Triple Witching Days: Not That Occult!

Once a quarter, the market experiences the so-called Triple Witching Day, or the simultaneous expiration on the same day of stock options, stock index futures, and stock index options. The last one was on March 15th. Prior to 2020, when individual single stock futures existed, there was the even more ominous-sounding Quadruple Witching Day (kind of like Double Secret Probation from Animal House). Each event is usually accompanied by a chorus of market doomsayers predicting imminent disaster. It’s 1929 all over again! Get ready for the crash! It brings to mind the popular risk management aphorism: “Predict disaster and be hailed as a prophet!” Of course, this conveniently ignores all the times disaster did not occur, which is almost always.

Why do people worry about Triple Witching (other than the ominous sounding name)? The theory goes that as traders adjust their positions on the day of expiration, super high volume will tend to accelerate prices swings, which could then be amplified and culminate in a panic. “Pin” risk, or the risk that the underlying will settle at the strike, can cause market makers to rapidly adjust their positions. Think of a large crowd, all trying to get through one small door, and you get the idea.

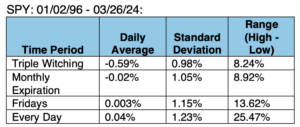

Is there anything to the warnings? To get to the answer, we reviewed SPY data from 1996 to current to see if triple witching days are more volatile than several other, more “normal” days. To that end, we calculated average daily returns, the standard deviation of those returns, and the range (difference between the highest and lowest returns). The results are below:

As you can see above, triple witching days aren’t that much different from any expiration, or any other Friday for that matter. When compared against every trading day since 1996, they display significantly less range between the highest and lowest returns (although the sample size for every trading day is obviously much larger).

However, just because something doesn’t happen frequently, doesn’t mean that you should ignore it. High impact/low probability events can be the basis of very profitable trades. From the short volatility side, you are betting that the income you derive over time, or your hedging ability, will be enough to shield you against the few times the event actually occurs (like selling fire or earthquake insurance); from the long volatility side, you are buying a lottery ticket, regardless of the odds against success. Which strategy you choose — long or short volatility — depends a lot on how risk averse you are, or not. Some people like betting on long shots, some don’t.

Please keep in mind that the analysis above measures interday swings, not intraday.

Although the evidence points to the fact that Triple Witching Days are generally benign, and indeed no more volatile than other expirations or trading days, they do have the potential for intraday fireworks.

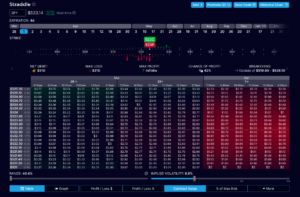

Short-dated options are great to play events, such as Triple Witching Days, normal expirations, or earnings announcements. If you think that movement will occur, but aren’t sure which way, then straddles (call and put — same strike) are usually the preferred strategy. Although the time to expiration will be extremely short, option greeks, especially time decay (theta) will be significant factors. As such, it is critical to use an easy-to-use options simulation and tracking application, such as OptionStrat. See below for the theta simulation for a typical, SPY at-the-money short-dated straddle expiring on April 1:

As you can see, the time display is in hours and minutes, instead of days, reflecting the short-dated expiration. Super short-dated straddles are essentially a time play — will there be enough time for the market to react sufficiently to get past breakeven?