Metals: One Crazy Ride!

Precious metals finally called it quits last Friday. Silver drove off a cliff and shed 25.6%, gold 13.4 %, platinum 16.8%, and palladium 15.73%. And yes, those are daily changes, not monthly or yearly. Friday was a very bad day for the longs, but today might be even worse for those that cut — all are sharply higher at the time of this writing.

To account for the carnage, many pointed to the nomination of a new and hawkish Fed chairman that relieved fears of the central bank’s independence. This sent the dollar sharply higher and was enough to finally prick the precious metals bubble (or whatever you want to call it). “Profit taking,” the all-purpose phrase that financial journalists use when they don’t really know what’s going on, was also mentioned.

The problem with “profit taking” in this instance is that no one knows if any profits were actually taken! The only thing we know for sure at this point is that a lot of people tried to get through a very small door at the same time. This is the classic behavior that has occurred at the end of every bubble, and everyone is always surprised when it happens. Read any account of Tulip Mania, the South Sea bubble, various railroad corners, meme stocks, etc., etc., and they all ended with a bang, not a whimper, and a mad dash to the exits. “What was I thinking?” is the usual refrain, and suddenly, euphoria turns to shock and then to panic.

But…does Friday’s action really signal the end of the precious metals party? I’m going to go out on a limb and say maybe not. The reason is that unlike most bubbles, the fundamentals supporting metals were never fanciful or incorrect. Tight supply/demand, increased industrial usage, inflation, the dollar, and hedging against uncertainty are all real factors supporting “hard assets.” These make sense, at least to those with a predilection for safe haven assets. The warning sign over the last few weeks was that the fundamentals were overstated and couldn’t account for the sudden appreciation.

Precious metals are notorious for periodic flushes of relatively weak hands. That supports the belief that the rally may have just been interrupted, not terminated, and that the markets are now a healthier place, at least temporarily – the bubble may reinflate!

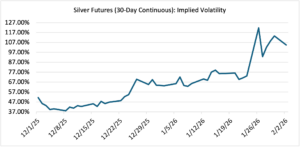

However, for those inclined to trade gold or silver with options, they are still sky-high expensive. In the case of silver (see chart below), implied volatility moved into the triple digits last week and peaked out at 113.6%. It came off after Friday’s selloff, but I suspect it will get even more expensive if the rally reconstitutes itself.

Source: OptionMetrics

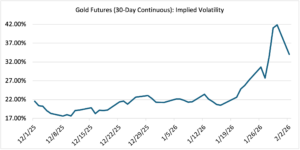

Similarly, gold IV peaked at almost 42% last Friday during the selloff (see chart below). Although it came off on Monday when it seemed like the market was settling down, I suspect that it will increase again if gold resumes its upwards march.

Source: OptionMetrics