A Bad Strategy for Strategy

Last September, I wrote about leveraged ETFs (Leveraged ETFs: Reward Isn’t Free!) and why they might yield some surprising results. I concluded that “Equity markets haven’t seen a prolonged bear market since 2022, and I suspect that is leading some investors to underestimate the risk of leveraged ETFs.” Since leveraged ETFs seem to be very popular lately, I thought I would review two examples that illustrate how these products can perform very unexpectedly. When it comes to investing, there are few things more frustrating than getting the market right but not making any money. And yet, when it comes to leveraged ETFs, that’s exactly what could happen.

The two leveraged ETFs I have in mind are the fabulously-named T-Rex 2X Long MSTR Daily Target ETF (MSTU), and the Defiance Daily Target 2x Long MSTR ETF (MSTX). Both are based on Strategy (MSTR, née MicroStrategy), the bitcoin treasury company and one of the hottest, and most controversial, stocks out there. The two funds have the same strategy, but differ in expense ratios. Products that combine leverage with volatility and a controversial business plan – what could go wrong? For anyone but short-term investors, plenty.

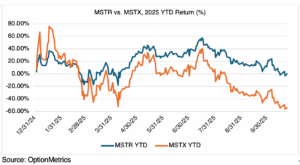

Misunderstanding the performance characteristics of leveraged ETFs can be fatal. As you may recall, leveraged ETFs have a particularly pernicious feature called “volatility decay” or “volatility drag” (sorry, it has nothing to do with options volatility). Rather, volatility decay refers to how daily leverage and compounding can erode performance and cause a leveraged ETF to diverge from its underlying index, sometimes significantly. Below is a comparison of the year-to-date performance of MSTR vs. MSTX. Notice the significant divergence starting mid-July:

How does this happen? Leverage combined with compounding. As I wrote last time, “Suppose a hypothetical index starts at 100 on day one, drops to 90 (a 10% loss) on day 2, and then recovers back to 100 (11.1% gain) on day three. Over the three days, the index was unchanged. However, a 3X ETF would amplify each daily move by 3: 30% down on day two (index moves down to 70), and a 33.3% gain on day three (index backup to 93.31). After all this, the index would wind up 6.69% lower from its start at 100, despite the fact that it was unchanged over the period.” For the uninformed, or the casually informed, the difference can be quite a shock and must lead to some interesting client calls.

Back to MSTU and MSTX. As of last Friday, 10/24/25, they closed down 53.29% and 53.84% year-to-date, respectively. Their index, MSTR, closed down 0.19% YTD (btw, bitcoin, which is MSTR’s only asset, was up 22.59% YTD). As I said, leveraged ETFs can and will diverge if they are held for more than one day and the effect of leverage and compounding has time to work. In this case, the effect was spectacular, the difference between almost breaking even and losing more than half your money (and not even including fees, which are high). Ouch.

If you started the year super-bullish on bitcoin, and bought any of these thinking that you could make even more money by deploying 2X leverage, you would be disappointed, to say the least. To be fair, leveraged ETF providers make it clear that the products are designed to achieve daily performance objectives; anything longer-term can lead to divergence. As an investor, however, it’s up to you to realize that and understand why it’s so.

What’s the moral of the story for those who got clobbered in MSTU or MSTX? First, understand the downside of any financial product. Although this seems pretty obvious, it’s easy to get caught up in speculative fever and ignore the risk. As Jack Reacher says, “in an investigation, details matter.” Second, always be skeptical; beware of products that combine hot stocks, leverage, and high fees. Markets can be fickle, and what’s in fashion this week may be old news by the time related derivatives are introduced.

The Bubble

Financial bubbles, whether in precious metals, AI stocks, crypto, or what have you, invariably include people buying in because they don’t want to be left out in the cold. Fear of being the only one who didn’t get rich, or just simple envy, explains a lot when it comes to investor behavior. Here are two great quotes on the subject:

Charles Kindleberger, economic historian and one of the authors of Manias, Panics, and Crashes: A History of Financial Crises (8th edition, 2023):

“There is nothing so disturbing to one’s well-being and judgment as to see a friend get rich.”

And even better from Gore Vidal:

“Whenever a friend succeeds, a little something in me dies.”