battle), prediction markets are yet another sign that certain aspects of the financial markets are getting very close to what’s available in Vegas. Maybe critics of Wall Street were right all along – Wall Street is a casino after all. However, one feels about that, it’s one of the more important developments in financial markets over the last few decades, one that doesn’t seem to get a lot of attention.