A Silvery Bubble?

First, a very Happy New Year to all my readers!

It’s 2026, and what better topic to begin the year than the endless conversation about financial bubbles, in this case silver. The metal registered the largest increase of any commodity in 2025, 142.4% (Platinum and Palladium were second and third, up 127.1% and 77.5%, respectively). In contrast, gold posted “only” a 64.5% gain. Silver’s 2025 performance was eight times that of the S&P. No wonder retail investors are flocking in.

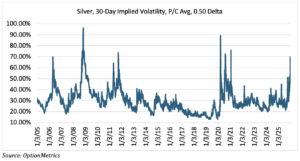

In keeping with the trend, silver went berserk during the last few days of the year after Christmas – there’s just no other way to put it. Consider the following price action: from 12/26 to 12/31, silver daily returns were 7.70%, (8.63%), 10.54%, and (9.35%). As you would expect, its implied volatilty exploded to 63.9%, a full 9.4 percentage points higher than it was just four trading days earlier. After all that, silver ended the year at $70.59, 46% higher than it was at the end of October. If you need visual confirmation of silver’s raging bull market, here it is:

The reasons cited were the usual roundup of depressing fundamentals – ever-increasing inflation, a declining dollar, political uncertainty, central bank purchases, and supply shortages exacerbated by industrial demand. In addition, there is the belief that the world is turning away from the US dollar as the reserve currency. In short, buyers are looking for a safe haven from what they perceive to be an unstable world. All of these factors have been present since precious metals started their upward run in 2024. The most recent events in Venezuela only confirmed the bulls’ logic.

The obvious question: is silver a bubble? When I’ve previously written about bubbles, I’ve been quick to point out that not all aggressive bull markets are bubbles and that confusing the two can be very expensive. I’ve also pointed out that genuine bubbles are rare, and usually only apparent in retrospect. Consider that last year, AI, private credit, and gold were all held forth as possible bubbles, ripe for imminent and dramatic destruction. Despite some short term downtrends, their destruction still hasn’t happened (at least not yet). Who knows if it ever will.

But again…is silver a bubble? I’m going to go out on a limb here and say that it sure smells like one. I know that’s surprising given everything I have written on the subject to date, but a few factors are leading me to that conclusion.

First, bubbles tend to be characterized by excessive social media and search presence in the “information ecosystem” (as one commentator put it). As revealed by Google Trends, search interest for “silver” has now reached an all-time high. Recent events in Venezuela have only added to the trend. This suggests that investors who don’t normally trade precious metals are entering the market. Since they are primarily momentum investors, and silver is less mainstream and familiar than gold, their staying power in the event of downside volatility will be limited. In other words, they got in quickly, and may leave quickly.

Second, prices tend to accelerate and become more volatile in the last phase of a bubble, the “blow-off” period. Silver’s daily returns since 12/26 have been +/- 7% for 5 of the 6 trading days. Since 2005, that level of return variation has only occurred 1.2% of the time; greater than a 7% daily return has only happened 20 days, or 0.4%. Silver’s implied volatility (see chart below) reflects this and is currently trading at roughly 65%. Levels above 60% have only occurred 2.2% of the time, and on average last just 13 days.

Third and last, we can look at one conventional metric, the gold/silver ratio. As you can see in the chart below, the ratio has been plunging since April 2025. As of 12/26/25, the ratio had declined 24.8% over the previous 20 trading days, it’s largest decline in percentage terms since 2005.

Given the three factors above, silver is beginning to look very bubble-like. However, as usual, I caution against standing in front of a barreling freight train. If silver’s possible bubble bursts, you will have plenty of time to trade it.