It’s NOT 2008!

People tend to think that whichever disaster they lived through personally was either the worst and most earth-shattering in history or a close contender. Hence, the usual clickbait headlines proclaiming “The worst [insert specific natural disaster, statistic, or crisis] since [insert something really big, like WW2 or the Great Depression]. The recent SVB inspired bank meltdown is a great example, with headlines screaming that it was “The worst financial crises since the Great Recession!” That might be true, technically, but gives the turmoil surrounding SVB a status that it doesn’t deserve (at least so far).

Consider the following about the long-term effects of the 2008 financial crisis:

- 8 million jobs lost

- Unemployment spiked to 10% by October 2009

- Eight million home foreclosures

- $19.2 trillion in household wealth evaporated

- Home price declines of 40% on average—even steeper in some cities

- S&P 500 declined 38.5% in 2008 alone

- $7.4 trillion in stock wealth lost from 2008-09, or $66,200 per household on average

- Employee sponsored savings/retirement account balances declined 25% or more in 2008

- Delinquency rates for adjustable-rate mortgages (ARMs) climbed to nearly 30% by 2010.

Source: Investopedia

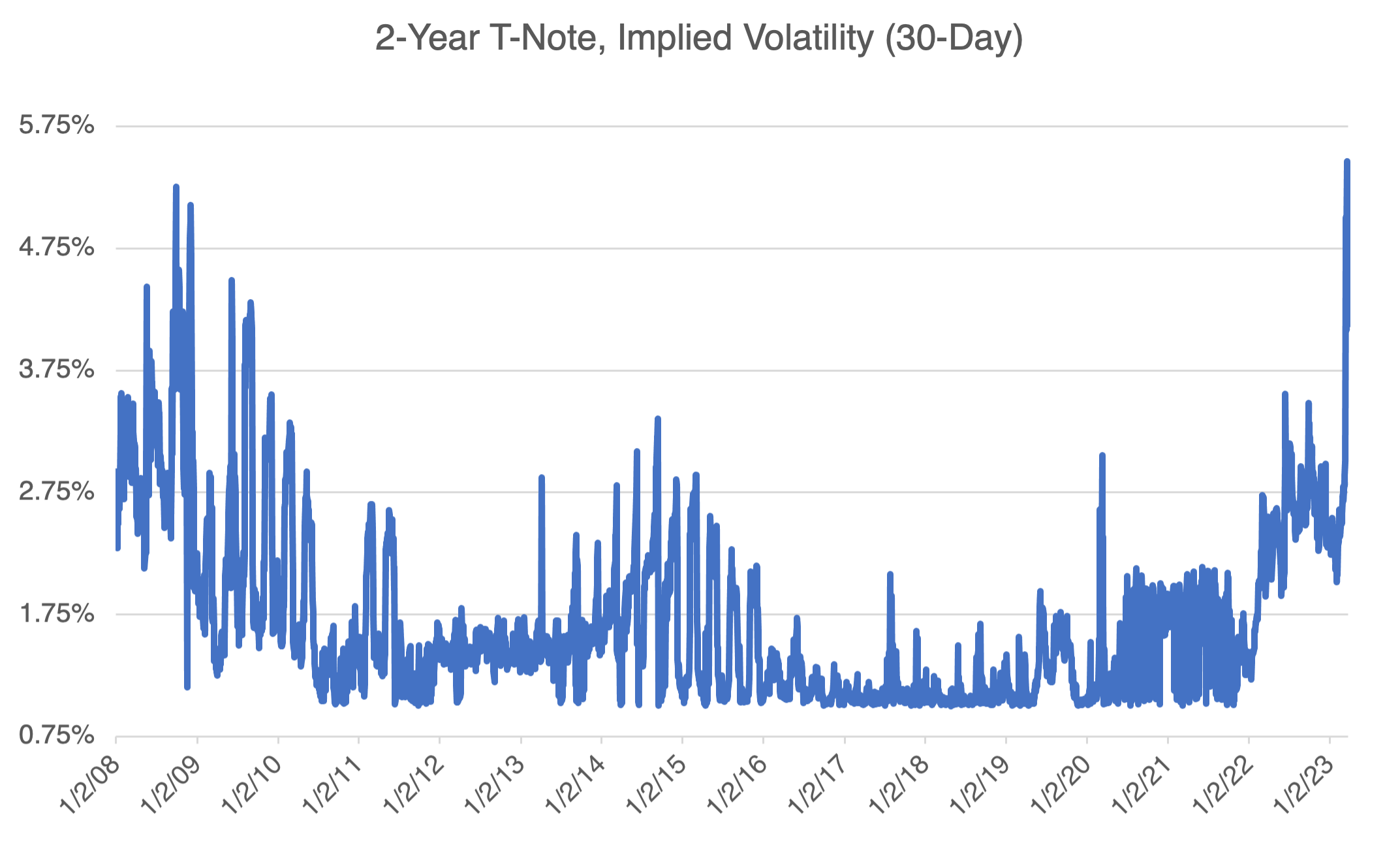

The only facet of the SVB crisis that is even remotely historical, or on par with 2008, was the price and implied movements in the fixed income market, which were truly awe-inspiring. Fixed income implied volatility is usually pretty boring, especially when compared to that of commodities and certain single stocks. Not anymore, or at least during the height of the crisis. As an example, below are the implied volatilities of 2-year and 10-year notes. The 2-year note’s IV was trading close to 2% at the beginning of February; it peaked out at almost 5.5% on March 20, almost 2.8X higher. That’s impressive, and only last seen during March 2020 (Covid) or September 2008.

Admittedly, the SVB crisis might — might — develop into something much more serious. But for now, it seems that the Fed and European authorities have kept a lid on it and markets are calming down and reverting back to pre-crisis conditions.

So, everybody calm down, the world isn’t ending (yet).

Interested in seeing what other traders are trading? Use our options flow tool to analyze real trades as they happen. You never know what you could find!