Is Strategy’s Strategy Over?

At the end of last month, I wrote a blog entitled “A Bad Strategy for Strategy?” that was really about the perils of leveraged ETFs (although I did use two ETFs related to Strategy (MSFT) as an example). As you probably know by now, since then bitcoin has cratered and is at the time of this writing 6.7% lower year-to-date and 20.2% lower so far this month alone. That’s quite a reversal: at its peak on October 6th, it was 34.6% higher YTD. Obviously, the decline is not good news for Strategy and its legions of crypto superfans.

Does this spell the end for Strategy and the crypto treasury company (alternatively, Digital Asset Treasury companies, or DATs) business model? I doubt it, but the euphoria phase of crypto’s ascent is probably over (for now). After all, crypto has been through similar bear markets before. Way back in late-2017, it was the hot new thing (despite the fact that it had been around for some time), the completely new asset that resonated with a certain class of investors. Anti-establishment and skeptical of Wall Street and fiat money (i.e., US dollars), crypto fit right into their digitally dominated worldview. After it suddenly burst into the mainstream, retail investors flooded in looking to make a fast buck. And then, just like a meme stock that has lost its luster, it was over and bitcoin went back hibernation. That is, until the giddy bull market after the pandemic and then the election of the current administration. At its peak this year, social media was flooded with those vowing to never sell, no matter what. Their anthem, HODL, or “hold on for dear life” (read: “never sell”) became all the rage.

Unfortunately for them, never can be a very long time, especially when you’re losing money. Now the question is whether they finally fold or hold on to an asset that doesn’t bear dividends or pay interest. Of course, conspiracy theories behind bitcoin’s fall are rampant. Regardless, many have concluded that it’s time to get out, and now (I suspect using the so-called “GMTFO” order – you can only guess what that means).

Obviously, crypto’s decline is not great news for crypto treasury companies and the host of leveraged ETFs that have grown up around them. It also lays bare the dubious nature of the underlying business mode itself. The idea was relatively simple and clever: basically, issue debt or equity and then use the proceeds to buy digital assets. Strategy began doing so in 2020 as it transformed itself from a software provider into a bitcoin holding company with essentially no other assets. The strategy really took off in 2023 when bitcoin started its latest multi-year run to new highs. From August 31, 2024, to its peak on 07/16/25, MSTR increased 3.4X; over the same period, bitcoin increased 2.0X. Indeed, for some time, investors valued MSTR at a premium to its bitcoin holdings. Why MSTR, a company with bitcoin as its only asset, should outperform bitcoin itself, has been the subject of much speculation and controversy. It also led to other companies copying the strategy as a means to boost their valuation. As of last September, treasury companies reportedly held approximately 4.7% of all bitcoin holdings. For most of the last two years, the strategy seemed to be working as their values shot up, confounding the doubters.

Until it didn’t. Bitcoin’s steep declines this month have destroyed MSTR’s valuation and premium. At its peak, MSTR was trading at a 2.66 multiple over the value of its bitcoin holdings (mNAV); currently, it’s about 0.97. In other words, the company is trading at a discount to the value of its assets. Adding to its difficulties, JP Morgan warned in a recent note that companies whose digital assets exceed 50% of total assets run the danger of being excluded from the MSCI, as well as other indexes.

Strategy’s co-founder and Executive Chairman, Michael Saylor, is keeping the faith, defiantly posting “I Won’t Back Down” on X. Realistically, as one of crypto’s highest profile supporters, what else could he say? If he hints at any strategy reversal or doubt, he could set off a crash in bitcoin and MSTR. As he put it grandiloquently, “The halls of eternity echo with the cries of those who sold their Bitcoin.” Not exactly Homer, but you get the idea.

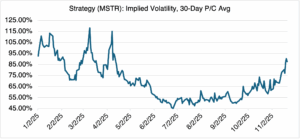

As you would expect, MSTR options pricing reflects the uncertainty surrounding its future. In short, they aren’t cheap. Below, you can see that its implied volatility has jumped 26 percentage points to 87.7% (see chart below). MSTR is no stranger to high volatility – it briefly went over 200% at the end of last November. Bitcoin implied volatility has also jumped 14.7 percentage points since the end of October, from 42.6% to 57.4%.

Source: OptionMetrics

The bloom is off the rose.

And with that, I wish you all a Happy Thanksgiving!