The Next Five Years

If you search for “Is the market in a bubble?” or “Is the market overvalued,” you will see various pop ups breathlessly indicating that it is “in dangerous territory” and liable for a serious correction. “It’s 1929 all over again!!” Some even go as far to say that a bear market would be beneficial (in the long-term) as it would get rid of the “weak hands.” But, here’s the thing: if you look carefully, you will discover that many of the blog and podcasts predicting imminent demise were from 2023 and 2024. That is, 85 and 28 new all-time highs ago, respectively. Evidently, we’ve been on a cliff’s edge for quite some time!

Maybe we are, maybe we aren’t, but we’ll know for sure — eventually. I’ve written in the past about the perils of trying to pick tops or bottoms and I think anyone who has tried it has learned their lesson by now.

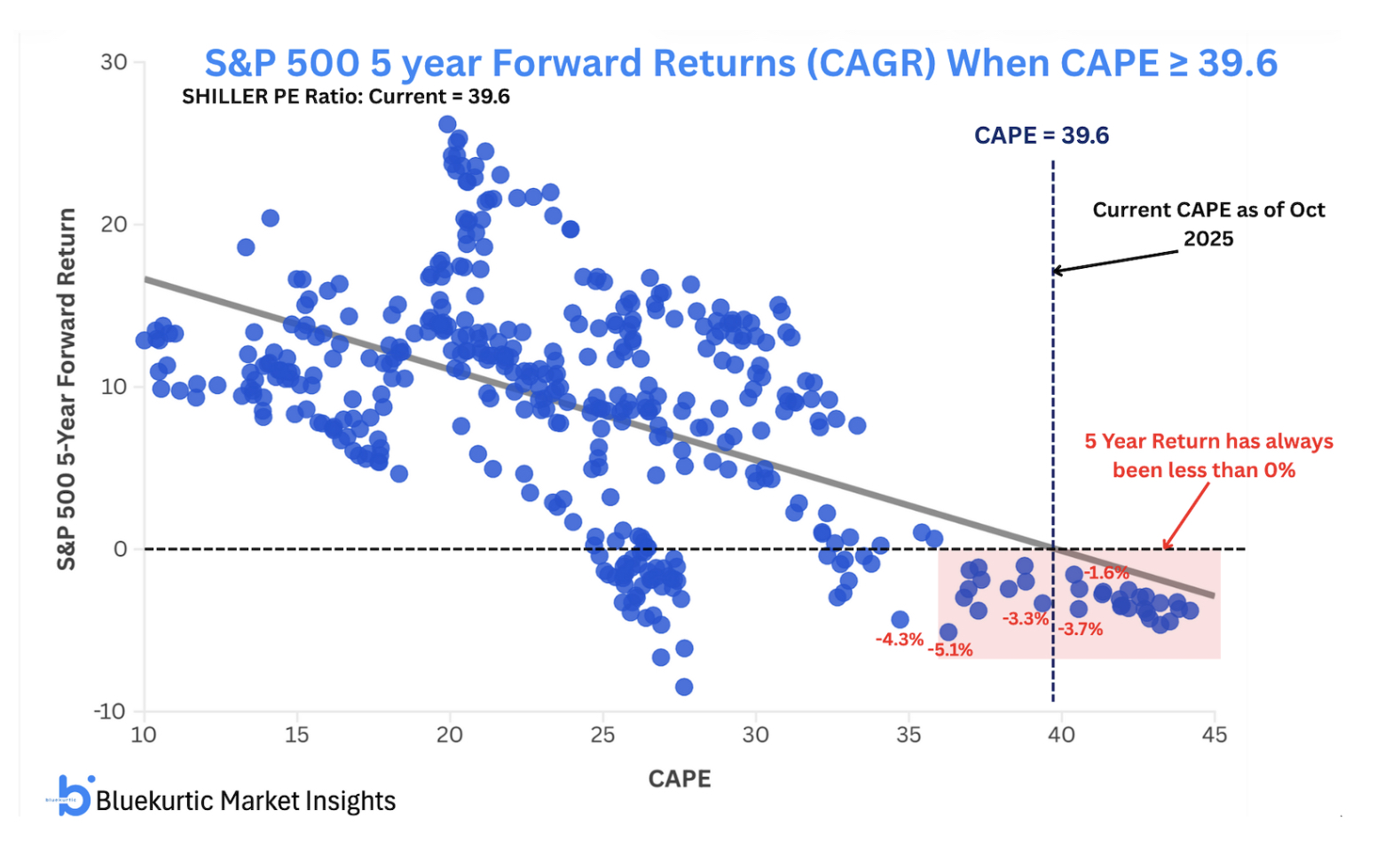

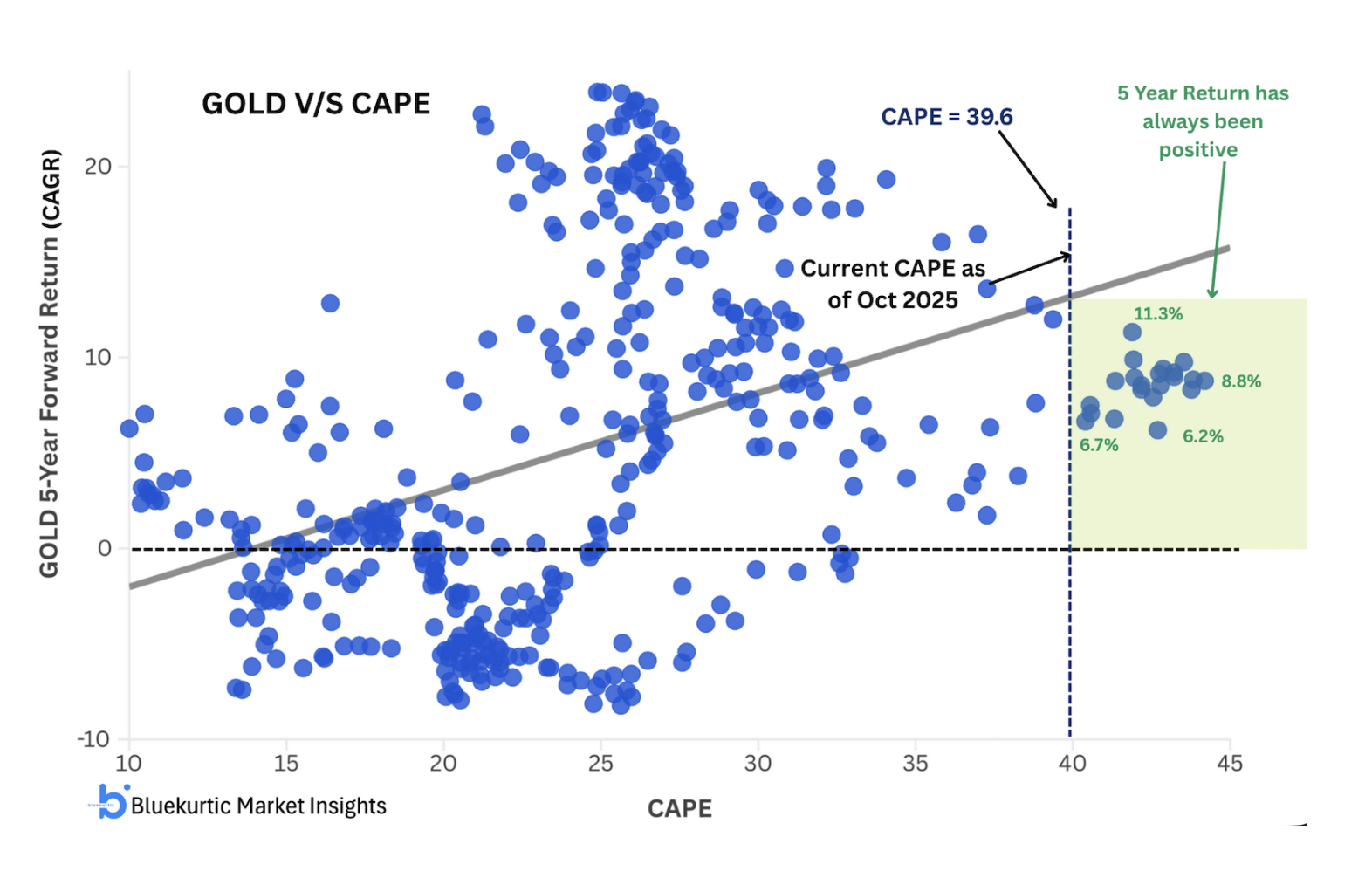

With that in mind, an ex-colleague of mine has pointed out an interesting valuation metric if you’re interested in long-term returns. Nikhith Mudhasani who runs Bluekurtic Market Insights (x.com/Bluekurtic), a firm that provides institutional level and data-driven tools and analysis to retail investors, has worked up some charts on the relation between CAPE ratios and 5-year S&P and gold returns. If you’re not familiar with the metric, CAPE is the Cyclically Adjusted Price-to-Earnings ratio, and is calculated by dividing a stock’s current share price by its average inflation-adjusted earnings over the past 10 years. Although it has some flaws (it uses historical returns and not necessarily the best measure of earnings), CAPE indicates whether the market is over- or undervalued. Using price series from January 1985 to October 2025, Bluekurtic compared CAPE values to rolling 5-year returns in both the S&P and gold. The results are below:

5-year returns were always positive for gold and always negative for the S&P with CAPEs greater than their current level of 39.6. Yikes. At least the two charts are eerily consistent.

Honestly, I’m not sure what combination of dismal economic or political fundamentals could yield such a gloomy picture over the next five years. But no doubt about it, current CAPE values are high and it seems that we are about to find out whether Bluekurtic’s analysis is correct or not.