Nuke ‘Em!

Last January, I wrote about one of the more esoteric investments out there, uranium (Uranium is Glowing). The element is in the midst of a resurgence due to the growing consensus in some quarters that nuclear power must be part of any plan to meet net zero targets by 2050. Jennifer Granholm, the current Secretary of Energy, said that “we have to at least triple our current nuclear capacity in this country.” She also suggested that some previously shut down plants might need to be restarted. Limited and inconsistent power from renewables using current technology just can’t supply the necessary amount of baseload power (i.e., consistent power supplied 7 X 24 to meet minimum demand requirements) to meet ever-increasing demand from AI, EVs, etc. Natural gas and coal are the other alternatives, but they do not meet the necessary emission standards. Consequently, there are 61 nuclear power plants currently under construction (the bulk in China and India), 90 being planned, and over 300 in the proposal stage.

When most people think of nuclear power, they think of massive power plants and cooling towers that take decades to build. Nuclear supporters point out that new technology is on the way, and that Small Modular Reactors (SMR) are the way forward. For the uninitiated, SMRs are small, about 1/3 the capacity of a full size reactor, and modular, meaning that they can be prefabricated and then installed on site. SMRs also include mini reactors, which can be used for backup generation or in regions inaccessible to the grid. In general, SMRs are safer, smaller, simpler, and more flexible than the previous generation of much larger nuclear generating units.

Several publicly traded startups are attempting to bring SMRs to market. One of the most newsworthy is Oklo, Inc. (OKLO), of which Sam Altman (CEO of OpenAI) is chairman. The company’s goal is to sell mini reactors to end users, such as power-hungry AI data centers looking for dedicated generation. Since Altman is involved, OKLO benefits from a timely AI tie in. Altman also has a large investment in Helion, a fusion energy startup. OKLO was formed via a SPAC and only began trading last May 7. Since initially plunging, the stock has stabilized in the mid $9 region. Understandably, OKLO’s options are expensive and trade in triple digits. If interested, I would shy away from the options until they settle down and only trade the stock.

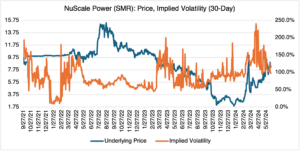

Another SMR manufacturer to consider is NuScale Power (SMR — they’ve got a great ticker for the business they’re in). NuScale makes small, conventional, water cooled reactors. They are the only SMR manufacturer to have their design certified by the US Nuclear Regulatory Commission.

Source: OptionMetrics

If picking between the various nuclear startups is too daunting, then you could invest in their main input: uranium. Over the last five years, uranium has more than doubled in price, easily outpacing lithium and copper, the two other commodities that most benefit from the push to net zero.

Source: Cameco

Investing in uranium directly isn’t an option for those not directly involved in the industry. The futures contract listed on the CME is illiquid and not viable.

You can, however, invest in uranium mining and processing companies that are highly correlated to the price of the metal. Currently, they are benefiting from the fact that Russia supplies fuel to almost a quarter of US nuclear reactors as well as many others in Europe and Asia. By any metric, Russia dominates the market. The war in Ukraine highlighted the problem with relying upon Russia for key commodities, uranium included. Consequently, public and private efforts are being made to secure uranium outside of Russia, and this is greatly benefiting miners and enrichment facilities.

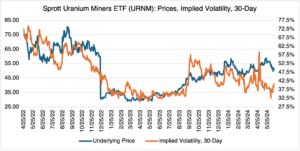

You can invest in uranium mining companies directly (Cameco (CCJ), Denison Mines (DNN), UEC (Uranium Energy Corp.), or NexGen Energy (NXE). Various funds, such as the Global X Uranium ETF (URA) or the Sprott Uranium Miners ETF (URNM) also exist:

Source: OptionMetrics

One caveat with uranium: it has a long history of boom and bust. Uranium producing regions, such as in Northern Canda, are littered with ghost towns that were once thriving due to the metal. As if to warn new investors, some are very close to new mines. Just a few short years ago, uranium mining was a niche business that attracted little attention outside of industry circles. The accident at Fukushima in 2011, as well as past incidents great and small, still cast a pall over the industry. There is nothing to say that the industry may be caught in yet another cycle.

Given its history, the expansion of nuclear power won’t come easy. Opposition to nuclear power is still the centerpiece for many environmental groups. However, practical considerations — the lack of consistent supply from other sources, the quest for zero or low emission power sources, and the necessity to keep the lights on in the face of ever increasing demand — are beginning to overwhelm the anti-nuclear movement. Recent elections in Europe decimated the Greens, the main source of anti-nuclear sentiment. The outlook for nuclear power looks good — as of now. Regardless, and based on its history, it’s safe to say that any sustained comeback will be an uphill slog and could be only one accident away from disappearing altogether.