Everything’s Relative

Last week, Nvidia’s market capitalization passed over $5 trillion. $205.76 was needed, and NVDA broke through without a sweat. At roughly the same time, Apple’s valuation topped $4 trillion, and Microsoft was close to doing the same.

To put Nvidia’s current valuation into perspective, it’s larger than the GDP of Japan or Germany. If it were a country, it would rank third in GDP, right after the US and China. To get a sense of how fast it’s grown, in May 2023, just 2½ years ago, Nvidia’s market cap exceeded $1 trillion for the first time.

A trillion-dollar valuation doesn’t seem to such a big deal anymore. In 2020, there were just three companies with a valuation over $1 trillion. Now there are 11, and a few more look like they are close to joining the club. Of the 11, 8 are from the US with a whopping total of $23.65 trillion in market cap. By the way, US GDP was $29.18 trillion at the end of 2024.

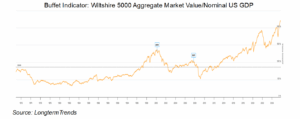

Despite the interesting comparisons, is it even appropriate to compare GDP with market capitalization? Apparently, Warren Buffett thinks so. The Buffett Indicator (which Buffett stated is “probably the best single measure of where valuations stand at any given moment”) measures the ratio of the total valuation of US equity markets to GDP. The theory goes that if the value of the market is growing faster than the economy, then it is overbought, and possibly even in a bubble. On the surface, it makes sense.

To calculate the index, the Wiltshire 5000 is used to express the total value of US stocks. After dividing by total nominal GDP, below is the index from 12/01/1970 – 10/30/2025. As you can see, the index is at record levels and stood at 223.8 at the end of October.

Does this indicate that US stocks are overvalued and possibly in a long-term bubble? According to the Buffett Indicator, maybe. Although it’s dramatic to toss around the term “bubble,” with all the allusions to 1929, tulips, and frantic selling, it’s important to distinguish between overvaluation and a real bubble. Simply, not all aggressive bull markets are bubbles. As a matter of fact, very few are, and usually only apparent in retrospect. Recent research indicates that genuine bubbles (i.e., a rapid doubling of stock prices followed by a crash that eliminates all or more of the gains over the next one year or five-year period) occur with a frequency of only

0.5%. And yet, surveys indicate that investors estimate the probability of a catastrophic price collapse at 10% to 20%. Why the disparity? The old newspaper saying, “if it bleeds, it leads,” says it all. Social media pundits exist to get clicks, and disaster sells.

Recommendations

One of the most frequent requests I get from new investors is to recommend which books they should read to become familiar with the ways of Wall Street and trading. Frankly, I have yet to read a good book on how to trade. They are usually self-serving, congratulatory, or out-of-date. However, several books on the history of Wall Street are excellent and make you realize that although the technology is different, the hopes, dreams, and psychology of investors hasn’t changed all that much. I’ve read a lot of books on the subject, but the three below stuck with me:

1. The Scarlet Woman of Wall Street, John Steele Gordon. Chronicles the rise of Wall Street and the epic fight for the Erie Railway (which was called at the time The Scarlet Woman of Wall Street). Cornelius Vanderbilt, Jay Gould, Jim Fisk, Dainiel Drew, Leonard Jerome (i.e., the father of Jenny Jerome, who was Winston Churchill’s mother) – all the original Wall Street speculators are at war in a time way before pesky regulations, income taxes, and the SEC. The most corrupt and venal traders from today’s markets have nothing on these guys.

2. Devil Take the Hindmost: A History of Financial Speculation, Edward Chancellor. Although it was published before the financial crisis of 2007, Chancellor chronicles the history of “speculative folly” from ancient Rome to the web.com bubble. Has anything changed?

3. Reminiscences of a Stock Operator, Edwin LeFévre. The account of a fictional stock trader, inspired by the life of Jesse Livermore, one of the pioneers of day trading, extreme leverage, technical trading, and stock manipulation. Livermore made and lost several fortunes and died broke, but he’s considered by many to be one of the greatest traders who ever lived. His life was in many ways a caricature of how a trader is supposed to think and live; a cautionary tale for the rest of us.