Economic & Geopolitical Uncertainty

Economic and geopolitical uncertainty, the main theme of 2025, seems to be accelerating into the new year. Two events this week may add fuel to the fire: the Supreme Court ruling on tariffs, and the intensifying protests in Iran. They are certainly significant events, and intuitively one would think that they should have an outsized effect on price and volatility. However, that may not be the case in anything but the short-term. The only thing that is certain is that both events will increase uncertainty.

First, tariffs. As you undoubtedly remember, April 2, 2025 was “Liberation Day,” the date that the current administration rolled out significantly higher tariffs. The reaction was swift and extreme, with the S&P falling about 12% over the next few days. Since then, the President has modified or compromised on many individual tariffs (“TACO”), and the market has relegated the issue to background noise. This Wednesday, it might get a lot louder, when the Supreme Court may rule on whether the tariffs were constitutional in the first place. If the court rules against the administration, they are sending a powerful message on the limits of executive authority regarding trade policy. The big question would then be how the Court handles the approximately $150 billion in tariffs that have already been collected. Do they require the government to refund them? That could be a very messy and lengthy process, and will have an impact on government spending, the deficit, and interest rates going forward. But so far, the market has largely ignored the potential impact.

Second, the situation in Iran. From a geopolitical standpoint, the Iranian revolution of 1979 was one of the major events of the 20th century and has had far-reaching effects since then. Although the demonstrations are more widespread than previous uprisings, it is by no means clear that the regime will fall. After all, one thing totalitarian regimes do very well is stay in power through any means necessary. Obviously, the risk to the markets is the same as with Venezuela: oil. Despite sanctions, Iran is a still a major exporter of crude (mostly to China) and refined products. If that supply were disrupted, crude oil would experience a significant jump in price that could negatively affect equity markets.

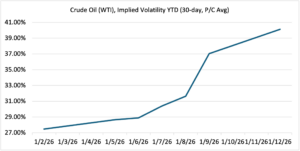

Given the risks emanating from Venezuela and Iran (mostly the latter), the market has moved higher in both price and implied volatility. Since last Wednesday when the Iranian protests got serious, crude oil (WTI, 30-day continuous) is up 4.1%. Over the same period, its implied volatility has jumped from 30.40% to 40.13%, a gain of 9.73 percentage points (see chart below). Hence, the flurry in crude oil options trading over the last few days.

Source: OptionMetrics

However, short-term moves could prove fleeting. The twin crises tend to cancel each other out, and while geopolitically significant, will most likely have a minimal effect on global supply. Investing in the Venezuelan oil industry is a risky proposition that very few energy companies (Chevron) are willing to undertake. Increases in crude supply are therefore largely illusory. At the same time, supply disruptions due to the turmoil in Iran are unlikely in anything but the short term. The one thing that both the current regime and the demonstrators agree on is that oil is crucial to pay the bills, so they are unlikely to do anything to jeopardize its continued flow (although much of the hard currency generated from oil sales is diverted abroad, one of the many reasons that the currency is essentially worthless and inflation is out of control). Of course, there’s always the possibility that the current regime will go out in a blaze of scorched earth glory and destroy the existing infrastructure, or that the fighting could damage energy facilities.

One area in which these events and increased uncertainty are having an effect: precious metals. As I covered last week (A Silvery Bubble?), their rally from 2025 is only intensifying this year. We’re only 7 trading days into the new year, and already gold is up 6.53% and silver 20.76% (futures, 30-day continuous). Although at this point momentum probably has more to do with the ongoing rally than anything else, new events keep on springing up that only confirm investors’ perceptions of uncertainty and instability. The Justice Department probe of current Fed chairman Jerome Powell is just the latest example. That being said, and as I wrote last week, the rally in silver, now showing +/- 4% daily returns over the last 9 of 11 trading days since Christmas, is feeling very bubble-like.