Tesla, ONE More Time

Last week, I wrote about everybody’s favorite, Tesla. Since I’m an options guy, I was quick to admit that I had no special insight on the stock’s fundamentals. However, being a recent EV shopper, I did point out that Tesla is no longer the only game in town and that other auto companies now offer compelling EV choices. EV sales jumped to 5.8% of all car sales last year, up from 3.2% in 2021. Not surprisingly, the market reacted by offering more choices to consumers. Hence, Tesla’s recent 20% price cut in an effort to retain market share. Yes, the laws of supply and demand apply even to “disruptors” and luxury goods. In short, Tesla will have to act more like a regular company from now on, and that includes frequent new models and refreshes, price cuts, advertising, quality control, and all that boring stuff.

Just like TSLA overshot in the heady days of 2021, I suspect that the 2022 pile-on is also overdone. Whatever the competition, Tesla remains an aspirational, innovative, and highly profitable product and the undisputed leader in the fast-growing EV segment. TSLA owners have the highest consumer satisfaction of any car company and have an almost cult-like loyalty to the brand. Say whatever you want about Elon Musk (and there is a lot to say), but building a successful car company from scratch centering around a brand new technology is a feat that few, if any, have accomplished since the early days of the 20th century and the birth of the auto industry. With this in mind, and even with its dismal performance in 2022, 64% of analysts covering Tesla have “buy” or “overweight” ratings for its stock, the highest share since the end of 2014.

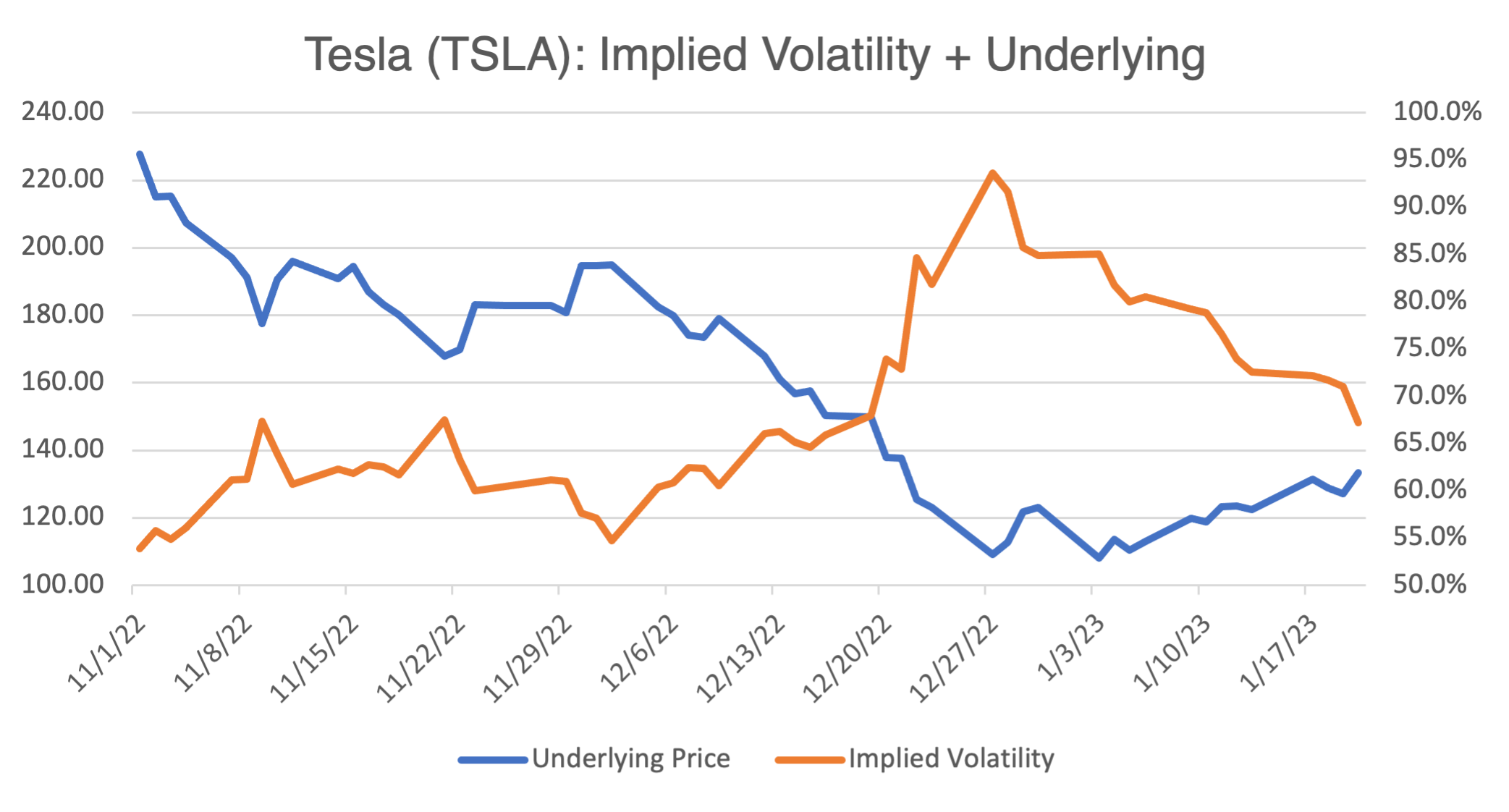

Whatever you think about TSLA‘s stock price, uncertainty rules for the time being. That being the case, options are a natural choice to express your bullish or bearish sentiment. That is, as long as you keep implied volatility and time decay in mind. As I wrote last week, “TSLA displays a characteristic common to many stocks: the tendency of its implied volatility to increase as prices decrease.” Tesla’s near-term action displays this clearly:

Whichever direction you think Tesla is headed, the inverse price/implied volatility relationship has important ramifications for building an options strategy. If you think Tesla is due for a price recovery, let’s examine what this could mean for two bullish options strategies using OptionStrat’s options profit calculator.

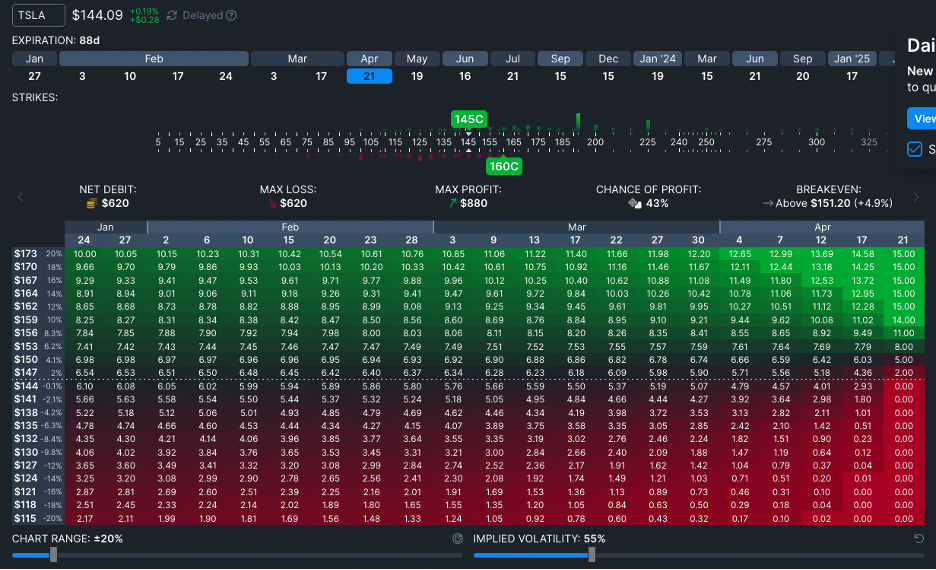

Assume TSLA is trading at approximately $144:

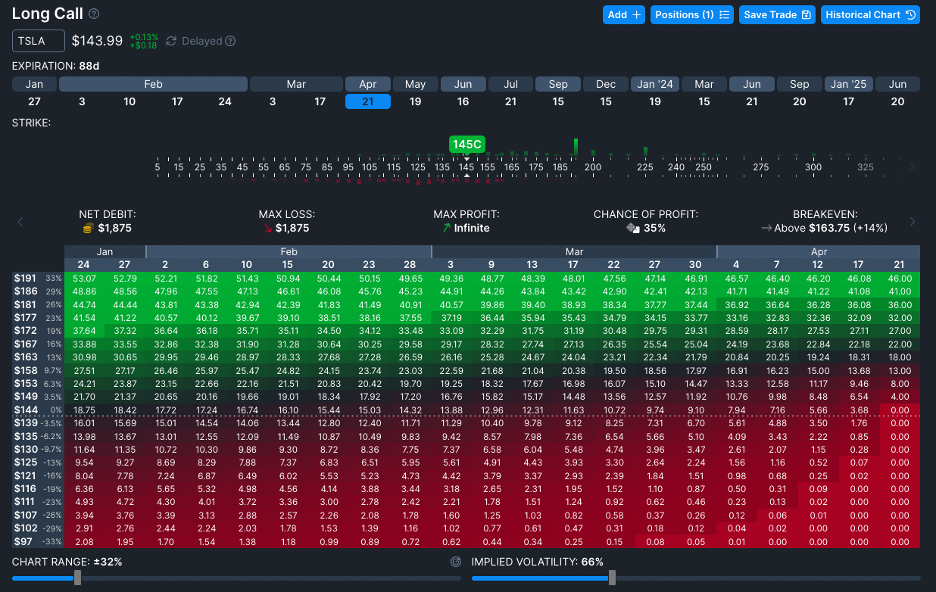

Strategy #1: Buy, 04/21 exp. $145 call @ $18.75

Below are the contract values for the outright call:

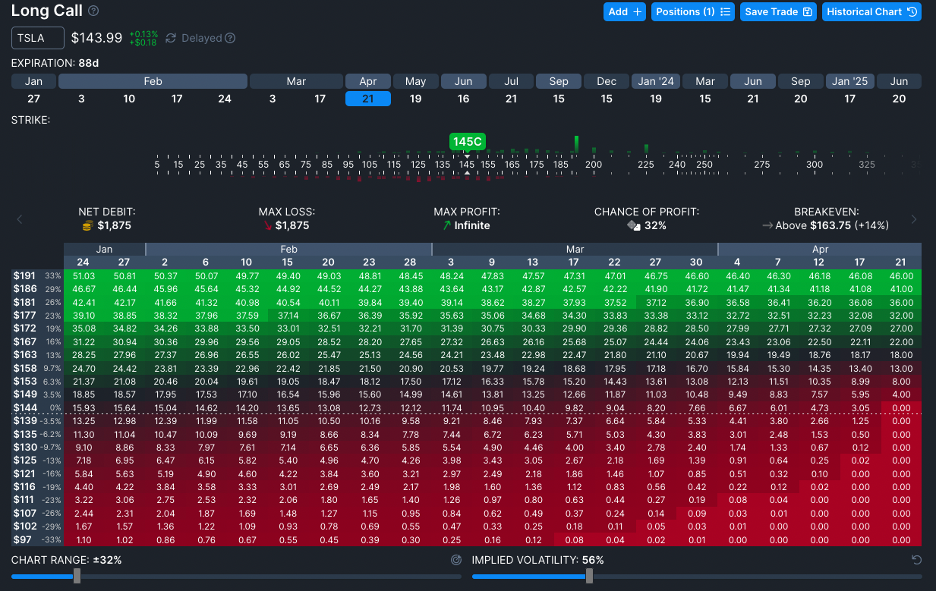

The options calculator shows the predicted profit and loss results for this trade. As you can see, the outright call suffers due to implied volatility decreasing as prices increase. Even if TSLA’s price increases, you will have implied volatility and time decay working against you. In other words, you were right but your strategy was, as quants say, “suboptimal.”

Option greeks make the analysis easier. The position’s Vega, or change in premium due to a 1% move in volatility, is $0.276. Theta, or the change in premium due to one day’s worth of time decay, is $0.11. In other words, a decline of 10 vol points from 66% to 56%, which is totally possible if Tesla recovers, will cost about $2.80 per contract. Add to that about a dime a day in time decay, and the long call strategy could be facing a significant headwind.

To avoid this and to reduce the sensitivity to volatility and time decay, a call spread is one possible solution:

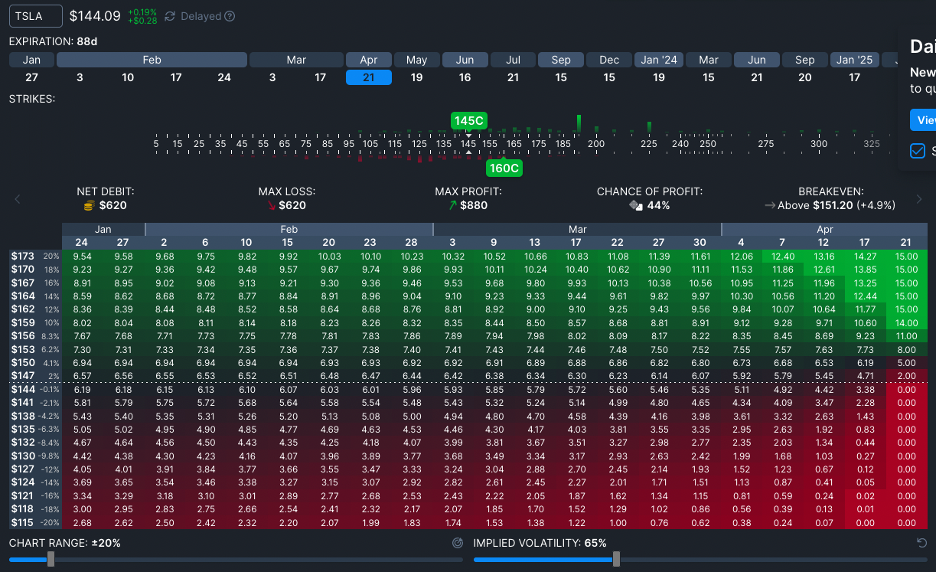

Strategy #2: Buy 04/21 $145 call @ 18.75; Sell, $160 call @ 12.60. In options jargon, you would then be long the $145/$160 bull call spread @ $6.15. Break even at expiration would be the long call strike + the net premium ($145 + $6.15, or $151.15); max profit is the difference between the strikes minus the net premium (($160 – $145) – $6.15), or $8.85; max downside is the net premium ($6.15).

Below are the contract values for the $145/$160 call spread:

The strategy’s greeks are informative. As you can see by comparing the greeks of the $145 and $160 calls, volatility (vega) and time decay (theta) virtually cancel each other out. Comparing that to Strategy #1, you can see that it is much less sensitive to volatility and time decay. In exchange for that, you will give up the upside potential of the outright call. Nothing is free in finance. However, given the expiration, a lower upside price target might be more in line with your expectations. These kind of trade-offs are easy to visualize using our options calculator, so feel free to replicate these strategies and play around with the calculations to see for yourself.

Recommendations Corner

Madoff, on Netflix. There have been a few movies on the subject, but this is the best at explaining what went on. Almost 15 years after the event, the audacity and magnitude of the crime still shocks me. A lot of people and institutions were involved, and few of them were adequately punished, if at all. The SEC and foreign feeder funds (basically, investment bundlers) top my personal list of those that got away with murder. I’ll not spoil it for you with the dirty details. Suffice it to say that they are all there and shocking, to say the very least. The “statements in the refrigerator” incident is my favorite. Watch it.

One interesting note for options traders. Madoff sold his “fund” (or whatever it was) by saying it was pursuing an innovative “split options strike strategy.” Potential investors ate it up. Next blog, I will review exactly what the strategy was, supposedly.