It Wasn’t TACO Time!

According to many market and political observers, last week witnessed the latest iteration in the Trump TACO trade. For those of you who may have been trapped in a cave last year, TACO stands for “Trump Always Chickens Out” and refers to his habit of threatening very bad things (in this case, high tariffs) and then backing down at the last moment.

It all started last April 2nd, “Liberation Day,” when the President first rolled out his new and draconian worldwide tariff scheme. The plan was greeted with shock and panic among investors, economists, commentators, and opposing politicians. The markets reacted swiftly and negatively across all asset classes, sending a clear message that they thought the new tariffs were a mistake and that they are the ultimate arbiters of economic policy. In other words, reduce them, or else. Consequently, the Administrator backed down just 7 days later and instituted a 90-day pause for negotiations. Whether that was his ultimate intention all along or not, the first TACO trade was born.

Most recently, the President threatened what could have amounted to an all-out trade war with Europe, and possibly even military intervention, if he didn’t get what he wanted regarding Greenland. This had been on the back burner for some time but now burst on the scene, taking the market by surprise. The press rushed in with the usual blaring headlines about “crashing” and “plunging” markets and “the biggest drop since…” And then, as usual, the President reported that an agreement was in the works, the tariffs were off, and all was well. The markets subsequently recovered, but many commentators rushed to judgement: the financial markets forced him to back down! As the Washington Post headlined “…the stock market is the ultimate check on Trump.” It’s TACO time again!

Or was it? Although I’m sure many would like to believe that the financial markets can keep the President in line, the events surrounding Greenland didn’t really prove the point. That’s not to say that the markets haven’t previously influenced the President’s decisions, just that it’s questionable whether they did this time.

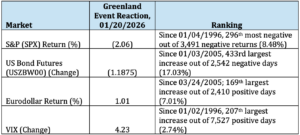

Let’s look at the evidence from January 12th to the 22nd, the interval of the Greenland event, to see if markets really acted in a manner and extent that forced Trump to back down. Below is a table that compares how various instruments reacted when the reaction to Greenland reached its peak:

As you can see, although the moves in the S&P, bond futures, Eurodollars, and the VIX were significant, they weren’t large enough, or long enough, to influence the President. Indeed, none of them approached Top-10 status, or came even close to the most extreme moves we saw during the tariff panic of last April 3rd and 4th. For example, the VIX jumped 15.29 points last April 4th while the SPX dropped 5.97%; compare that to a 4.23 jump and 2.06% drop on January 20th when the Greenland event reached its peak. The markets certainly moved, but no more so than any other bad day and not enough to get the President to back down. Why he compromised is subject to speculation, but market forces were most likely not the factor.

Why is this important? As we’ve seen, the financial press and social media often exaggerate to get readers and clicks. And due to the ever-shortening news cycle, they tend to stick to popular narratives that confirm preexisting notions, such as the power of the financial markets to influence geopolitics. That may be mostly true, but not all the time. One of the most important traits of successful investors is to be skeptical. Always question, always confirm with your own analysis, and never take anything for granted. After all, it’s your money on the line.