Gold Resurgent?

Like everything else, Wall Street is susceptible to fads and fashion. When I started trading foreign exchange as my first real trading job, a certain short-term metric of the US money supply, M1, was all the rage. Everybody was absolutely convinced that it was the key to predicting interest rates. M1 came out weekly right after the markets closed, and everyone was glued to their screens before and after. After a while, the Fed changed M1 to a monthly metric, and just like that, everybody forgot about it and moved on to other indicators. I guess M1 wasn’t that important after all!

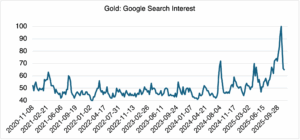

The point is that Wall Street obsessions come and go, and rarely for more than just a few weeks. Let’s check in with one of the longest lasting ones that faded a few weeks ago but might be reanimating: precious metals. At the beginning of last month, gold and silver were on the front page. It’s no coincidence that Google Trends, which tracks relative search interest, reached its maximum level on October 19th when gold settled at its all-time high of $4341.30 (30-day continuous futures), having surged almost 10% since October 9th. Gold ETF volume was exploding, the “debasement” trade was the talk of the town, and everybody was thinking about melting down grandma’s jewelry. No wonder interest was surging!

Source: Google Trends

Markets punish the overexuberant (eventually), and gold proved to be no different. After “cleaning house” on October 20th with a 5.7% rout (which, btw, many formerly super-bullish pundits suddenly called inevitable), it eventually fell back under the $4000 level by the end of October.

Is gold yesterday’s news? Not so fast – it’s been quietly and steadily recovering since then and was still up 52.2% year-to-date as of last Friday. That places it in third place for the largest commodity gain of the year, exceeded only by silver and platinum. The fundamentals that were so often repeated during its rapid ascent – uncertainty, currency debasement, inflation, the weak dollar – are all still present. The only thing that has changed is that a) gold’s momentum has stalled (daily changes have decreased), and b) it’s no longer trending as strong as it was just a few weeks ago (search interest is way down).

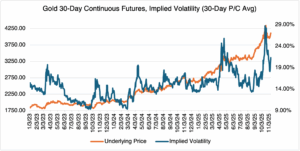

Gold’s implied volatility tells the tale (see chart below). Most recently, when it shot up over $4000 for the first time on October 8th, and peaked on October 20th just 7 trading days later, its implied volatility spiked from 19.9% to 28.2%, a full 8.4% points higher. Option market makers in gold were clearly uncomfortable with both the level and the price variation. They weren’t overreacting. Keep in mind that since 2023, there have been only 38 trading days with implied volatility greater than 20.0%, or only 5.3%, and of those, 16 occurred in October alone. If gold’s resurgence turns out to have legs, expect its implied volatility to follow suit and move back into the mid-20s. Playing the move with options could therefore be expensive.

Source: OptionMetrics

You Might Not Need to Worry…About Anything!

On December 19th, you might no longer need to worry about options or the markets or money or anything else for that matter!

One of the more interesting stories that has been gaining traction is about 3I/Atlas, which in case you didn’t know, is only the third object outside of our solar system that we have ever detected and is now in the vicinity of the sun. The vast majority of astronomers believe it is a comet, no big deal. Or is it? Avi Loeb, a theoretical physicist at Harvard, has pointed out via his blog that 3I/Atlas is exhibiting some very un-comet-like behavior. It has a strange and unusual trajectory and color and seems to move as if it’s under its own power!

To anyone that has watched more than just one sci-fi movie, there can be only one explanation: it’s a giant extraterrestrial spaceship that has come to visit. Undoubtedly, the aliens will be good looking, speak English, will have cool robots, and warn us that we better behave, or else. From some of the comments I’ve seen, there are many people who not only think that this is going to happen but are looking forward to it.

To be clear, Loeb doesn’t really believe that aliens are about to land, but that we should be open to the possibility and should track the object very carefully, just in case. He’s a serious guy and makes some interesting points about the perils of groupthink in academia, the need for large object detection systems on the edge of the solar system, and how we should treat low probability/high impact events. He’s worth reading, as long as you don’t take it too far.

Whatever it is, 3I/Atlas is scheduled to come closest to Earth on December 19th. Resistance will be futile!