Perp Futures

If you haven’t noticed by now, Wall Street is a perpetual motion machine for new financial products. Exchanges, brokerage firms, and banks are always hard at work trying to figures out the latest iteration or combination of products that will fly off the shelves. Most don’t catch on, but some turn out to be the right product at the right time. In some cases, they can be an accurate reflection of current market trends or sentiment. For example, during bull markets and when investors tend to get greedy, return-enhancing and leveraged products are introduced.

Which brings me to perpetual futures contracts. The product has been around overseas for some time, mostly in crypto. Reportedly, they make up about 70% of the worldwide crypto market – all offshore. You can see why the US-based exchanges are in a hurry to introduce them. Last July, the CFTC approved two crypto perpetual contracts (bitcoin and ether) offered on Coinbase. The CME has its own variation called Spot Quoted Futures (SQF), launched at the end of last June, which include spot contracts on crypto and various equity indexes. Not to be left out, the CBOE plans to issue perpetual bitcoin and ether contracts in November.

Commonly known as “perps,” perpetuals eliminate one of the features of traditional futures contracts that discourages new investors the most, the expiration of individual contracts. Perpetual futures (sometimes called perpetual swaps in non-US markets), have no maturity dates. As such, there is no need to roll or terminate the contracts due to expiration.

There is one complication, however. Since traditional futures contracts expire with fixed maturities, they must eventually converge with the spot or cash price at expiration. Otherwise, a risk-free arbitrage would be possible. In order to avoid this, perpetual futures have a funding rate mechanism. If the funding rate is positive (i.e., perpetual > spot), then longs pay shorts the rate; conversely, if the funding rate is negative, (i.e., perpetual < spot), then shorts pay longs. Depending on the exact contract specs and exchange, the funding rate is calculated at various intervals during the trading day. The exact rate varies depending on the prevailing spot to perpetual spread and interest rates. The greater the spread, the higher the funding rate, and vice versa.

As offered overseas, perpetual futures offered another feature: serious leverage, in some cases 100X or even higher (that’s A LOT of juice!). For many crypto traders looking for make-it-or-break-it trades, that was the hook. Unfortunately for them, the US versions on Coinbase have been neutered (otherwise, they would have never received CFTC approval) and are capped at 10X leverage. Given the pressure for ever more leveraged products, and the current administration’s lax regulatory stance, we’ll see how long that lasts.

Analyze This

In an attempt to provide pricing signals, some commentators on social media have been saying that bitcoin is now a seasonal product, i.e., displaying consistent pricing patterns over the course of each year. Seasonality is usually confined to commodities with fixed and consistent production and demand cycles, such as agricultural products. It’s much less common, and sometimes very questionable, when it comes to financials.

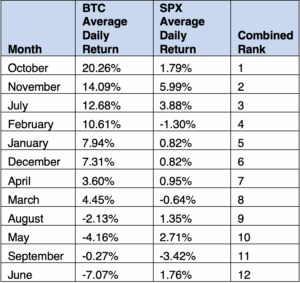

But guess what? Based on five years of bitcoin futures data, they’re right! Below are the average of daily returns for each month for bitcoin going back to the start of 2020. As you can see, there are clear differences – October and Q4 have the highest returns, and May and June have the worst.

One word of caution: the results are based on only five years of data, and includes the pandemic year, 2020. That’s enough to be suggestive, but not definitive.

Source: OptionMetrics

For those of you who trade bitcoin and the S&P, October seems to be the best month and June the worst. Again, not enough data to bet the farm, but suggestive of an October tailwind!