Gold Questions

At the end of the year, when finance editors sit down to determine the stories of the year, the rise of precious metals will undoubtedly be a candidate. As of Monday’s close in NY, gold was up 65.1% year-to-date and briefly came close to piercing the $4400 level. On October 9, just 7 trading days ago at the time of this writing, it settled at $3972.60, over $400 lower. Less reported, but even more impressive, is silver, which managed to breach the 45 year-old high of $49.45 reached way back in 1980. It is now solidly over $50, and closed at $51.39 yesterday, up 75.7% YTD. Even esoteric platinum has gotten into the game. As of yesterday’s settlement, it was up 85.1% YTD, which is the largest gain this year for any commodity. Even the most ardent skeptics, those who believe that the metals are overbought and overhyped, are probably beginning to wonder whether they got it all wrong.

The obvious and reasonable question is whether precious metals are in a bubble. I’ve written several times previously that certain metrics related to gold and silver options (implied volatility, out-of-the-money to at-the-money volatility skew) are indicating that they are in an aggressive bull market, but not a bubble. Bubbles are very rare, and commentators are too quick to label any bull market that they can’t quite figure out “bubbles,” as well as impending bloodshed. Going against the tide gets clicks!

Has anything changed since I wrote about gold just a few weeks ago? As I’ve pointed out, for those with a certain worldview, gold is the solution to everything that is wrong with the world. Uncertainty, interest rates, currency debasement (had anyone ever heard the word “debasement” a month ago?), inflation, national debt, central bank independence, foreign central bank buying, military conflict — you name it — they are all evidence that gold is the only investment that will offer protection from imminent financial disaster. Read the comments section of any article on gold, or watch precious metals videos on social media, and you’ll know what I mean. With almost evangelical fervor, they portray a pessimistic, dark view of the world, one in which the only bright spot is illuminated by gold.

None of these have changed since gold started rallying in earnest in early-2024. Most of the fundamentals have been present in one form or another for quite some time. The only difference is that now the rally has attracted widespread attention and the supporting fundamentals have become self-confirming. By the latter, I mean that if you’re looking for evidence of economic calamity, uncertainty, or disruption, everything starts to fit the bill. You can then wind up with a very one-sided market in which any unsupportive news is ignored or explained away. At the same time, supportive news, even if tangential at best, is greeted with unbridled enthusiasm – “see, I was right!”

For those reasons, I still believe that gold is currently an inflating momentum play that is becoming increasingly divorced from fundamentals. In other words, people are buying it because the price is increasing, and nothing more. The fundamentals are an excuse, not the reason.

Although I have been strictly in the “it’s not over till it’s over” gold camp (coined by Yogi Berra in 1973), there are certain signals that are making me nervous. That’s not to say that I think gold has peaked, or ready to go short, but a few things that you should know.

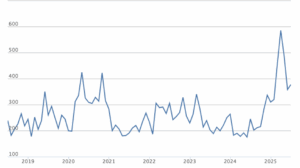

First, the Global Economic Policy Uncertainty Index peaked in April:

Monthly Global Economic Policy Uncertainty Index

Source: “Measuring Economic Policy Uncertainty” by Scott Baker, Nicholas Bloom and Steven J. Davis at www.PolicyUncertainty.com

Of course, it’s volatile and you can’t really predict it. For example, if the Trump/Xi trade talks at the end of this month don’t go well, or are even cancelled, then the index will spike, along with gold. However, the index can cut both ways: if the Fed decides not to lower rates, which is built in to the market, you will likely see a spike in the index but a mass exit from gold.

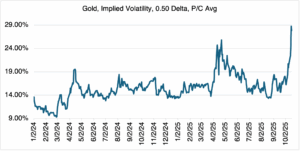

Second, gold implied volatilty is indicating that increased price uncertainty is creeping into options pricing. Up until the beginning of this month, gold’s IV was relatively quiet, trading in the mid- to high-teens. When gold broke through the $4000 even number barrier, it’s IV also broke through the 20% level. As of last Friday, 10/16, it reached almost 29%, the highest it’s been since March 2022. Of course, it can go a lot higher (it peaked at over 36% during the last major rally in 2012 and almost 63% during the financial crisis), but it does indicate that an increased uncertainty factor is being built into options prices.

Source: OptionMetrics

Similarly, gold options skew, the spread between out-of-the-money and at-the-money implied volatilities, has increased. Although it’s nowhere near the upper levels recorded since 2024, skew has more than doubled since the beginning of the month. Apparently, people are being attracted to cheaper premium options, and overpaying for them in IV terms. That’s sometimes indicates an overbought market.

Source: OptionMetrics

Third and last, the shape of the futures curve continues to indicate that supply is plentiful. As gold rallies, new supply naturally comes to market as it becomes more valuable. The result is that the front-end of the futures curve declines relative to the back-end, increasing the slope (i.e., steeper contango). Although this has been occurring since gold first started rallying in early-2024, it accelerated in October.

Gold Futures, 30-Day Expiration – 182-Day Expiration

Source: OptionMetrics

Source: OptionMetrics