Reality Bites!

Bubble speculation is one of the markets’ favorite pastimes, but for most the definition remains elusive. A useful guide to technological bubbles has been provided by author Alasdair Nairn in his book Engines That Move Markets: Technology Investing from Railroads to the Internet and Beyond (2001). He argues that all bubbles share 10 common characteristics:

- Emergence of a new technology; extravagant clams

- Easy money and credit

- Investor and consumer optimism

- Favorable media touting the new technology

- An ever-increasing number of new companies, fueled by public and private markets

- Unusual financial valuation and assessment criteria; new metrics

- Immature technology

- Massive capital commitments

- Fraudulent or unscrupulous behavior

- Disappointment; shakeout

Note that all of the steps except the last are not sequential and can occur concurrently.

Let’s see if two recent developments fit into the cycle.

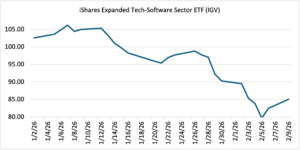

First, AI and software. The release last Tuesday of Anthropic’s Claude Opus 4.6 and OpenAI’s GPT-5.3-Codex, the latest versions of AI tools that are designed to write code and produce software, took the market by surprise and drove software stocks sharply lower:

Source: OptionMetrics

The prospect that end users can design and build their own specialized software was not good news to companies that do exactly that, such as LegalZoom and Salesforce. Although they have recovered somewhat due to the fact that AI isn’t replacing their products overnight, the writing is on the wall.

Does this signal that we are entering the late stage of the AI rally, the disappointment phase? Not exactly. Rather, it is more of an indication that the effects of AI are still unknown and that the winners and losers have yet to be sorted out. What we do know is that we now have AI writing AI software (Anthropic claims that their new tool was 100% AI generated) and that the development cycle is getting shorter and shorter. The pace of AI advancement is accelerating and where that will lead is anyone’s guess.

Although that’s true, the real question for investors is whether the market has gotten ahead of itself and is due for a change in sentiment. Another event that confirms the market’s worst fears about AI, such as a yet unknown competitor, or lack of cash flow to justify the massive investments in AI (estimated to reach 10% of US GDP by 2029), could be enough to move the market into the “disappointment” phase. Past technological bubbles, such as railroads, automobiles, radio, and the internet, followed that pattern.

Second, crypto and its first cousin, crypto treasury companies (so-called DATs, or “digital asset treasury companies”). The demise of crypto (down over 21% year-to-date at the time of this writing) has cast a bright light on their offshoot, digital asset treasury companies, or DATs.

If you don’t recall, the idea behind the DAT business model is that the company issues debt or stock and then buys bitcoin or another crypto as its main treasury holding, thereby allowing its stock to trade at a substantial premium to the value of their crypto holdings, whether due to leverage, marketing, or whatever. As long as bitcoin and other cryptocurrencies were rallying, it worked like a charm. At its peak, Strategy’s (MSTR) market capitalization was 2.5 – 2.7X its NAV (the value of its bitcoin).

Seemingly, the DAT guys had hit upon the magic formula to increase stock valuations, and many other new DATs came to market. But that’s the problem: at the end of the day, these companies were essentially informal investment funds with just one asset, massive concentration risk, and no plans to decrease their position if crypto falls. In other words, “buy and hold” to the extreme.

In the case of Strategy, it’s buy and hold bitcoin. Since bitcoin lost its luster last October, it’s been heavy sledding. MSTR has lost almost 70% since its peak last July (bitcoin has lost about 41% over the same period) and recently announced a Q4 loss of $12.4 billion, or a whopping $42.93 per share. The company has over $2.2 billion in cash reserves, so they have a cushion for the time being. Obviously, any reversal will depend on bitcoin rallying.

Source: OptionMetrics

Both crypto and DATs check many of the bubble characteristics listed above and now seem to be in the Disappointment phase. In the case of DATs, this has led to the nagging realization that the business model didn’t make much sense in the first place, or was at a minimum overstated. The DAT bubble has been pierced, or at least until crypto recovers its sheen.