0DTE, Wood

0DTE Expanding, Again

The inexorable rise of 0DTE options continues. Responding to ever-increasing volumes and expiration dates, exchanges, brokerages, and trading firms are now discussing expanding the 0DTE universe beyond just indexes to include individual stocks as well. For certain investors seeking sky high returns on single names, this is great news. It’s also great news for market makers and exchanges that thrive off volume. Brokerages, on the other hand, are less enthusiastic. Historically, most investors have not made money on short-dated options and nobody likes unhappy, possibly litigious (regardless of the merits), customers. Regardless, the writing seems to be on the wall, and a limited launch on a few stocks could occur in Q3 2025. By 2026, expect full availability.

Will the expansion to single stocks be the final evolution of 0DTE options? Don’t bet on it. Wall St. and the exchanges have entire departments devoted to dreaming up new products to generate additional volume, and revenue. Since options expirations have been getting shorter and shorter, intraday, or even hourly, options are not inconceivable.

As many pundits have pointed out, the line between retail options trading and sports betting is becoming increasingly fine. Is the proliferation of 0DTE options just gambling in a different, fancier wrapper? Eventually, regulators might be asking the same question.

A Wood Pellets Debacle

The sad tale of Enviva (EVA) should be required reading for anyone involved in investing, trading, or investor relations. It contains valuable lessons in how not to make a bad situation worse and how to communicate bad news to Wall St.

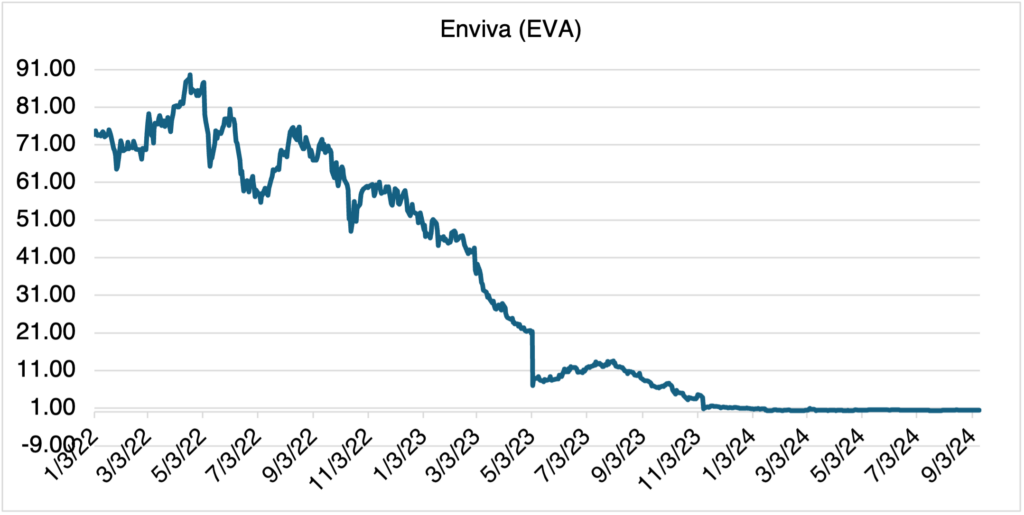

Enviva is the world’s largest manufacturer of wood pellets, which are used to fuel everything from barbeques to wood stoves to power plants. The pellets themselves are made from mill waste, scraps, and trees too small to provide lumber. Utilities, aided by green power subsidies, use them in an effort to reduce their greenhouse gas emissions. [As a side note, many doubt that wood pellets reduce emissions and accuse the industry of greenwashing.] Up until mid-2022, when the stock peaked at $87.71, Enviva’s business was booming and they were a darling of ESG investors. With 10 plants in operation, and plans to build 6 more, the future looked bright.

And then, the war in Ukraine intervened and the company’s problems began. With the curtailment of Russian fuel supplies to Europe, prices for wood pellets surged, along with their demand. Normally, for a producer of pellets, this would be great news, but not if you sold pellets using long term fixed price contracts and you didn’t have enough pellets to fulfill the existing contracts. Since there is a market for spot pellets, Enviva resorted to buying them there to meet the shortfall. They also rescheduled or cancelled some contracts, which resulted in a $141 million charge that was noted in their 2022 results. In the meantime, with their plants operating at full capacity, breakdowns as well as noise and air quality violations began to mount up.

If that’s all there was, Enviva wouldn’t be the first company to get caught short product in a rising market and they would have worked it out, eventually. But here’s where it gets interesting. In disclosing the $141 million charge to modify certain contracts, the company failed to reveal a wood pellet trade they made with RWE in Q4 2022, a German power producer and an Enviva customer. Thinking that the market would continue to increase, they bought pellets from RWE, the plan being to resell them later at a higher price and apply the profit to the existing $141 million loss. The trade was not reported to the board.

As if that wasn’t enough, in March 2023, a tornado destroyed one of their plants, raising investor concerns. In the next month, management reported that the dividend was safe and that they would continue to build more plants. But then, and just a few short weeks later, they did an about face and reported that their losses for 2023 were projected at five times their previous forecast, and that they were not paying the dividend. Needless to say, the market does not like surprises, or being misled, and EVA fell 67% after the announcement, accelerating the stock’s decline (see below).

Source: OptionMetrics

Worse was to follow in November, when management finally got around to revealing the trade with RWE. Turns out that the market for wood pellet prices collapsed after the company did the deal. The result: the trade was underwater by about $280 million and counting. That’s real money for any large scale trading operation, much less for a company supposedly not involved in trading in the first place. Needless to say, the usual array of lawyers and advisors were called in to determine what happened (read: who to blame). Rumors of bankruptcy began to circulate.

After missing an interest payment on its debt last January, Enviva finally arrived at its ultimate destination and filed for chapter 11 bankruptcy in March, 2024. Eventually, we will find out exactly how a producer of wood pellets came to bet the company on one disastrous, ill-timed trade. Although management can say that they were unlucky and that events outside of their control combined to force a “perfect storm” of lower prices, producing and selling wood pellets was their business, not trading. The well-worn aphorism “stick to your knitting” applies.