Gold, Again

In mid-September, I was interviewed on the Futures Rundown, a YouTube podcast that specializes in futures trading (link here). The interview was entitled “Is Gold in a Bubble?’.” At the time, I concluded that it was just in an aggressive and very consistent bull market, but was not yet displaying the characteristics of a classic bubble. Others on the show had previously pointed out that the metal was overbought and overhyped and possibly at its apex. The host asked me what I thought about that.

In short, not much. My answer came in two parts. First, a tip I picked up as a very small child: don’t stand in front of freight trains! It’s never a good idea, in real life or in trading. And second, trying to pick highs or lows is a fool’s errand, and those who claim they can do so either have a very selective memory or don’t have a daily mark-to-market to contend with. It’s very easy to predict highs and lows, or go against trend, especially when you don’t have real skin in the game and can afford to be wrong by days, weeks, or even months. You might be right, eventually, but in the real world, timing is everything and the hard discipline of a daily mark-to-market can be bankruptcy-inducing.

In order to give my response some context, consider the following: Since August 1st, 30-day continuous gold futures have settled at new all-time highs 16 times, or 35% of the 46 trading days since then. Silver has a similar record: it settled at new highs 41% of the time. Do you really want to be short these?

The main fundamentals driving both of them — economic, political, and social uncertainty — haven’t changed for some time. Inflation, depreciation of the US dollar, and ETF and central bank flows are also mentioned. They are all still valid, and have been for some time, but are getting a little stale. Gold and silver are now a “risk on” momentum play, essentially a bet that the stampede into precious metals will continue.

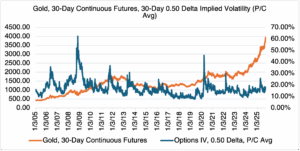

My logic on why gold is not in a bubble still holds. Simply, if gold were in a bubble, it’s implied volatilty would be shooting up due to ever-increasing uncertainty and irrationality. As you can see in the chart below, that hasn’t happened:

Source: OptionMetrics

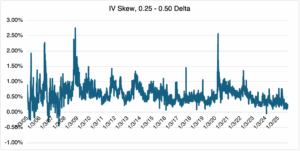

Similarly, the implied volatilty skew between out-of-the-money strikes and at-the-money strikes is not expanding and is at historically low levels. In a bubble, you would expect to see the public racing into the relatively cheap out-of-the-money strikes, expanding the skew. That isn’t the case:

Source: OptionMetrics

Of course, things can change. Just this morning, I started receiving unsolicited emails touting gold as the only solution to a post-US dollar world order of impending doom. Round numbers, such as $4000 gold or $50 silver, usually attract the attention of the mainstream press and retail investors. Although gold options are signaling that it is behaving in an orderly manner, that could change. Stay tuned.

Despite the naysayers and top-pickers, December gold futures are now solidly over $4000, up almost 50% for the year, and silver is nearing $50, up almost 60% YTD. $50 is silver’s all-time high from 1979 when the Hunt Brothers tried to corner the market (and ultimately failed). If you’re not familiar with that story, look it up – it’s a great yarn if you’re into financial crime.