Two Updates

This week, I’m going to update two unrelated topics I wrote about previously, bitcoin treasury companies and quantum computing.

First up, bitcoin treasury companies, or financial innovation at its best. I’ve written about these previously, mostly about Strategy (MSTR), and was skeptical of their underlying financial logic and their long-term viability. Strategy was the original crypto treasury company, but its success has led to many others to pursue the same strategy but with other assets. Ethereum, various tokens (Dogecoin and Trumpcoin), meme stocks, and gold are now all available in treasury company format. As always, increased competition is reducing the strategy’s profitability, and revealing its limitations.

To recap, MSTR’s basic strategy is to issue stock or debt, buy bitcoin with the proceeds, and then repeat. In essence, the stock is a leveraged bitcoin proxy that trades at a premium to the value of its bitcoin holdings. The premium varies as the enthusiasm for bitcoin, and MSFT, increases or decreases.

If bitcoin is the only asset that MSTR holds, why does the stock trade at a premium to the value of its bitcoin inventory? Good question, and the answer depends on whom you ask. According to MSTR super fans, it’s because the company gives investors access to bitcoin, a store of value with limited supply, on a levered basis. At the same time, super bears will tell you that investors already have access to bitcoin if they want it, and that the premium is built on online hype and leverage, and when bitcoin finally loses the Trumpian wind at its back, the premium will disappear.

Whichever side is ultimately proven correct, I think both sides would agree that the strategy is very clever. But unfortunately for the bulls, it may have run its course for now (see chart below):

Source: bitbo.io

Since peaking right around the time of the inauguration last November and when the administration was aggressively backing crypto, the MSTR/BTC premium has been shrinking. Whether that’s because other companies are offering similar treasury accumulation strategies, or investors are no longer buying the idea that MSTR will be able to keep on issuing debt or selling shares, or because it’s becoming old news, is anyone’s guess.

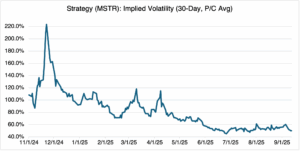

If you agree with MSTR’s strategy and think it’s just experiencing a short-term lull, there is some good news from all this. If you want to trade MSTR options, they have grown considerably cheaper on an implied volatilty basis. At its current level of a little over 50%, options are priced at about a quarter of what they were last November at their high (see chart below):

Source: OptionStrat

Second, and very unrelated to anything having to do with crypto (other than they both can be bewildering), is quantum computing (QC). I wrote about it last January, and concluded that the options had been pumped up by some well-publicized advancements and had made them just too expensive. Timing is everything, especially in new technology in which new advancements are rare and sometimes greeted with too much enthusiasm. The concepts behind QC are wickedly difficult, and commercialization will be a long road.

Developments in quantum computing seems to be accelerating, and the ramifications of its eventual commercialization are mind-boggling, especially when combined with AI. QC isn’t just computationally faster – it’s a lot faster. Last December, Google’s QC chip Willow performed a certain calculation in under 5 minutes that would have taken today’s fastest computers 10 septillion years to solve (which is older than the universe). That’s an extreme example, but you can see why investors are enthusiastic, especially those that think AI may be becoming old news and are looking for the next New Big Thing.

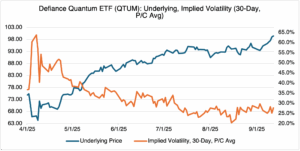

Google is hard at work developing its version of QC, as are other established players, including old-school IBM. There are also a plethora of startups working on it. Since it’s hard to tell at this point who has the advantage, the Defiance Quantum ETF (QTUM) is available.

QTUM on an options basis presents an interesting setup. In the chart above, you can see that it’s volatility has been coming off since it peaked last April. At the same time, QTUM’s underlying has been increasing, steadily. If you want to participate, QTUM option prices are about 40% lower (all things being equal) than they were last April. That’s a good deal.

What Could Go Wrong?

I don’t normally keep track of goings on in the world of credit, but the demise of Tricolor seemed particularly crazy, even for subprime lending. The details are available elsewhere, but two sentences from an opinion piece in the WSJ (Tricolor and the Subprime Debt Canary, WSJ, 09/15/25) says it all:

“Tricolor caught investors and creditors off guard when it said Wednesday it is liquidating after 18 years in business. The Texas-based firm specialized in lending to car buyers with no credit history or Social Security number, including undocumented migrants in the Southwest.”

I can think of many adjectives for those that financed Tricolor, but “investors” is not one of them.