Predict This!

One of the most important developments of 2025 has been the increased popularity of prediction markets. Originally concentrated on sports betting, they moved into politics, entertainment, and financial bets. If you want to bet on something, one of the platforms will accommodate you. During the 2024 presidential election, prediction markets came into their own by correctly predicted that Trump would be the clear winner when most mainstream polls were hopelessly deadlocked. The main players are familiar by now: Polymarket, Kalshi, PredictIt, and various homegrown upstarts from Interactive Brokers, Robinhood, and Coinbase (I’m sure there are many others). The main barrier to entry seems to be the ability to come up with a catchy name.

If you’re not familiar with how prediction markets and event contracts work, they are quite simple. Each event contract is in the form of a yes/no question. The maximum you can make on each contract is $1.00. Depending on your prediction of the outcome, you can then bet “yes” or “no.” Here’s an example from Polymarket:

In this case, suppose you decided to bet that Netflix will close above the $100 level by the end of December. Given the latest prices, that will cost you $18 cents. If it turns out that it does close above $100, then the maximum you could make per contract is $0.82 cents ($1.00 $0.18). If it doesn’t, you lose $0.18 cents, your entire investment. You don’t have to hold the contract all the way to expiration; if it goes up, or you decide against it, you can sell it back to the exchange and cash out.

Event contracts and prediction markets sound new and shiny, but they’re really not. Long before many of the founders of prediction markets were even born, so-called binary options were trading over-the-counter and offshore (they were illegal in the US until 2008. As an aside, most modern derivatives were trading in one form or another long before they became popularly known. The only difference is that they were informally priced without the help of computers and quantitative models. Cotton-linked notes denominated in British pounds with knock-in and knock-out features were trading during the Civil War). Binary options are an exotic derivative and can take the form of a yes/no question with an all-or-nothing payout, just like event contracts.

I know what you’re thinking, because I thought of it the minute, I heard about event contracts based on financial events. Can I arbitrage binary options to their equivalent event contract? In other words, can I buy one and sell the other more or less simultaneously and make a riskless profit? In theory, yes; in practice, no.

Using the Netflix example above priced at $0.18 cents and expiring at the end of December, the equivalent binary option would be priced at about $0.16 cents, two cents less. The more out-of-the money levels, such as $120, $140, and $160, are priced at $0.5 cents for “yes,” but are essentially worthless as binary options. In other words, they are overpriced, just like many other out-of-the-money strikes on organized exchanges.

Can they be arbitraged? As an institutional player, maybe, but as a typical retail trader, no. First, the volume is too low to make any real money or make it worth your time and trouble. Second, you will need access to an OTC binary options market maker, which is beyond the reach of almost all retail traders. Third, even if you did somehow get a quote for the equivalent binary option, the bid/offer spread on the binary, and the event contract will be wide enough to make the arbitrage impossible. And finally, some prediction markets either charge a “cash-out” fee, or force cashing out in crypto; the latter adds a whole new layer of risk to the trade.

Keep in mind that event contracts only allow one to bet “yes” or “no,” but you can’t sell “yes” or sell “no.” In options equivalent, that would be like selling a call or selling a put. For options traders, that difference is significant and strategically limiting.

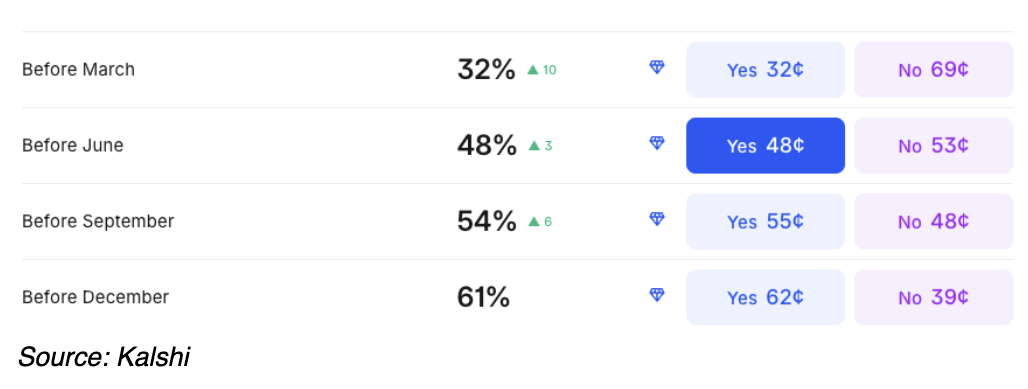

Prediction markets do have one key advantage, however. The Netflix vs. Paramount fight for Warner is instructive. Event contracts allow you to make a pure bet on whether the deal will take place and when. Here’s an example from Kalshi:

Of course, you could trade the acquisition using conventional options. A simple example would have you buying $30 calls using various expirations. However, that’s not a pure bet on the acquisition; there are many theoretical reasons why Warner’s price could change other than just its potential acquisition. As a result, and even if you use short-dated options, you cannot infer the acquisition probability of success using conventional options. You can get close, but prediction markets offer a more accurate assessment.