2025 Commodity Top-10

The year is almost over, and it’s time to examine the top five winners and losers in commodities and what they may portend for 2026.

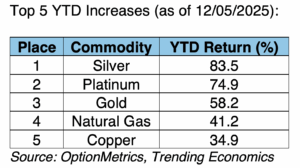

On the winning side (although I guess that really depends on whether you were long or short), precious metals lead the list, specifically silver and gold. This shouldn’t come as a shock, since their inexorable rise was one of the main finance stories of the year. Although gold peaked on October 20th and briefly snuck under $4000, it’s been slowly and steadily recovering since. At the same time, silver hardly took a break and continues to make new highs. This indicates that the fundamentals driving the rally in precious metals – inflation, uncertainty, and a generally dismal view of the future — might well continue into 2026.

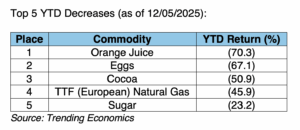

The contrast in the performance of US and European natural gas is interesting. In the US, it’s one of the top five winners; in Europe, its’s one of the top five losers. Natural gas has been rallying in the US since early October on the back of a surge in LNG exports and higher AI power requirements. In contrast to the US, European natural gas has been sharply lower during the year due to increased LNG imports, higher storage, and a mild winter.

As for decreases, the list is dominated by agriculturals, some of which are characterized by relatively low trading volume and limited interest outside of the specific industry. As a retail investor, they would be difficult to trade. Regardless, some of these commodities often make the news because they are included in most consumers’ shopping baskets and have an outsized influence on inflationary expectations. In reality they represent a small fraction of worldwide commodity volume. A great example is eggs, which were the symbol of out-of-control inflation early in the year. After all the attention waned, eggs came off sharply and are currently down 67.1% YTD. Another example is orange juice, which made new all-time highs in October 2024 but is now over 70% lower.

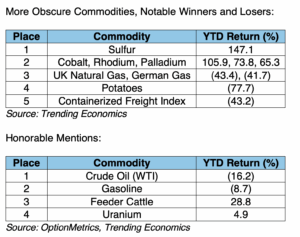

Please note that I have excluded certain niche commodities that are more obscure and generally not available to most retail investors. They are included below. Sulfur, which is used primarily in fertilizer, is at all-time highs and registered the largest increase for any commodity in 2025. Certain metals driven by automotive demand and their use in batteries are also included. And finally, the Containerized Freight Index measures the cost of shipping goods in containers along certain trade routes. In 2025, it suffered from oversupply of ships and trade disruptions.

Despite significant geopolitical instability in the Mideast, crude oil has been drifting lower since mid-June. Consequently, gasoline has also been moving lower. Both have helped to moderate inflation. On the other hand, and as any meat shopper can testify, feeder cattle moved sharply higher in 2025. And finally, uranium showed only modest gains this year, despite the renewed interest in nuclear energy due to AI.