Random Musings, Interesting Stuff

More about Nickel

Last week, we discussed the crazy goings on in the nickel market and why retail investors should take note. As I wrote, Tsingshan Holdings, the world’s largest producer of nickel and founded by Chinese oligarch Xiang Guangda (nicknamed “Big Shot”), had amassed a giant short position in nickel and got caught in a vicious short squeeze. Nickel prices, normally around $25,000/ton, rocketed briefly to over $100,000 for a few minutes. The London Metals Exchange (LME), the site for all this madness, promptly suspended trading for a week and cancelled all trades, retroactively, for the day it considered prices to be “wrong,” or not the “real” price. In that time, Tsingshan was able to secure financing for its short position from the banks that acted as his intermediaries to execute the position in the first place: JP Morgan, Standard Chartered, and BNP Paribas. In other words, all the banks that would have gotten killed if they didn’t bail Tsingshan out. Remember the concept of “moral hazard.” Apparently, the LME doesn’t!

Of course, Tsingshan was allowed to keep their massive short position, no harm, no foul. At the same time, the exchange instituted price limits to keep the nickel stable. Apparently, the exchange thinks that it knows better than the market what the true price of nickel should be. Or it’s so worried about insolvency that it’s willing to do anything to survive. Or both.

Lesson for retail investors: exchanges will, and for the most part can, do anything if they feel their financial insolvency is threatened. That includes, but is not limited to, suspending trading, instituting price limits, or even cancelling trades.

Agricultural Sanctions? The next big trade?

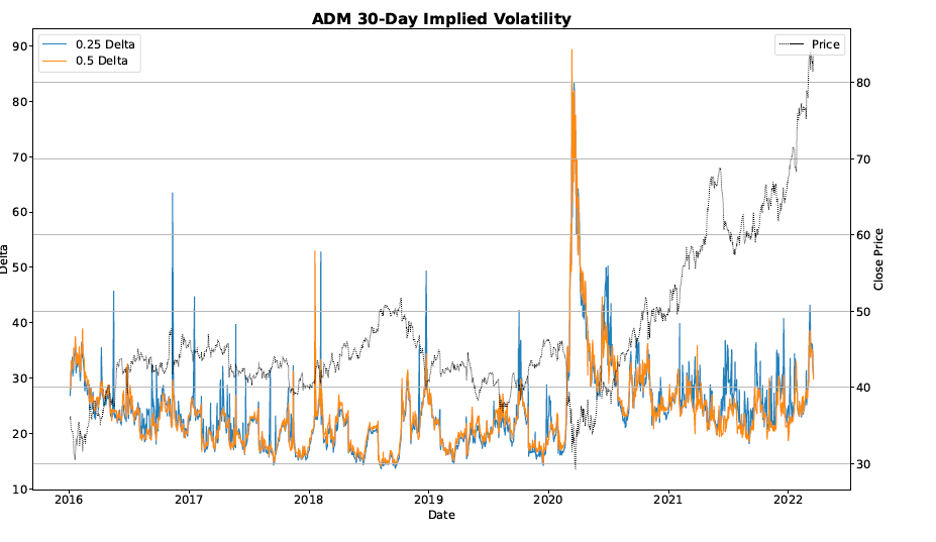

The Ukrainian war is unfortunately entering its fourth week, unabated. Financial sanctions are draconian and widespread, but certain sectors less so than others. Citing humanitarian grounds, Cargill, ADM, Bayer, Bunge, and others continue to sell seeds and handle product in Russia. So far, agricultural products have been spared sanctions, but there are increasing calls to extend them to the sector. Since Russia is a major exporter of wheat, prices are up about 45% so far this year. Sanctions will only drive wheat and other crops higher, and in turn, any equities related to them. As you can see in the chart below of Archer Daniels Midland (ADM), the stock has already shot up about 15% since the beginning of the war. However, and crucial for options investors, its implied volatility has moved upward but not significantly so. The result is that options in ADM are still not expensive relative to volatility.

(Source: OptionMetrics)

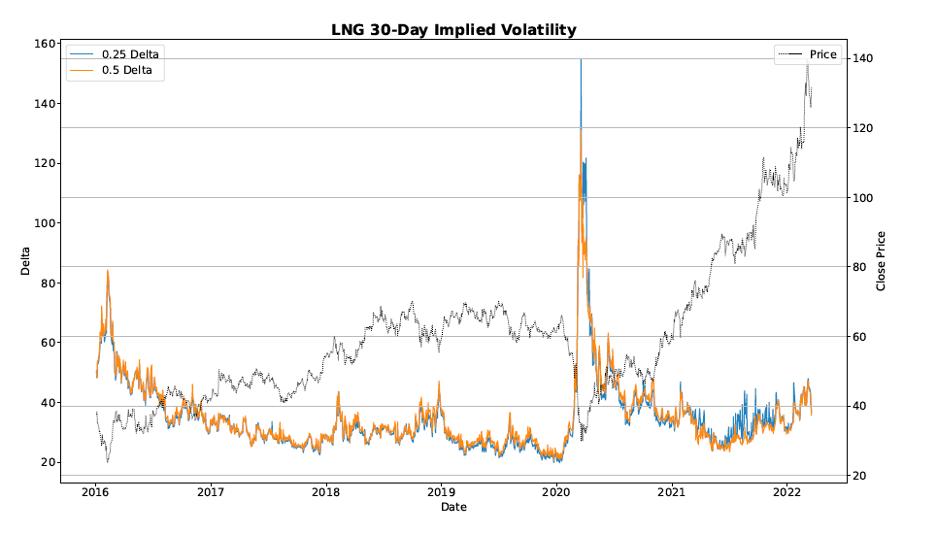

As we have highlighted in previous blogs, a similar effect (volatility has not kept up with prices) can be seen in Cheniere Energy (LNG) below:

(Source: OptionMetrics)

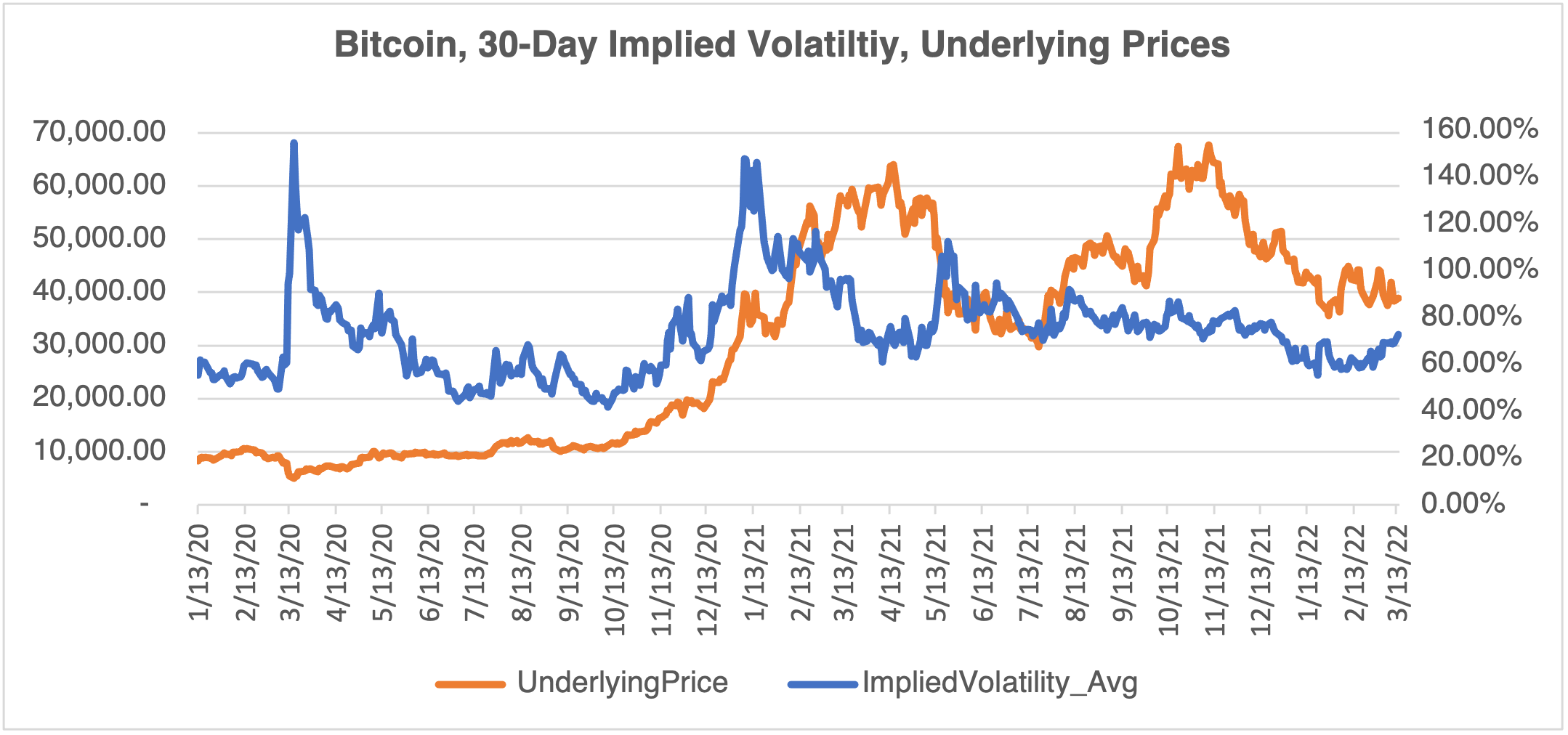

Bitcoin is Very Sleepy

After listening to anyone who regularly attended The True Church of Crypto over the last several years, you would have thought that the last six months would have been the golden age of crypto. Inflation, sanctions, war: all the elements cited for its ascendancy came to pass. And yet, in 2022, not much has been going on in either its price or implied volatility.

(Source: OptionMetrics)

Why? More on this next week.

Finally, I would be remiss if I didn’t mention the latest meme nuttiness:

Hycroft Mining Holding Corp (HYMC)

If you follow meme stocks, this is pretty good. The story concerns Hycroft, a small-cap gold mining company in Nevada that ceased operations at its only mine last November, and AMC, which now seems to be a meme stock merchant bank with a chain of movie theaters attached. On March 15, Hycroft announced that it was getting a getting a $28 million equity investment from AMC. (Why AMC invested in a gold mine is another subject. Needless to say, they are trying to diversify away from empty movie theaters. Ok, good plan, but gold mines?)

Prior to that date, Hycroft was all the rage on Reddit, with prices driving from $0.33 on March 7th to a high of $1.88 on March 11th. As is usually the case, meme investors flooded into certain short dated out of the money calls, anticipating lift off – the $2.50 call, expiring last Friday, went from a volume of 20 contracts on March 7th to 15,806 on the 14th. Needless to say, the hype fizzled, and the stock closed at $1.34. I imagine lots of disappointed investors. But isn’t that the point of meme investing? You don’t just buy one low premium, out of the money call, you buy lots of them in different stocks and sectors, hoping that just a few will be extraordinarily profitable. You can call it the Insect Baby Strategy: thousands are born because only a few will survive. I guess it’s similar to what AMC is trying to do: invest in many different businesses and sectors in the hope that one of them will bail them out. We shall see!